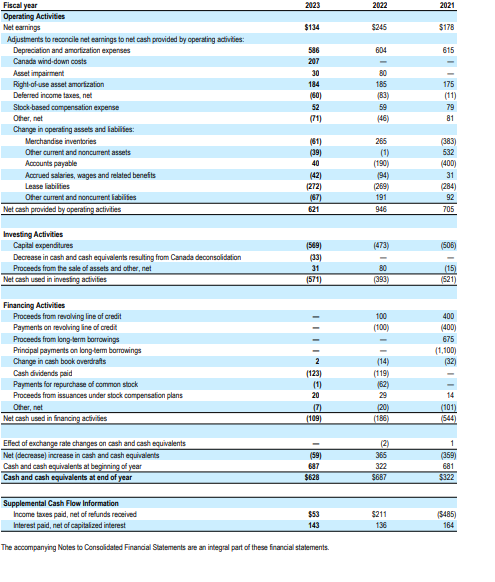

Question: Complete a financial statement analysis of Nordstorm using 2 0 2 3 annual report Fiscal year table [ [ Operating Activities ] , [

Complete a financial statement analysis of Nordstorm using annual report Fiscal year

tableOperating ActivitiesNet earnings,$$$Adjustments to reconcile net earnings to net cash provided by operating adivities:Cansda winddown costs,Acset impairment,Rightof use asset amorization,Slockbased compensation expense,Oter net,Change in operating assets and labiifes:Merchandise invertaries,Other currert and noncurrert assets,Other current and noncurrent fiatiifes,Net cash provided by operafing activties,

Investing Activties

tableCaptal expenditures,Decrease in cash and cash equivalents resulting from Canada deconsolidation,Proceeds from the sale of assets and other, net,Net cash used in irvesfing activites,

Financing Activities

tableProceeds from revolving line of credit,Payments on tevolving line of credt,Proceeds from longterm borrowings,Pringipal payments on longterm borrowings,Change in cash book overdrats,Cash dividends paid,Payments for repurchase of cormmon stock,Proceeds from issuances under stock compensation plans,Other net,Net cash used in financing activities,Effed of exchange rale changes on cash and cash equivalents,Net decrease increase in cash and cash equivalents,Cash and cash equivalerts at begiming of year,Cash and cash equivalents at end of year,$$$

tableSupplemental Cash Flow Information,,,hoome taxes paid, net of refunds received,$$$Interest paid, net of capitaized interest,

The accompanying Notes to Consolidated Financial Satements are an irtegral part of these francial statements. Nordstrom, Inc.

Consolidated Balance Sheets

In milions

February January

tableAssetsCurrent assets:Cash and cash equivalents,$$Accounts receivable, net,Merchandise inventories,Prepaid expenses and other current assets,Total current assets,Land property and equipment, net,Operafing lease rightofuse assets,GoodivillOther assets,Total assets,$$

Commitments and contingencies Note

Shareholders' equity.

tabletableCommon stock, no par value: shares authorized; and shares issued andoutstandingAccumulated deficit,Accumulated other comprehensive gain lossTotal shareholders' equity,Total liabilities and shareholders' equity,$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock