Question: Comparing three depreciation methods ? Instructions Depreciation Expense Final Questions Instructions Dexter Industries purchased packaging equipment on January 8 for $111,200. The equipment was expected

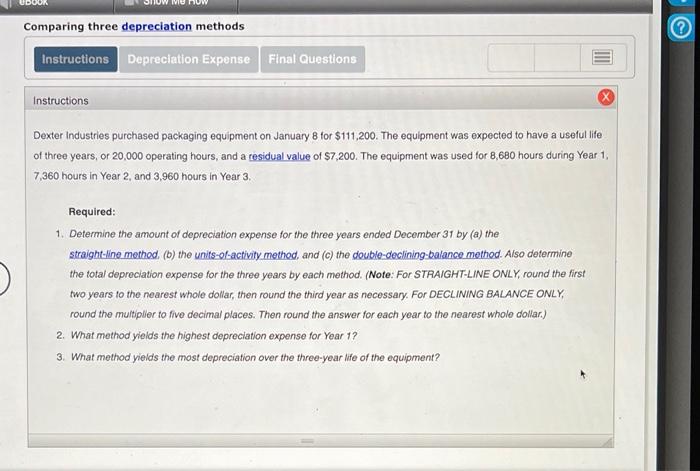

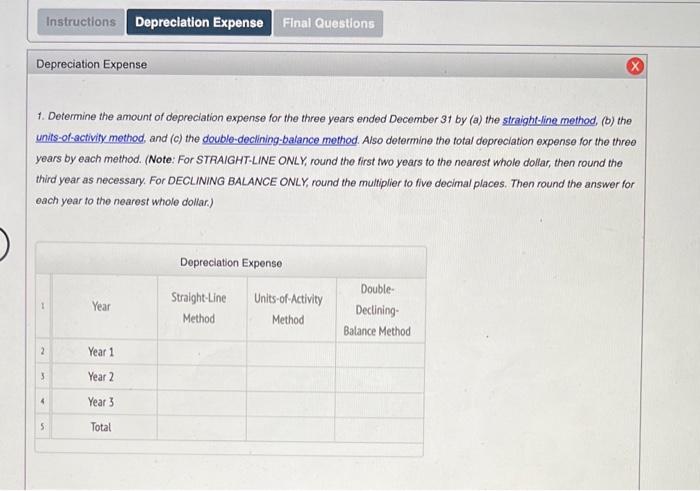

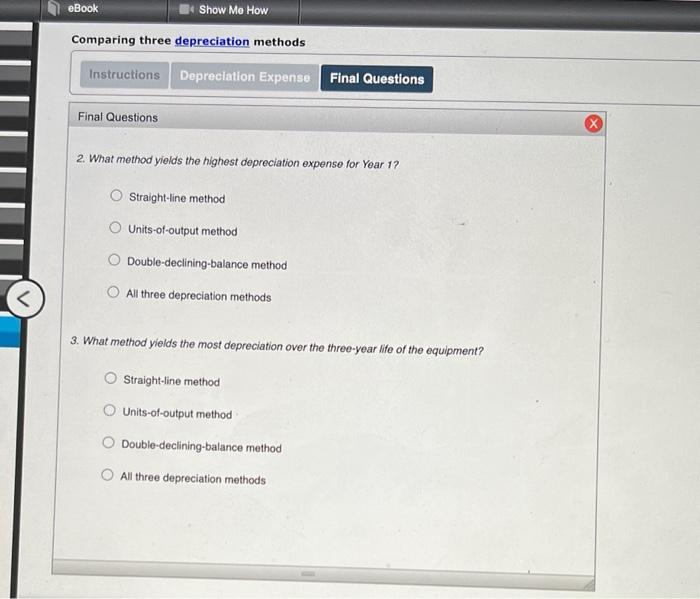

Comparing three depreciation methods ? Instructions Depreciation Expense Final Questions Instructions Dexter Industries purchased packaging equipment on January 8 for $111,200. The equipment was expected to have a useful life of three years, or 20,000 operating hours, and a residual value of $7.200. The equipment was used for 8,680 hours during Year 1, 7,360 hours in Year 2 and 3,960 hours in Year 3. Required: 1. Determine the amount of depreciation expense for the three years ended December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the three years by each method. (Note: For STRAIGHT-LINE ONLY, round the first two years to the nearest whole dollar, then round the third year as necessary. For DECLINING BALANCE ONLY, round the multiplier to five decimal places. Then round the answer for each year to the nearest whole dollar.) 2. What method yields the highest depreciation expense for Year 1? 3. What method yields the most depreciation over the three-year life of the equipment? Instructions Depreciation Expense Final Questions Depreciation Expense X 1. Determine the amount of depreciation expense for the three years ended December 31 by (a) the straight-line method, (b) the unts-or-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the three years by each method. (Note: For STRAIGHT-LINE ONLY, round the first two years to the nearest whole dollar, then round the third year as necessary. For DECLINING BALANCE ONLY, round the multiplier to live decimal places. Then round the answer for oach year to the nearest whole dollar) Depreciation Expense 1 Year Straight-Line Method Units-of-Activity Method Double- Declining Balance Method 2 Year 1 3 Year 2 4 Year 3 5 Total eBook Show Me How Comparing three depreciation methods Instructions Depreciation Expenso Final Questions Final Questions x 2. What method yields the highest depreciation expense for Yoar 1? Straight-line method Units-of-output method O Double-declining-balance method All three depreciation methods 3. What method yields the most depreciation over the three-year life of the equipment? Straight-line method Units-of-output method O Double-declining-balance method All three depreciation methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts