Question: Comparison of Multiple Hedging Methods. A US based MNC Kline has payables of CHF 40,000 in 6 months. The firm's economist forecasts that the CHFUSD

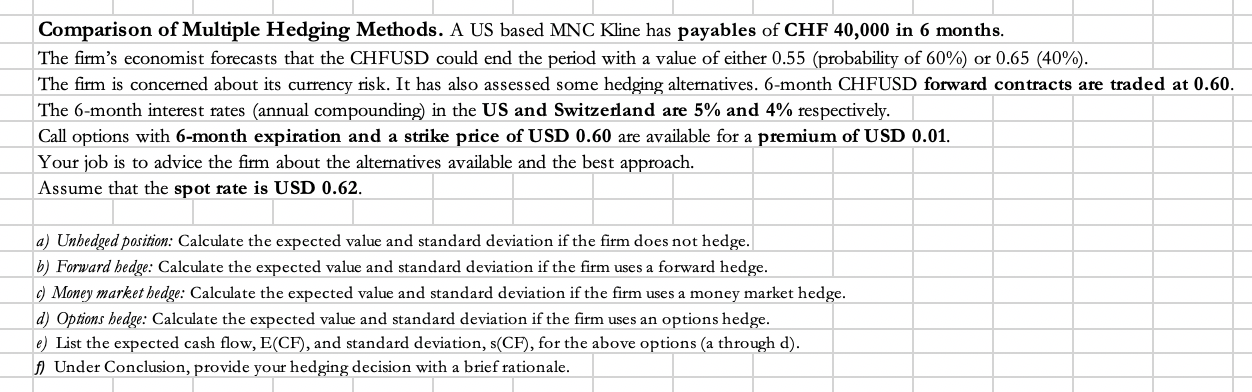

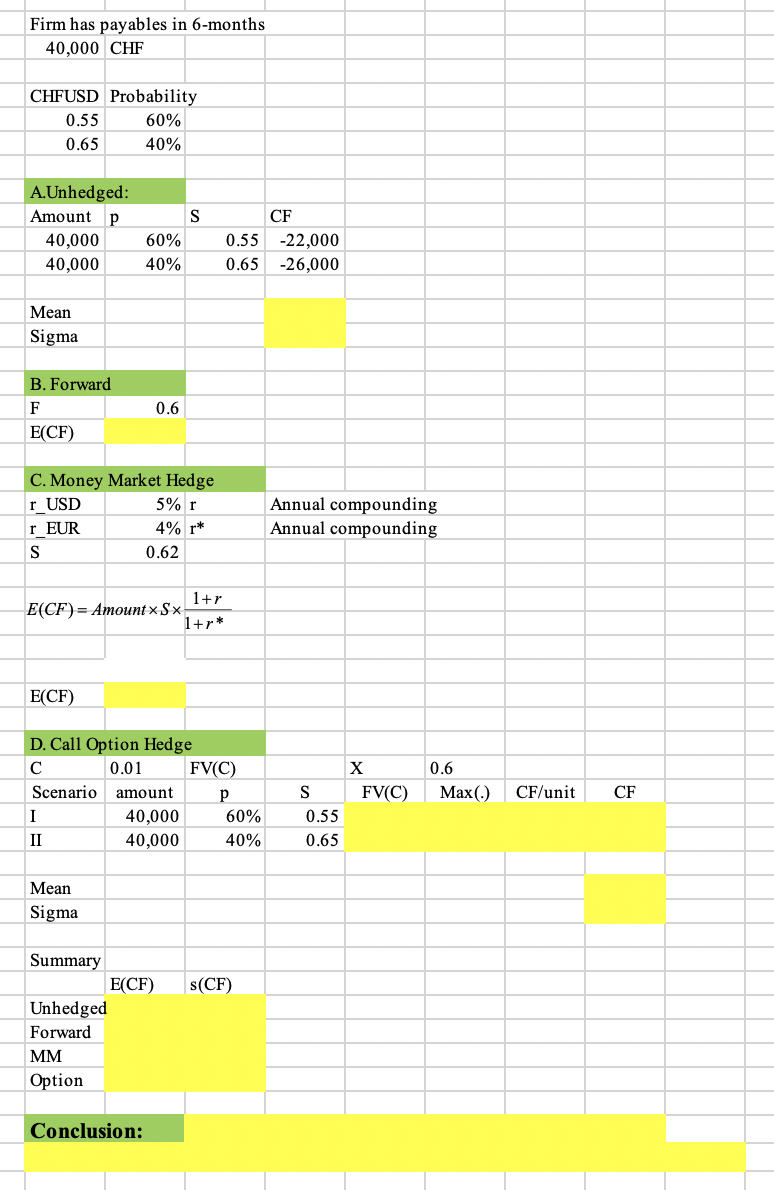

Comparison of Multiple Hedging Methods. A US based MNC Kline has payables of CHF 40,000 in 6 months. The firm's economist forecasts that the CHFUSD could end the period with a value of either 0.55 (probability of 60%) or 0.65 (40%). The firm is concerned about its currency risk. It has also assessed some hedging alternatives. 6-month CHFUSD forward contracts are traded at 0.60. The 6-month interest rates annual compounding in the US and Switzerland are 5% and 4% respectively. Call options with 6-month expiration and a strike price of USD 0.60 are available for a premium of USD 0.01. Your job is to advice the firm about the alternatives available and the best approach. Assume that the spot rate is USD 0.62. a) Unhedged position: Calculate the expected value and standard deviation if the firm does not hedge. b) Forward bedge: Calculate the expected value and standard deviation if the firm uses a forward hedge. c) Money market hedge: Calculate the expected value and standard deviation if the firm uses a money market hedge. d) Options hedge: Calculate the expected value and standard deviation if the firm uses an options hedge. e) List the expected cash flow, E(CF), and standard deviation, s(CF), for the above options (a through d). Under Conclusion, provide your hedging decision with a brief rationale. Firm has payables in 6-months 40,000 CHF CHFUSD Probability 0.55 60% 0.65 40% A.Unhedged: Amount P 40,000 40,000 S 60% 40% CF 0.55 -22,000 0.65 -26,000 Mean Sigma B. Forward 0.6 E(CF) C. Money Market Hedge r USD 5% r r EUR 4% r* 0.62 Annual compounding Annual compounding E(CF)= Amount x Sx T+r_ 1+r* E(CF) D. Call Option Hedge 0.01 FV(C) Scenario amount p 40,000 60% 40,000 40% X FV(C) 0.6 Max(.) CF/unit CF S 0.55 0.65 Il Mean Sigma (CF) Summary E(CF) Unhedged Forward MM Option Conclusion: Comparison of Multiple Hedging Methods. A US based MNC Kline has payables of CHF 40,000 in 6 months. The firm's economist forecasts that the CHFUSD could end the period with a value of either 0.55 (probability of 60%) or 0.65 (40%). The firm is concerned about its currency risk. It has also assessed some hedging alternatives. 6-month CHFUSD forward contracts are traded at 0.60. The 6-month interest rates annual compounding in the US and Switzerland are 5% and 4% respectively. Call options with 6-month expiration and a strike price of USD 0.60 are available for a premium of USD 0.01. Your job is to advice the firm about the alternatives available and the best approach. Assume that the spot rate is USD 0.62. a) Unhedged position: Calculate the expected value and standard deviation if the firm does not hedge. b) Forward bedge: Calculate the expected value and standard deviation if the firm uses a forward hedge. c) Money market hedge: Calculate the expected value and standard deviation if the firm uses a money market hedge. d) Options hedge: Calculate the expected value and standard deviation if the firm uses an options hedge. e) List the expected cash flow, E(CF), and standard deviation, s(CF), for the above options (a through d). Under Conclusion, provide your hedging decision with a brief rationale. Firm has payables in 6-months 40,000 CHF CHFUSD Probability 0.55 60% 0.65 40% A.Unhedged: Amount P 40,000 40,000 S 60% 40% CF 0.55 -22,000 0.65 -26,000 Mean Sigma B. Forward 0.6 E(CF) C. Money Market Hedge r USD 5% r r EUR 4% r* 0.62 Annual compounding Annual compounding E(CF)= Amount x Sx T+r_ 1+r* E(CF) D. Call Option Hedge 0.01 FV(C) Scenario amount p 40,000 60% 40,000 40% X FV(C) 0.6 Max(.) CF/unit CF S 0.55 0.65 Il Mean Sigma (CF) Summary E(CF) Unhedged Forward MM Option Conclusion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts