Question: Compatibilit Mode - Sign in Review View Help Share Aa-A 24 ) 1 Normal 11 No Spac... Heading 1 Heading 2 Title Subtitle Find -

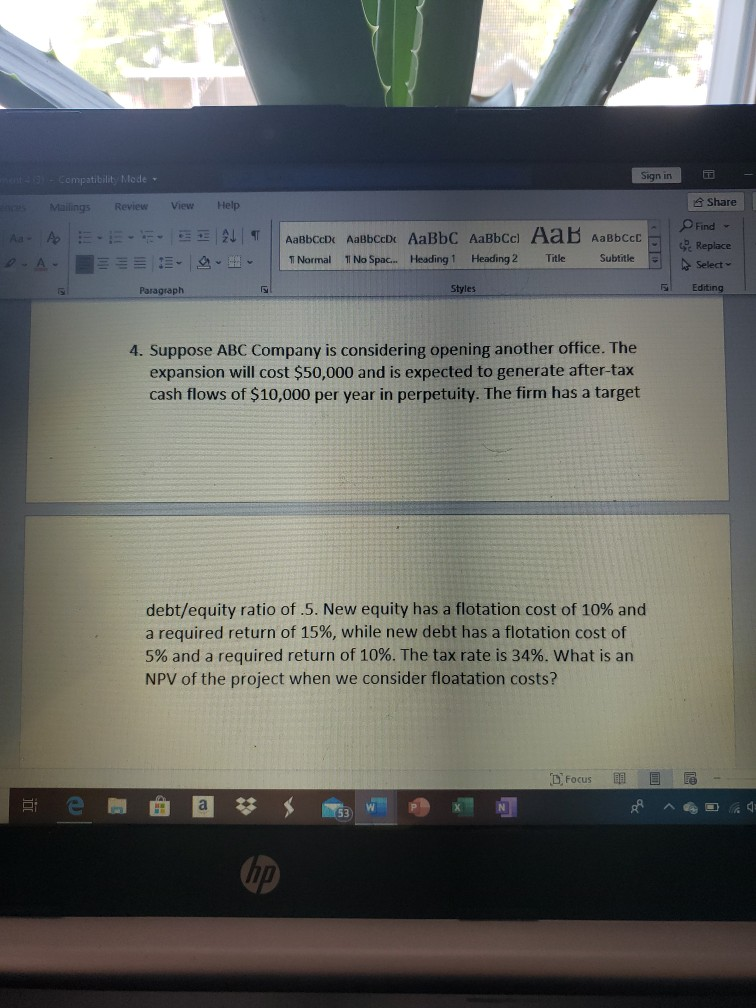

Compatibilit Mode - Sign in Review View Help Share Aa-A 24 ) 1 Normal 11 No Spac... Heading 1 Heading 2 Title Subtitle Find - Replace Select Paragraph Styles Editing 4. Suppose ABC Company is considering opening another office. The expansion will cost $50,000 and is expected to generate after-tax cash flows of $10,000 per year in perpetuity. The firm has a target debt/equity ratio of.5. New equity has a flotation cost of 10% and a required return of 15%, while new debt has a flotation cost of 5% and a required return of 10%. The tax rate is 34%. What is an NPV of the project when we consider floatation costs? Focus 20 a W ge hp

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock