Question: Complete a vertical analysis and a horizontal analysis for the balance sheet and the income statement. A B C D E F Balance Sheet W

Complete a vertical analysis and a horizontal analysis for the balance sheet and the income statement.

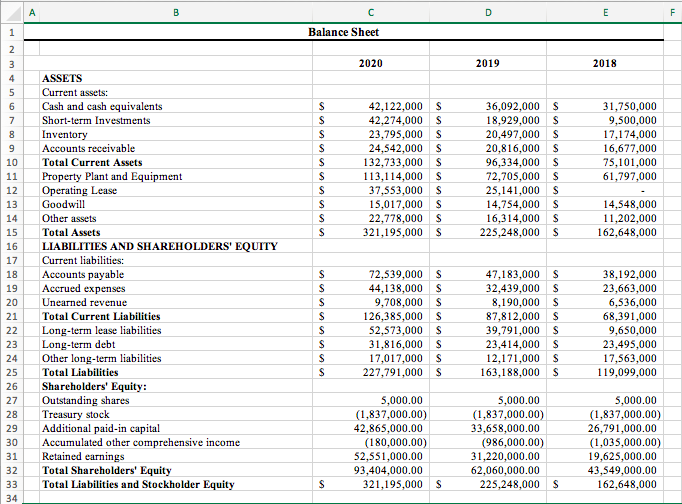

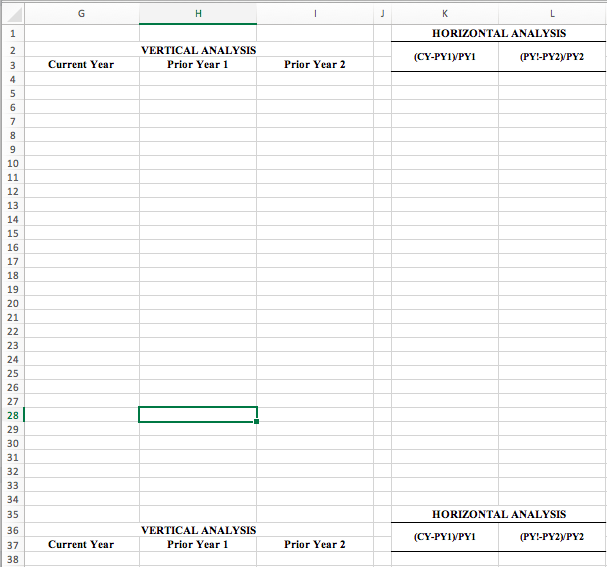

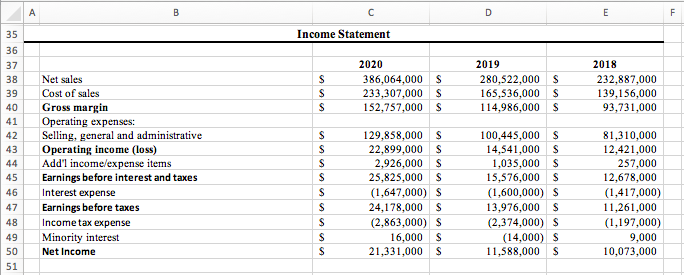

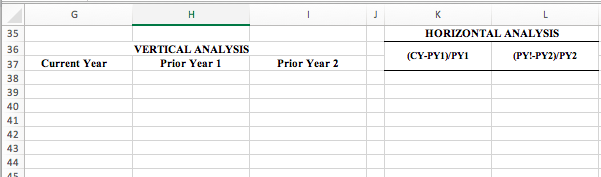

A B C D E F Balance Sheet W N H 2020 2019 2018 ASSETS Current assets: Cash and cash equivalents 42,122,000 36,092,000 S 31,750,000 Short-term Investments 42,274,000 18,929,000 9,500,000 Inventory 23,795,000 20,497,000 17,174,000 Accounts receivable 24,542,000 20,816,000 16,677,000 Total Current Assets 132,733,000 96,334,000 75,101,000 11 Property Plant and Equipment 113,114,000 72,705,000 61,797,000 12 Operating Lease 37,553,000 25,141,000 13 Goodwill 15,017,000 14,754,000 14,548,000 14 Other assets 22,778,000 16,314,000 11,202,000 15 Total Assets 321,195,000 225,248,000 162,648,000 16 LIABILITIES AND SHAREHOLDERS' EQUITY 17 Current liabilities: 18 Accounts payable 72,539,000 47,183,000 38,192,000 19 Accrued expenses 44,138,000 32,439,000 23,663,000 20 Unearned revenue 9,708,000 8,190,000 6,536,000 21 Total Current Liabilities 126,385,000 87,812,000 S 68,391,000 22 Long-term lease liabilities 52,573,000 39,791,000 9,650,000 23 Long-term debt 31,816,000 23,414,000 23,495,000 24 Other long-term liabilities 17,017,000 12,171,000 S 17,563,000 25 Total Liabilities 227,791,000 163,188,000 S 119,099,000 26 Shareholders' Equity: 27 Outstanding shares 5,000.00 5,000.00 5,000.00 28 Treasury stock (1,837,000.00) (1,837,000.00) (1,837,000.00) 29 Additional paid-in capital 42,865,000.00 33,658,000.00 26,791,000.00 30 Accumulated other comprehensive income (180,000.00) (986,000.00) (1,035,000.00) 31 Retained earnings 52,551,000.00 31,220,000.00 19,625,000.00 32 Total Shareholders' Equity 93,404,000.00 62,060,000.00 43,549,000.00 33 Total Liabilities and Stockholder Equity 321,195,000 225,248,000 162,648,000 34G H I J K L HORIZONTAL ANALYSIS VERTICAL ANALYSIS W N H (CY-PYly/PY1 (PYI-PY2)/PY2 Current Year Prior Year 1 Prior Year 2 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 HORIZONTAL ANALYSIS 36 VERTICAL ANALYSIS (CY-PYIV/PY1 (PY!-PY2)/PY2 37 Current Year Prior Year 1 Prior Year 2 3.8A B C D E F 35 Income Statement 36 37 2020 2019 2018 38 Net sales 386,064.000 S 280,522,000 S 232,887,000 39 Cost of sales 233,307,000 S 165.536,000 S 139.156,000 40 Gross margin 152,757,000 S 114.986,000 S 93,731,000 41 Operating expenses: 42 Selling, general and administrative 129,858,000 100,445,000 S 81.310,000 43 Operating income (loss) 22,899,000 S 14.541,000 12,421,000 44 Add'l income/expense items 2,926,000 1,035,000 257,000 45 Earnings before interest and taxes 25,825,000 15,576,000 S 12,678,000 46 Interest expense (1,647,000) $ (1,600,000) S (1,417,000) 47 Earnings before taxes 24,178,000 13,976,000 S 11,261,000 48 Income tax expense (2,863,000) 5 (2,374,000) $ (1,197,000) 49 Minority interest 16,000 S (14,000) S 9,000 50 Net Income 21,331,000 11,588,000 S 10,073,000 51G H L K L 35 HORIZONTAL ANALYSIS 36 VERTICAL ANALYSIS 37 Current Year Prior Year 1 (CY-PYIVPYI Prior Year 2 (PY!-PY2)/PY2 38 39 40 41 42 43 44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts