Question: complete a basic individual tax return using a standard 1040 and the appropriate schedules Scenario: Year ending December 31, 2022 The taxpayers are Bill Beau

complete a basic individual tax return using a standard 1040 and the

appropriate schedules

Scenario: Year ending December 31, 2022

The taxpayers are Bill Beau Bagin (social security number 333-33-3330), born January

17, 1973, and his wife, Sara Lee Bagin (social security number 444-44-4440), born April

12, 1973. Both have good eyesight, and live with their two children, Ned and Megan, at

789 N. Code Drive, Chicago, Illinois 60699, (312) 679-9999.

Mr. Bagin wants to contribute $3 of his income tax to the Presidential Election

Campaign Fund. Mrs. Bagin elects not to contribute.

The Bagins' son, Ned, is a 17-year-old high school student, born June 15, 2005. Their

daughter, Megan, is twelve years old, born August 9, 2010 and a junior high school

student. Neither child had any income. Ned's social security number is 300-11-0001 and

Megan's social security number is 300-33-0003.

Wages and Expenses Generally

During 2022, Mrs. Bagin was employed as an elementary school teacher, employed at

Elementary School 0205, Main Street, Chicago, IL 60699. The school's employer ID# is

99-6665432.

Her Form W-2 for 2022 reports the following:

Box 1. Wages, tips and other compensation $56,350

Box 2. Federal income tax withheld $ 4,569

Box 4. Social security tax withheld $ 3,497

2

Box 6. Medicare tax withheld $ 817

Box 17. State income tax $ 2,536

Mr. Bagin works part-time at Joker Grocery, West Maple, Chicago, IL 60689.

His Form W-2 for 2022 reports the following:

Box 1. Wages, tips and other compensation $12,000

Box 2. Federal income tax withheld $ 0

Box 4. Social security tax withheld $ 744

Box 6. Medicare tax withheld $ 174

Box 17. State income tax $ 0

Neither Mr. nor Mrs. Bagin is covered by their employer's retirement plan.

Mrs. Bagin made a $1,500 contribution to a traditional IRA and a $2,000 contribution to

a Roth IRA in 2022. Mr. Bagin decided against making a contribution to a traditional

IRA.

The Bagins received a $520 state income tax refund. They used itemized deductions of

$25,420 on their 2021 federal income tax return and elected to take the state income

tax as a deduction. The Bagins also received a $310 federal income tax refund.

The Bagins made federal estimated tax payments of $2,100 for 2022.

The Bagins incurred the following medical expenses during 2022:

? prescription drugs $1,000

? doctor bills $6,724

? hospital bills $4,256

? transportation $ 100

? eyeglasses $ 500

The Bagins own their residence. They paid 2022 real estate taxes $4,300 on July 1,

2022.

Mr. and Mrs. Bagin paid the total of $8,675 home mortgage interest on the residence.

Their mortgage company is Any Bank on South Street in Chicago, IL 60689. Their

account # is 11000011.

They paid the following personal interest in 2022:

? $1,625 to finance Mrs. Bagin's car, and

? $ 400 in credit card interest.

3

The Bagins gave $1,500 in cash to various recognized charities; no individual gift was

$250 or more; all charities sent an acknowledgment of the contribution. They had no

carryover charitable contributions.

Mrs. Bagin bought $345 of supplies for her classroom.

Dividends and Interest

During 2022, the Bagins received $780 in interest from the Heartland National Bank,

EID 99-9990001 and $150 as nominees for Julia Major (Mrs. Bagin's mother from the

Third National Savings and Loan, EID 55-0001234.

They received $450 in interest from tax-exempt bonds issued by the State of Illinois.

The Bagin's received the following qualified dividends: $715 from E&Z Tax Preparation,

Inc., and $350 from Secure Money Market Fund.

Sale of Stock and Other Investments

During 2022, the Bagins sold the following capital assets:

(1) On February 2, 100 shares of Ahab Inc. were sold for $1,000. They had been

purchased on November 18, 2008 for $3,500.

(2) On November 5, 200 shares of Pequod Inc. were sold for $10,000. They had

been purchased on January 5, 2008 for $7,000.

(3) On December 4, 100 shares of Squall Inc. were sold for $12,500. They had

been purchased on January 4, 1998 for $9,000.

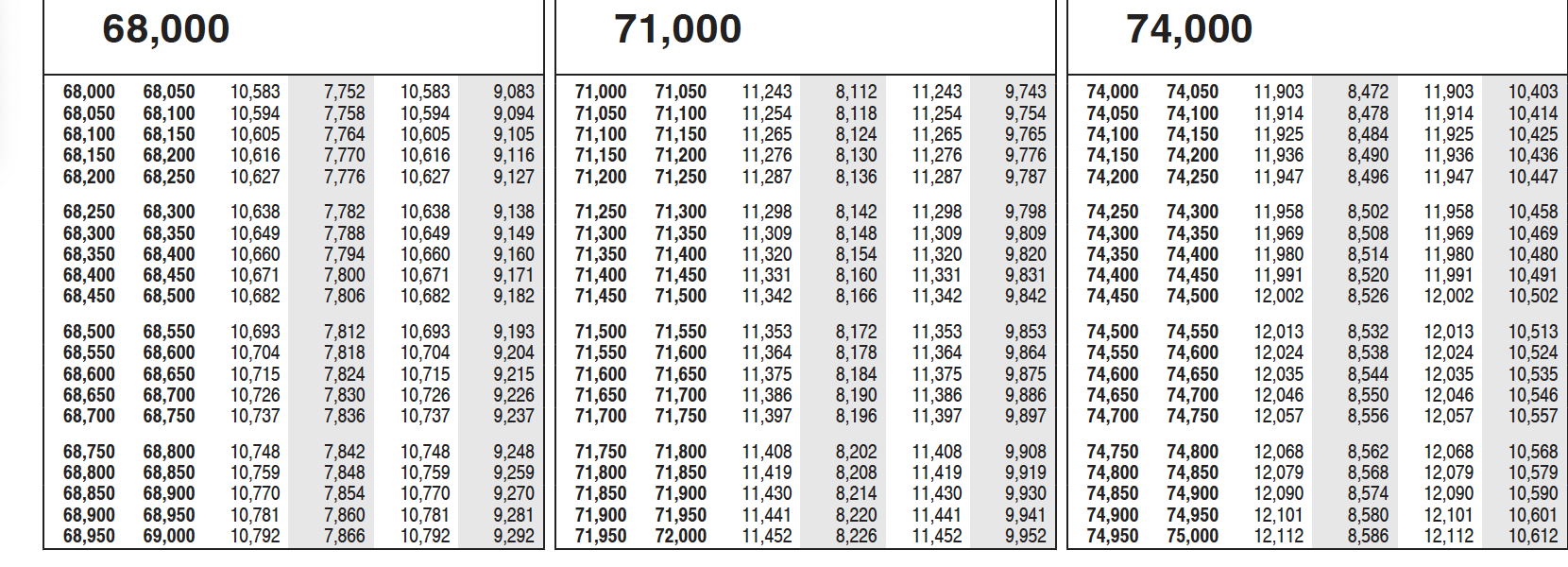

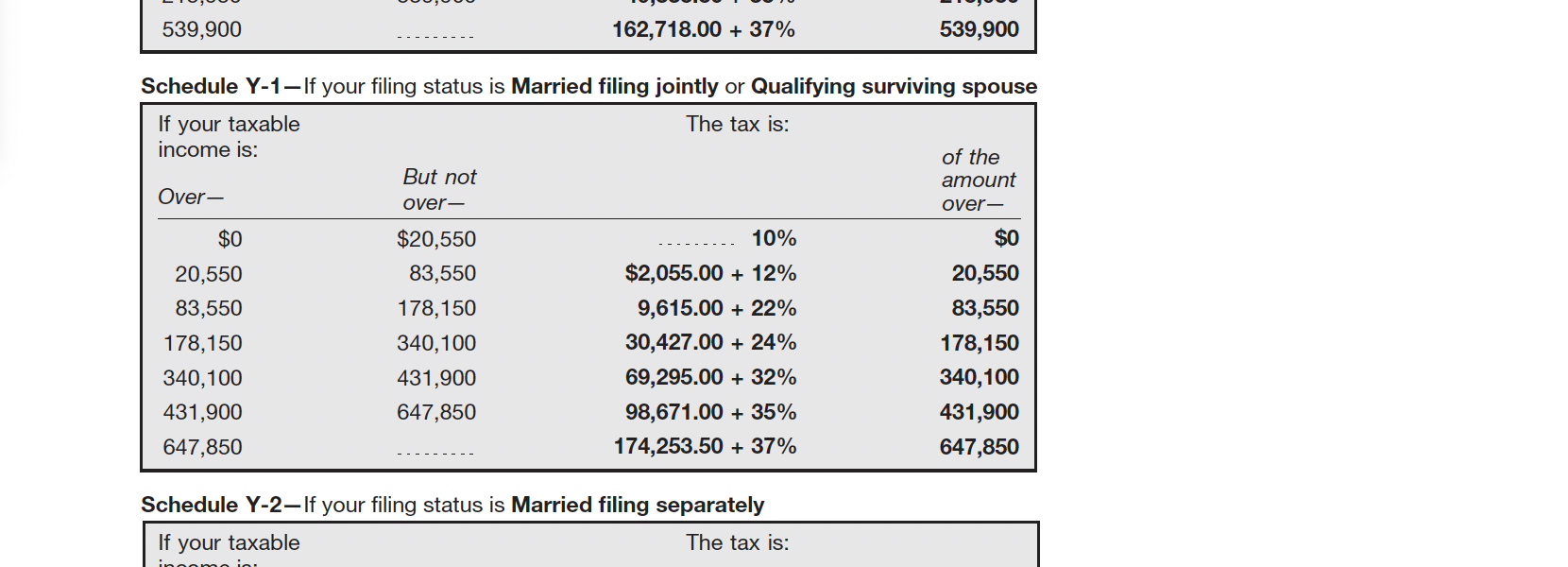

68,000 71,000 74,000 68,000 68,050 10,583 7,752 10,583 9.083 71,000 71,050 11,243 8,112 11,243 9,743 74,000 74,050 11,903 8,472 11,903 10,403 68,050 68,100 10,594 7,758 10,594 9,094 71,050 71,100 11,254 8, 118 11,254 9,754 74,050 74,100 11,914 8,478 11,914 10,414 68,100 68,150 10,605 7,764 10,605 9,105 71,100 71,150 11,265 8,124 11,265 9,765 74, 100 74,150 11,925 8,484 11,925 68,150 10,425 68,200 10,616 7,770 10,616 9, 116 71,150 71,200 11,276 8,130 11,276 9,776 74,150 74,200 11,936 8,490 11,936 10,436 68,200 68,250 10,627 7,776 10,627 9,127 71,200 71,250 11,287 8,136 11,287 9,787 74,200 74,250 11,947 8.496 11,947 10,447 68,250 68,300 10,638 7,782 10,638 9,138 71,250 71,300 11,298 8, 142 11,298 9,798 74,250 74,300 11,958 8,502 11,958 10,458 68,300 68,350 10,649 7,788 10,649 9,149 71,300 71,350 11,309 8,148 11,309 9,809 74,300 74,350 11,969 8,508 11,969 10,469 68,350 68,400 10,660 7,794 10,660 9,160 71,350 71,400 11,320 8,154 11,320 9,820 74,350 74,400 11,980 8,514 11,980 10,480 68,400 68,450 10,671 7,800 10,671 9,171 71,400 71,450 11,331 8,160 11,331 9,831 74,400 74,450 11,991 8,520 11,991 10,491 68,450 68,500 10,682 7,806 10,682 9,182 71,450 71,500 11,342 8,166 11,342 9,842 74,450 74,500 12,002 8,526 12,002 10,502 68,500 68,550 10,693 7,812 10,693 9,193 71,500 71,550 11,353 8,172 11,353 9,853 74,500 74,550 12,013 8,532 12,013 10,513 68,550 68,600 10,704 7,818 10,704 9,204 71,550 71,600 11,364 8, 178 11,364 9,864 74,550 74,600 12,024 8,538 12,024 10,524 68,600 68,650 10,715 7,824 10,715 9,215 71,600 71,650 11,375 8, 184 11,375 9,875 74,600 74,650 12,035 8,544 12,035 10,535 68,650 68,700 10,726 7,830 10,726 9,226 71,650 71,700 11,386 8, 190 11,386 9,886 74,650 74,700 12,046 8,550 12,046 10,546 68,700 68,750 10,737 7,836 10,737 9,237 71,700 71,750 11,397 8, 196 11,397 9,897 74,700 74,750 12,057 8,556 12,057 10,557 68,750 68,800 10,748 7,842 10,748 9,248 71,750 71,800 11,408 8,202 11,408 9,908 74,750 74,800 12,068 8,562 12,068 10,568 68,800 68,850 10,759 7,848 10,759 9,259 71,800 71,850 11,419 8,208 11,419 9,919 74,800 74,850 12,079 8,568 12,079 10,579 68,850 68,900 10,770 7,854 10,770 9,270 71,850 71,900 11,430 8,214 11,430 9,930 74,850 74,900 12,090 8,574 12,090 10,590 68,900 68,950 10,781 7,860 10,781 9,281 71,900 71,950 11,441 8,220 11,441 9,941 74,900 74,950 12, 101 8,580 12, 101 10,601 68,950 69,000 10,792 7,866 10,792 9,292 71,950 72,000 11,452 8,226 11,452 9,952 74,950 75,000 12,112 8,586 12,112 10,612539,900 162,718.00 + 37% 539,900 Schedule Y-1-If your filing status is Married filing jointly or Qualifying surviving spouse If your taxable The tax is: income is: of the But not amount Over- over- over- $0 $20,550 10% $0 20,550 83,550 $2,055.00 + 12% 20,550 83,550 178, 150 9,615.00 + 22% 83,550 178,150 340, 100 30,427.00 + 24% 178, 150 340, 100 431,900 69,295.00 + 32% 340,100 431,900 647,850 98,671.00 + 35% 431,900 647,850 174,253.50 + 37% 647,850 Schedule Y-2-If your filing status is Married filing separately If your taxable The tax is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts