Question: Complete 2A or 2B. 2A. List and EXPLAIN the coverages on your auto policy. Name of the company, premium payment for each coverage, any deductibles,

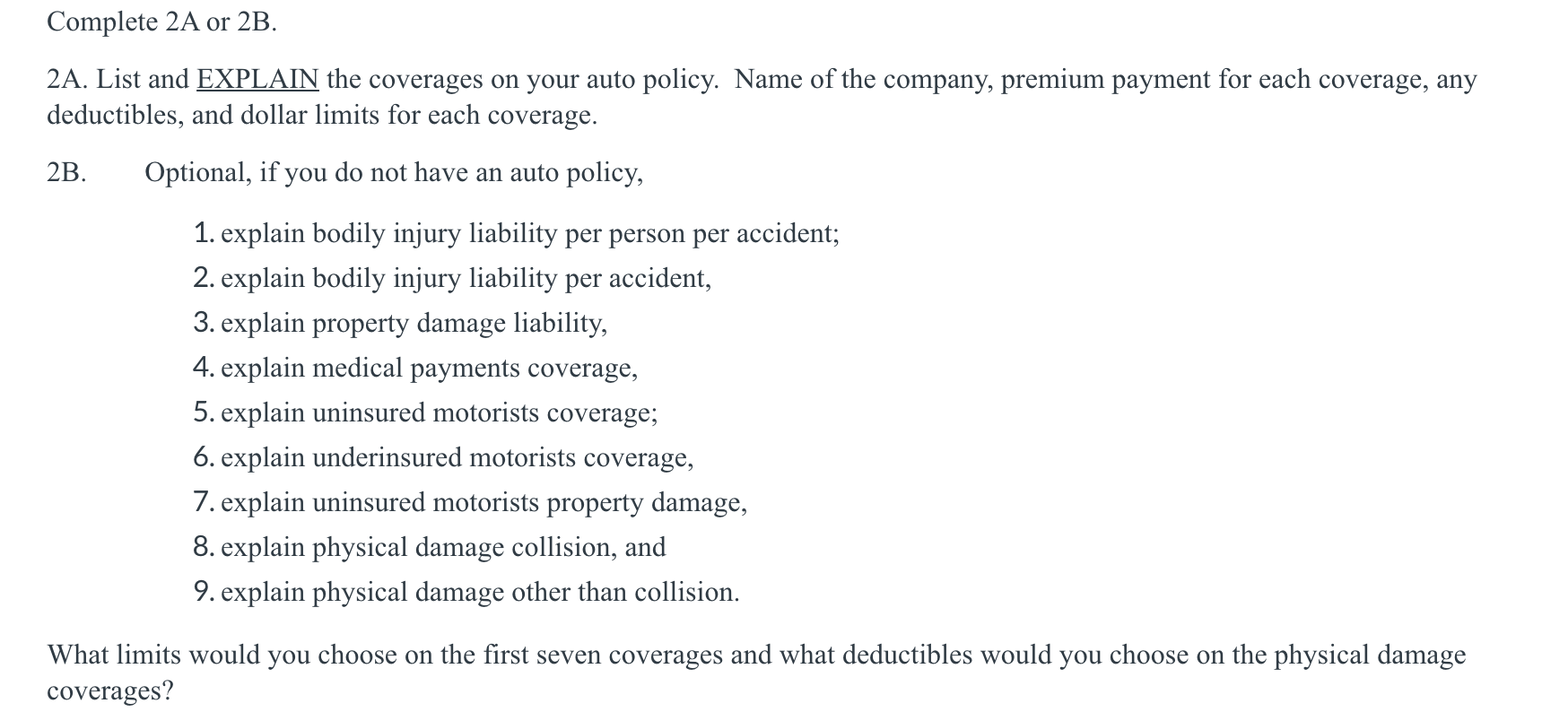

Complete 2A or 2B. 2A. List and EXPLAIN the coverages on your auto policy. Name of the company, premium payment for each coverage, any deductibles, and dollar limits for each coverage. 2B. Optional, if you do not have an auto policy, 1. explain bodily injury liability per person per accident; 2. explain bodily injury liability per accident, 3. explain property damage liability, 4. explain medical payments coverage, 5. explain uninsured motorists coverage; 6. explain underinsured motorists coverage, 7. explain uninsured motorists property damage, 8. explain physical damage collision, and 9. explain physical damage other than collision. What limits would you choose on the first seven coverages and what deductibles would you choose on the physical damage coverages? Complete 2A or 2B. 2A. List and EXPLAIN the coverages on your auto policy. Name of the company, premium payment for each coverage, any deductibles, and dollar limits for each coverage. 2B. Optional, if you do not have an auto policy, 1. explain bodily injury liability per person per accident; 2. explain bodily injury liability per accident, 3. explain property damage liability, 4. explain medical payments coverage, 5. explain uninsured motorists coverage; 6. explain underinsured motorists coverage, 7. explain uninsured motorists property damage, 8. explain physical damage collision, and 9. explain physical damage other than collision. What limits would you choose on the first seven coverages and what deductibles would you choose on the physical damage coverages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts