Question: Complete a form 1 1 2 0 for Jims auto body Additional information Jim's Auto Body ( Inc , or LLC ) 1 1 2

Complete a form for Jims auto body

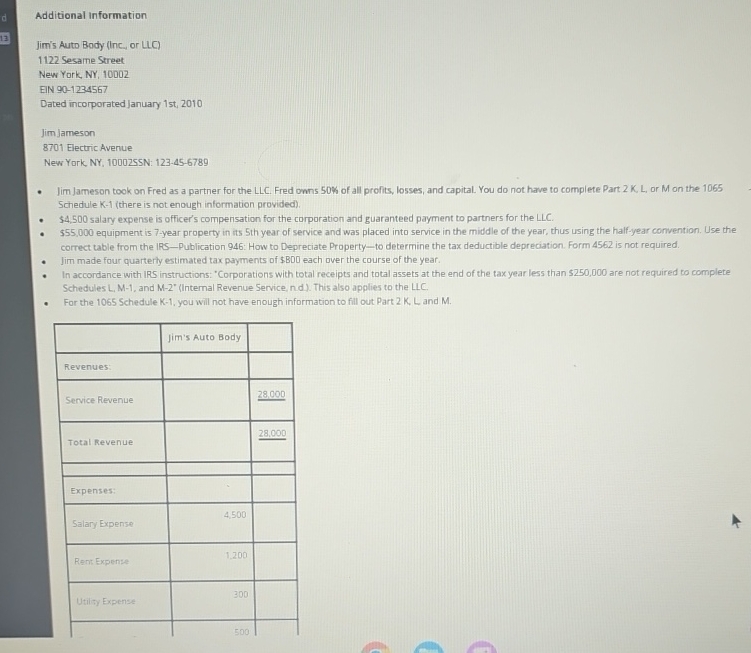

Additional information

Jim's Auto Body Inc or LLC

Sesame Street

New York, NY

EIN

Dated incorporated January st

Jim Jameson

Electric Avenue

New York NYSSN:

Jim Jameson took on Fred as a partner for the LLC Fred owns of all profits, losses, and capital. You do not have to complete Part K L or M on the Schedule K there is not enough information provided

$ salary expense is officer's compensation for the corporation and guaranteed payment to partners for the LLC

$ equipment is year property in its th year of service and was placed into service in the middle of the year, thus using the halfyear convention. Use the correct table from the IRSPublication : How to Depreciate Propertyto determine the tax deductible depreciation. Form is not required.

Jim made four quarterly estimated tax payments of $ each over the course of the year.

In accordance with IRS instructions: "Corporations with total recelpts and total assets at the end of the tax year less than are not required to complete Schedules L M and MInternal Revenue Service, nd This also applies to the LLC

For the Schedule K you will not have enough information to fill out Part K L and M

tableJim's Auto Body,Revenues:Service Revenue,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock