Question: Complete an Internal Factor Analysis Summary (IFAS) table for Tesla using the following template FOR OXY company Strengths of Oxy Internal Strategic Factors * Strong

Complete an Internal Factor Analysis Summary (IFAS) table for Tesla using the following template

FOR OXY company

Strengths of Oxy Internal Strategic Factors

* Strong dealer community It has built a culture among distributor & dealers where the dealers not only promote companys products but also invest in training the sales team to explain to the customer how he/she can extract the maximum benefits out of the products.

* Strong Free Cash Flow Oxy has strong free cash flows that provide resources in the hand of the company to expand into new projects.

* Highly successful at Go To Market strategies for its products.

* High level of customer satisfaction the company with its dedicated customer relationship management department has able to achieve a high level of customer satisfaction among present customers and good brand equity among the potential customers.

* Good Returns on Capital Expenditure Oxy is relatively successful at execution of new projects and generated good returns on capital expenditure by building new revenue streams.

* Highly skilled workforce through successful training and learning programs. Oxy is investing huge resources in training and development of its employees resulting in a workforce that is not only highly skilled but also motivated to achieve more.

* Successful track record of integrating complimentary firms through mergers & acquisition. It has successfully integrated number of technology companies in the past few years to streamline its operations and to build a reliable supply chain.

* Automation of activities brought consistency of quality to Oxy products and has enabled the company to scale up and scale down based on the demand conditions in the market.

Weakness of Oxy Internal Strategic Factors

The marketing of the products left a lot to be desired. Even though the product is a success in terms of sale but its positioning and unique selling proposition is not clearly defined which can lead to the attacks in this segment from the competitors.

* Limited success outside core business Even though Oxy is one of the leading organizations in its industry it has faced challenges in moving to other product segments with its present culture.

* Financial planning is not done properly and efficiently. The current asset ratio and liquid asset ratios suggest that the company can use the cash more efficiently than what it is doing at present.

* Not highly successful at integrating firms with different work culture. As mentioned earlier even though Oxy is successful at integrating small companies it has its share of failure to merge firms that have different work culture.

* High attrition rate in work force compare to other organizations in the industry Oxy has a higher attrition rate and have to spend a lot more compare to its competitors on training and development of its employees.

* There are gaps in the product range sold by the company. This lack of choice can give a new competitor a foothold in the market.

* Not very good at product demand forecasting leading to higher rate of missed opportunities compare to its competitors. One of the reason why the days inventory is high compare to its competitors is that Oxy is not very good at demand forecasting thus end up keeping higher inventory both in-house and in channel.

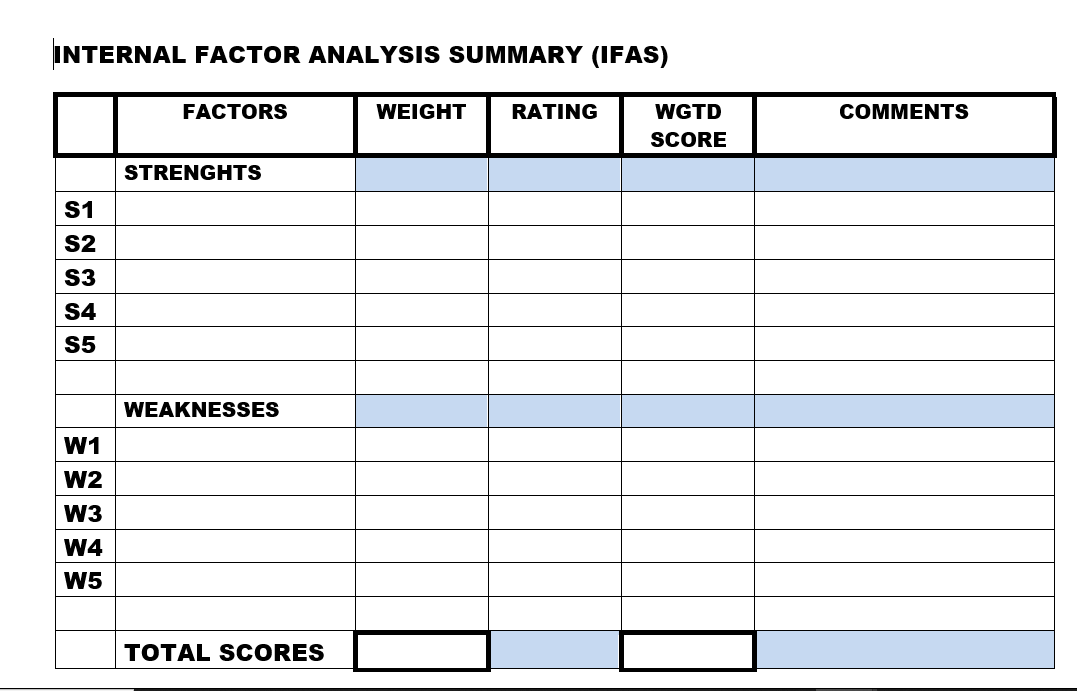

INTERNAL FACTOR ANALYSIS SUMMARY (IFAS)Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts