Question: Complete Equity with Upstream Sales Lo6 (Note. This is the same problem as Problem 6-7 and Problem 6-13, but assuming the use of the complete

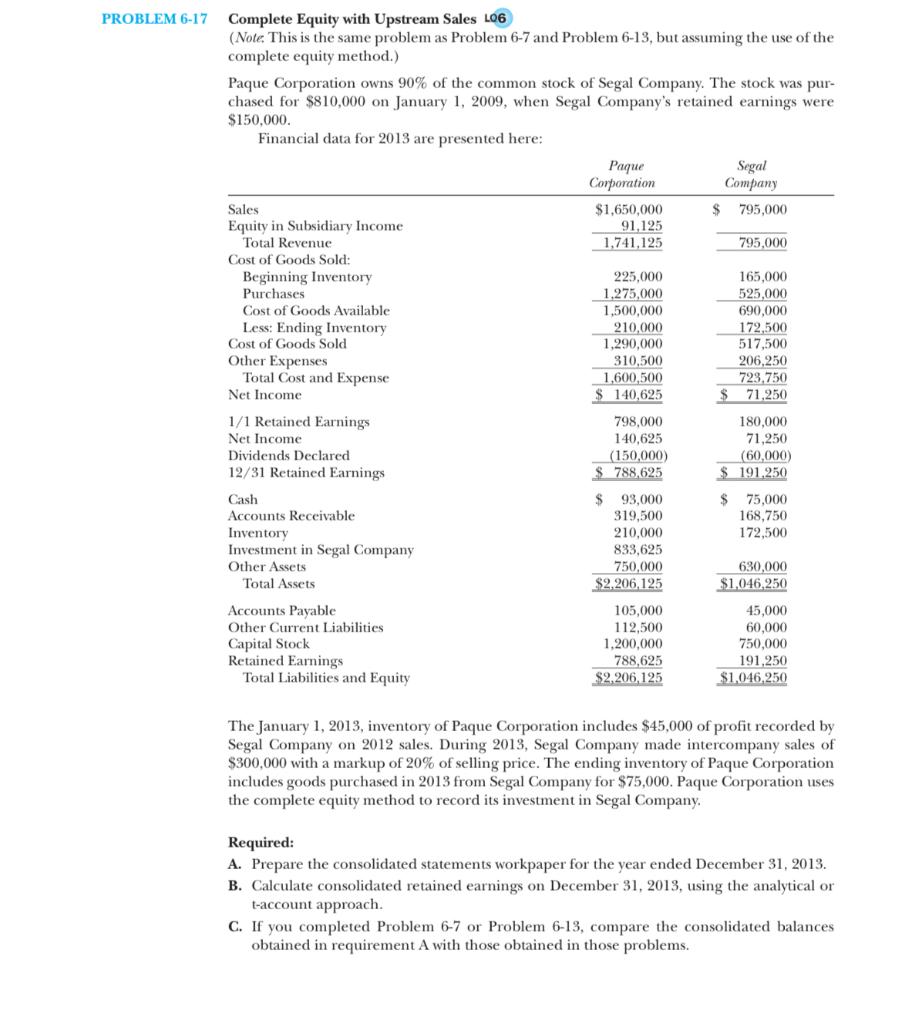

Complete Equity with Upstream Sales Lo6 (Note. This is the same problem as Problem 6-7 and Problem 6-13, but assuming the use of the complete equity method.) Paque Corporation owns 90% of the common stock of Segal Company. The stock was purchased for $810,000 on January 1, 2009, when Segal Company's retained earnings were $150,000. Financial data for 2013 are presented here: The January 1, 2013, inventory of Paque Corporation includes $45,000 of profit recorded by Segal Company on 2012 sales. During 2013, Segal Company made intercompany sales of $300,000 with a markup of 20% of selling price. The ending inventory of Paque Corporation includes goods purchased in 2013 from Segal Company for \$75,000. Paque Corporation uses the complete equity method to record its investment in Segal Company. Required: A. Prepare the consolidated statements workpaper for the year ended December 31, 2013. B. Calculate consolidated retained earnings on December 31, 2013, using the analytical or t-account approach. C. If you completed Problem 6-7 or Problem 6-13, compare the consolidated balances obtained in requirement A with those obtained in those problems

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts