Question: complete business activity & instalment activity statements $ PR Task 11 Irene Abbott operates a small business as a sole trader selling jewellery, and receives

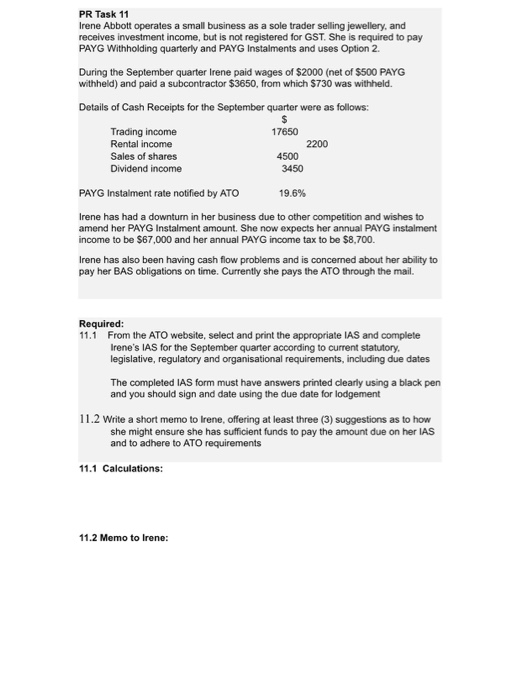

$ PR Task 11 Irene Abbott operates a small business as a sole trader selling jewellery, and receives investment income, but is not registered for GST. She is required to pay PAYG Withholding quarterly and PAYG Instalments and uses Option 2. During the September quarter Irene paid wages of $2000 (net of $500 PAYG withheld) and paid a subcontractor $3650, from which $730 was withheld. Details of Cash Receipts for the September quarter were as follows: Trading income 17650 Rental income 2200 Sales of shares 4500 Dividend income 3450 PAYG Instalment rate notified by ATO 19.6% Irene has had a downturn in her business due to other competition and wishes to amend her PAYG Instalment amount. She now expects her annual PAYG instalment income to be $67,000 and her annual PAYG income tax to be $8,700. Irene has also been having cash flow problems and is concerned about her ability to pay her BAS obligations on time. Currently she pays the ATO through the mail. Required: 11.1 From the ATO website, select and print the appropriate IAS and complete Irene's IAS for the September quarter according to current statutory, legislative, regulatory and organisational requirements, including due dates The completed IAS form must have answers printed clearly using a black pen and you should sign and date using the due date for lodgement 11.2 Write a short memo to Irene, offering at least three (3) suggestions as to how she might ensure she has sufficient funds to pay the amount due on her IAS and to adhere to ATO requirements 11.1 Calculations: 11.2 Memo to Irene: $ PR Task 11 Irene Abbott operates a small business as a sole trader selling jewellery, and receives investment income, but is not registered for GST. She is required to pay PAYG Withholding quarterly and PAYG Instalments and uses Option 2. During the September quarter Irene paid wages of $2000 (net of $500 PAYG withheld) and paid a subcontractor $3650, from which $730 was withheld. Details of Cash Receipts for the September quarter were as follows: Trading income 17650 Rental income 2200 Sales of shares 4500 Dividend income 3450 PAYG Instalment rate notified by ATO 19.6% Irene has had a downturn in her business due to other competition and wishes to amend her PAYG Instalment amount. She now expects her annual PAYG instalment income to be $67,000 and her annual PAYG income tax to be $8,700. Irene has also been having cash flow problems and is concerned about her ability to pay her BAS obligations on time. Currently she pays the ATO through the mail. Required: 11.1 From the ATO website, select and print the appropriate IAS and complete Irene's IAS for the September quarter according to current statutory, legislative, regulatory and organisational requirements, including due dates The completed IAS form must have answers printed clearly using a black pen and you should sign and date using the due date for lodgement 11.2 Write a short memo to Irene, offering at least three (3) suggestions as to how she might ensure she has sufficient funds to pay the amount due on her IAS and to adhere to ATO requirements 11.1 Calculations: 11.2 Memo to Irene

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts