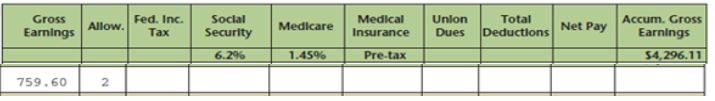

Question: Complete a partial earnings record for Christina Morales. Compute the deductions, net pay, and accumulated gross earnings. Assume that Christina is married and that $40.50

Complete a partial earnings record for Christina Morales. Compute the deductions, net pay, and accumulated gross earnings. Assume that Christina is married and that $40.50 (pre-tax) was withheld for medical insurance and $15 for union dues each week. Use the wage bracket method to determine federal income tax.

Gross Fed. Inc. Social Medical Unlon Dues Total Accum. Gross Allow. Medicare Net Pay Earnings x Security Insurance Deductions Earnings 6.2% 1.45% Pre-tax $4,296.11 759.60 2

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock