Question: complete business activity & instalment activity statements what do you need for more info please? question show you all , the country is australia ,

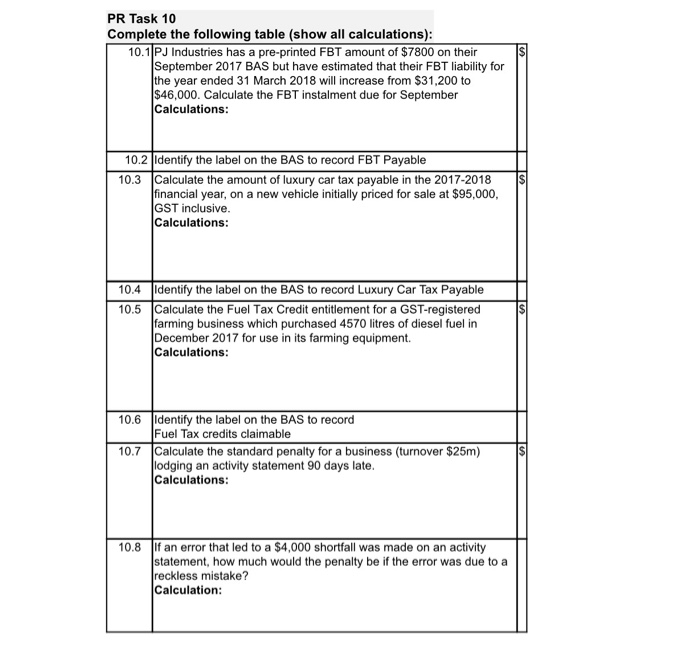

$ PR Task 10 Complete the following table (show all calculations): 10.1 PJ Industries has a pre-printed FBT amount of $7800 on their September 2017 BAS but have estimated that their FBT liability for the year ended 31 March 2018 will increase from $31,200 to $46,000. Calculate the FBT instalment due for September Calculations: 10.2 identify the label on the BAS to record FBT Payable 10.3 Calculate the amount of luxury car tax payable in the 2017-2018 financial year, on a new vehicle initially priced for sale at $95,000, GST inclusive. Calculations: 10.4 Identify the label on the BAS to record Luxury Car Tax Payable 10.5 Calculate the Fuel Tax Credit entitlement for a GST-registered farming business which purchased 4570 litres of diesel fuel in December 2017 for use in its farming equipment. Calculations: 10.6 Identify the label on the BAS to record Fuel Tax credits claimable 10.7 Calculate the standard penalty for a business (turnover $25m) lodging an activity statement 90 days late. Calculations: S 10.8 If an error that led to a $4,000 shortfall was made on an activity statement, how much would the penalty be if the error was due to a reckless mistake? Calculation: $ PR Task 10 Complete the following table (show all calculations): 10.1 PJ Industries has a pre-printed FBT amount of $7800 on their September 2017 BAS but have estimated that their FBT liability for the year ended 31 March 2018 will increase from $31,200 to $46,000. Calculate the FBT instalment due for September Calculations: 10.2 identify the label on the BAS to record FBT Payable 10.3 Calculate the amount of luxury car tax payable in the 2017-2018 financial year, on a new vehicle initially priced for sale at $95,000, GST inclusive. Calculations: 10.4 Identify the label on the BAS to record Luxury Car Tax Payable 10.5 Calculate the Fuel Tax Credit entitlement for a GST-registered farming business which purchased 4570 litres of diesel fuel in December 2017 for use in its farming equipment. Calculations: 10.6 Identify the label on the BAS to record Fuel Tax credits claimable 10.7 Calculate the standard penalty for a business (turnover $25m) lodging an activity statement 90 days late. Calculations: S 10.8 If an error that led to a $4,000 shortfall was made on an activity statement, how much would the penalty be if the error was due to a reckless mistake? Calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts