Question: complete all 3 parts Case Study In 2002, Markus Braun, a German entrepreneur, joined Wirecard, a small financial technology company which, at that time, was

complete all 3 parts

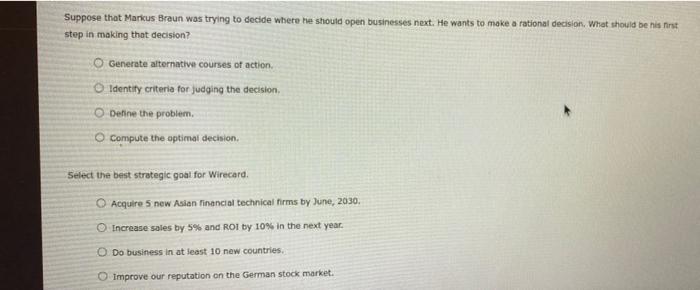

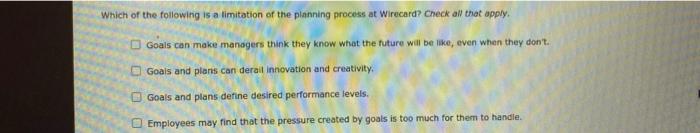

Case Study In 2002, Markus Braun, a German entrepreneur, joined Wirecard, a small financial technology company which, at that time, was on the brink of Collapsing. Mr. Braun built up Wirecard, and in 2005, the company was listed on the Frankfurt Stock Exchange, By 2008, questions were raised about Wirecard's finances. Wirecard's 2007 consolidated accounts were said to be incomplete and misleading. Wirecard hired Ernst & Young (EY) to audit their books, and the company found no Irregularities. The company continued to grow, getting 500 million euros from shareholders. It also bought up small companies in Asia, which made its share price go up. Apparently, Wirecard set up escrow accounts through the small businesses it acquired. This allowed the company to do business in countries where it didn't have a license. These companies supposedly brought Wirecard a large amount of its revenue and profit over the years, but those funds may never have existed, despite the fact that they were supposed to be deposited into escrow accounts. In 2015, Wirecard bought an Indian payments business for 340 million euros. At the same time, Capital Research put out a report saying that Wirecard's Asia investments were smaller than the company was reporting. Wirecard said that short sellers had requested and paid for that report But in 2016, the Financial Times also started asking questions about Wirecard. The journalists who wrote these stories reported that Wirecard harassed them in numerous ways, from phishing emails to threats of making police complaints. But all through this time, Wirecard was becoming bigger and bigger, eventually gaining a place in the DAX Index, a stock index representing the 30 largest companies in the German stock market. In 2020, Wirecard hired KPMG to audit its books after delaying the 2019 annual report from EY. That audit reported that the company was unable to prove that 1 bilion euros of revenue existed. By July of 2020, Wirecard had filed for insolvency, and Markus Braun was arrested on charges that his company had defrauded investors of 3.7 billion dollars. Sources: Ewing, J. Wirecard Ex-C.E.O. Arrested on New Charges of Defrauding Banks. New York Times. Retrieved from https://www.nytimes.com/2020/07/22/business/Wirecard ex.ceo arrested.html; Alderman, L. & Scheutz, C. In a German Tech Giant's Fall, Charges of Lies, Suppose that Markus Braun was trying to decide where he should open businesses next. He wants to make a rational decision. What should be his first step in making that decision? O Generate alternative courses of action Identify criteria for judging the decision, Define the problem Compute the optimal decision. Select the best strategic goal for Wirecard, Acquire 5 new Asian financial technical firms by June, 2030, Increase sales by 5% and ROI by 10% in the next year. O Do business in at least 10 new countries Improve our reputation on the German stock market. Which of the following is a limitation of the planning process at Wirecard? Check all that apply. Goals can make managers think they know what the future will be like, even when they don't. Goals and plans can derail Innovation and creativity Goals and plans define desired performance levels Employees may find that the pressure created by goals is too much for them to handle

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock