Question: complete exercises in a paper BE2.2 (LO 1) Transactions for the Oleg Thorn Company for the month of June are presented below. Identify accounts to

complete exercises in a paper

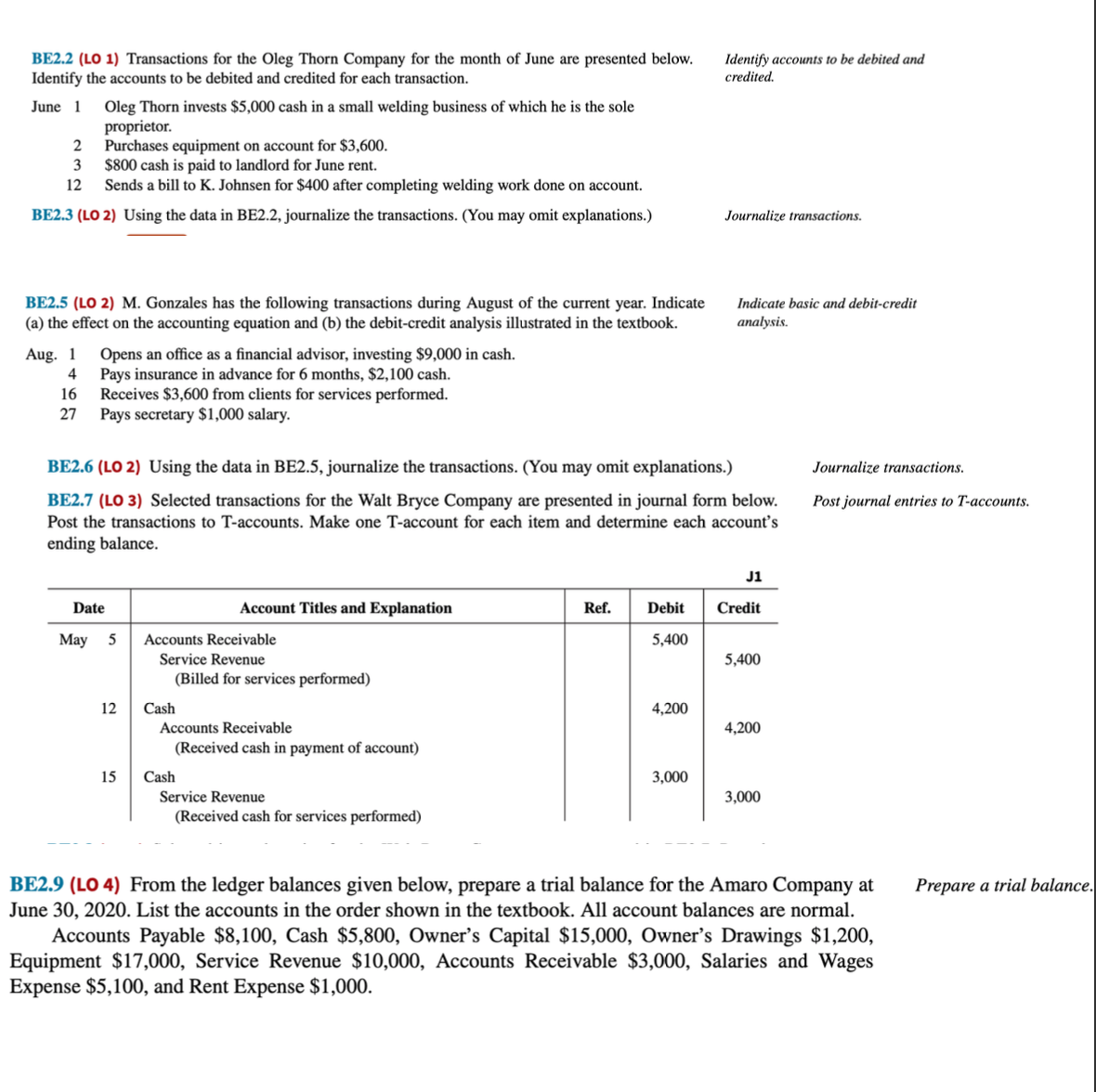

BE2.2 (LO 1) Transactions for the Oleg Thorn Company for the month of June are presented below. Identify accounts to be debited and Identify the accounts to be debited and credited for each transaction. credited. June 1 Oleg Thorn invests $5,000 cash in a small welding business of which he is the sole proprietor. 2 Purchases equipment on account for $3,600. $800 cash is paid to landlord for June rent. 12 Sends a bill to K. Johnsen for $400 after completing welding work done on account. BE2.3 (LO 2) Using the data in BE2.2, journalize the transactions. (You may omit explanations.) Journalize transactions. BE2.5 (LO 2) M. Gonzales has the following transactions during August of the current year. Indicate Indicate basic and debit-credit (a) the effect on the accounting equation and (b) the debit-credit analysis illustrated in the textbook. analysis. Aug. 1 Opens an office as a financial advisor, investing $9,000 in cash. 4 Pays insurance in advance for 6 months, $2,100 cash. 16 Receives $3,600 from clients for services performed. 27 Pays secretary $1,000 salary. BE2.6 (LO 2) Using the data in BE2.5, journalize the transactions. (You may omit explanations.) Journalize transactions. BE2.7 (LO 3) Selected transactions for the Walt Bryce Company are presented in journal form below. Post journal entries to T-accounts. Post the transactions to T-accounts. Make one T-account for each item and determine each account's ending balance J1 Date Account Titles and Explanation Ref. Debit Credit May 5 Accounts Receivable 5,40 Service Revenue 5,400 (Billed for services performed) 12 Cash 4,200 Accounts Receivable 4,200 (Received cash in payment of account) 15 Cash 3,000 Service Revenue 3,000 (Received cash for services performed) BE2.9 (LO 4) From the ledger balances given below, prepare a trial balance for the Amaro Company at Prepare a trial balance. June 30, 2020. List the accounts in the order shown in the textbook. All account balances are normal. Accounts Payable $8,100, Cash $5,800, Owner's Capital $15,000, Owner's Drawings $1,200, Equipment $17,000, Service Revenue $10,000, Accounts Receivable $3,000, Salaries and Wages Expense $5,100, and Rent Expense $1,000