Question: Complete Chapter 3 Application Questions & Exercises: #2 found on page 98. Use Exhibit 3.8 found on page 91 to complete the 20 financial ratios

Complete Chapter 3 Application Questions & Exercises: #2 found on page 98.

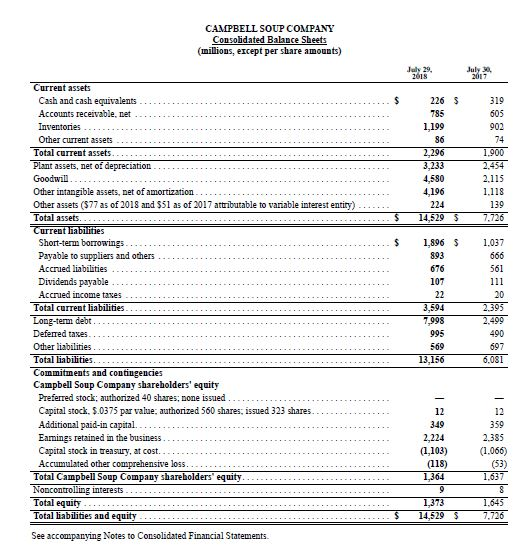

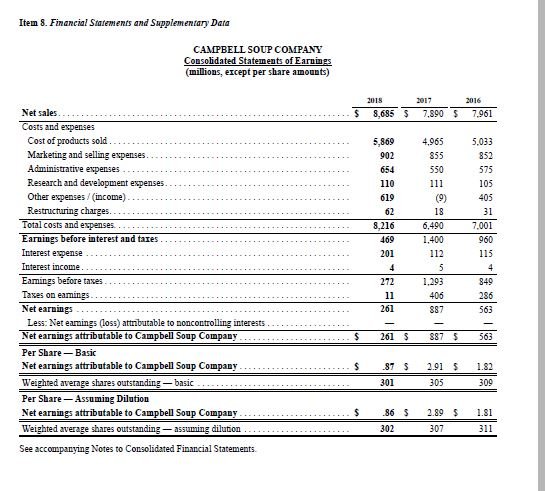

Use Exhibit 3.8 found on page 91 to complete the 20 financial ratios for Campbell Soup (Case #15 - p. C91-C101). Use the financial information located on C98-C100 to calculate each ratio. You will need a cite for the data you use. See pages 418 421 in your textbook for formulas. Use the table below.

http://investor.campbellsoupcompany.com/phoenix.zhtml?c=88650&p=irol-reportsAnnual ***this is just for up to date reference for the annual report****

strategic management: text cases- Dess, McNamara, Aisner, 9e, recognizing a firms Intellectual assets *** this is the book to reference****

| Number | Ratio Name | Formula | Values Used | Calculated Ratio |

| 1 | Current Ratio | Current Assets / Current Liabilities

| 2,296,000/ 3,594,000 | .63 |

| 2 | Quick Ratio | Current Assets- Inventory / Current Liabilities

| 1,199,000/ 3,594,000 | .33 |

| 3 | Cash Ratio | Cash / Current Liabilities

| 226,000/ 3,594,000 | .57 |

| 4 | Total Debt Ratio | Total Assets- Total Equity/ Total Assets

|

|

|

| 5 | Debt to Equity Ratio | Total Debt/ Total Equity

|

|

|

| 6 | Equity Multiplier | Total Assets / Total Equity

|

|

|

| 7 |

|

|

|

|

| 8 |

|

|

|

|

| 9 |

|

|

|

|

| 10 |

|

|

|

|

| 11 |

|

|

|

|

| 12 |

|

|

|

|

| 13 |

|

|

|

|

| 14 |

|

|

|

|

| 15 |

|

|

|

|

| 16 |

|

|

|

|

| 17 |

|

|

|

|

| 18 |

|

|

|

|

| 19 |

|

|

|

|

| 20 |

|

|

|

|

CAMPBELL SOUP COMPANY Consolidated Balance SIh (milions, ercept per share amounts) July 29, uly 30 Total current assets assets, net of depreciation Other intangible assets, net of amortization.. . Other assets ($77 as of 2018 and $51 as of 2017 attributable to variable interest entity) Short-ter borrowings.... Payable to suppliers and others .. . .. . . .. .$1,896 1037 . .. . .-... . . .. Commitments and contingencies equity Preferred stock: authorized 40 shares; none issued Capital stock in treasury, at cost. Accumulated other comprehensive loss (1.066) Total Campbell Soup Company shareholders' equity ee accompanying Notes to Consolidated Financial Statements Item 8. Financial Statements and Supplementary Data CAMPBELL SOUP COMPANY onsolidated Statements of Earning (millions, ercept per share amounts) Net sales $ 8,685 $ 7.890 $ 7961 and expenses Cost of products sold 5,869 4,965 5.033 852 575 105 855 550 902 Research and development expenses. Other expenses / (income). Restructuring charges 110 619 . . 18 6,490 1.400 112 osts and espenses. 8,216 7,001 960 115 arnings before interest and tares. Interest expense. . . Interest income Eanings before tases Taxes on eanings Net earnings 201 1,293 405 887 849 286 563 261 Less: Net eamings (loss) attnbutable to nonc Net earnings attributable to Campbell Soup Company Per Share-Basic Net earnings attributable to Campbell Soup Company Weizhted average shares outstanding-basic Per Share-Assuming Dilution Net earnings attributable to Campbell Soup Company Weighted average shares outstandinEa5suming dilution noncontrolling interests 261 $ 887 $ 563 $87 2.91 182 309 301 305 86 S 2.89 $ 1.81 302 307 311 See accouspanying Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts