Question: complete all requirements. my answers are probably incorrect. Data table Reference Global Energy Saver (GES), a producer of energy efficient light bulbs, expects that dentand

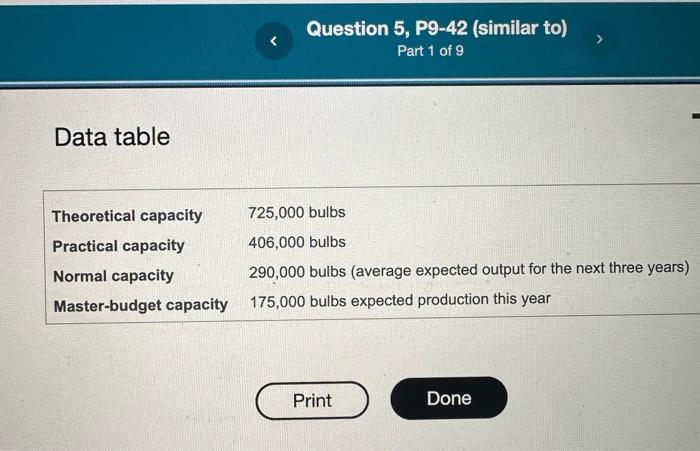

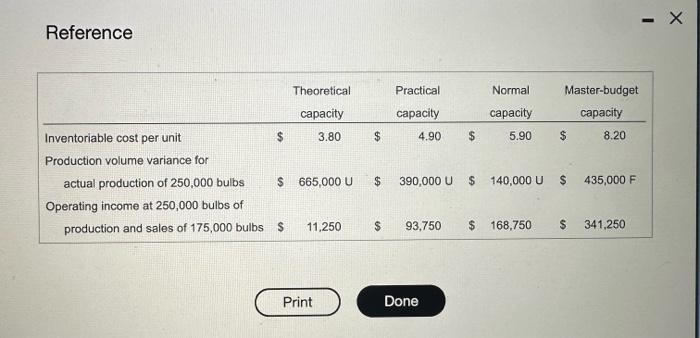

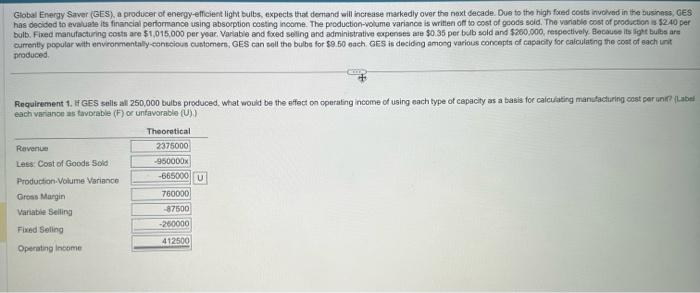

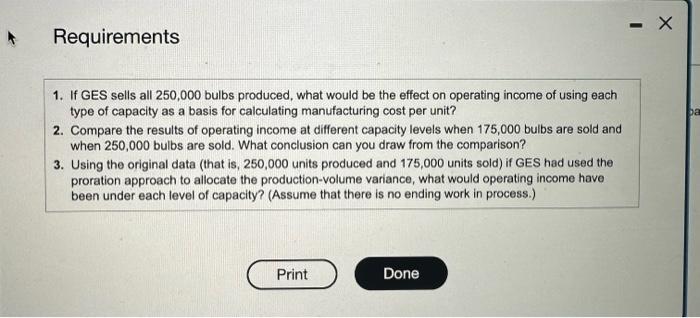

Data table Reference Global Energy Saver (GES), a producer of energy efficient light bulbs, expects that dentand will increase markedly over the noxt decade. Due to the high foced conts itvolved in the businesa, GES has decibed to evaluate its financial perlomance using absorption costing income. The production-volume variance is writien of to cost of goods soid. The velable cost of prociction I 52.40 per bulb. Fhee manufacturing conts are $1,015,000 per yoar. Varlabie end foxed seling and administrative expenses ane $0.35 per belb sold and $. ourrenty popular with envronmentally-eonsoious cuntomern, GES can toll the bulbe for $9.50 oach GES is deciding amoog various concepts of capaoly for calculating the coat of sach int pheduced. Requirement 1. I GES selis al 250,000 bulbs produced, What would be the effect co cperating income of using each type of capacity as a basis for calculating manctacturing cost per uni? (Labef each varianoe as favorable (F) or unfavorable (U)) 1. If GES sells all 250,000 bulbs produced, what would be the effect on operating income of using each type of capacity as a basis for calculating manufacturing cost per unit? 2. Compare the results of operating income at different capacity levels when 175,000 bulbs are sold and when 250,000 bulbs are sold. What conclusion can you draw from the comparison? 3. Using the original data (that is, 250,000 units produced and 175,000 units sold) if GES had used the proration approach to allocate the production-volume variance, what would operating income have been under each level of capacity? (Assume that there is no ending work in process.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts