Question: Complete forms 1050 page 1&2 ans schedule A ONLy 45. Alice J. and Bruce M. Byrd are married taxpayers who file a joint retun. Their

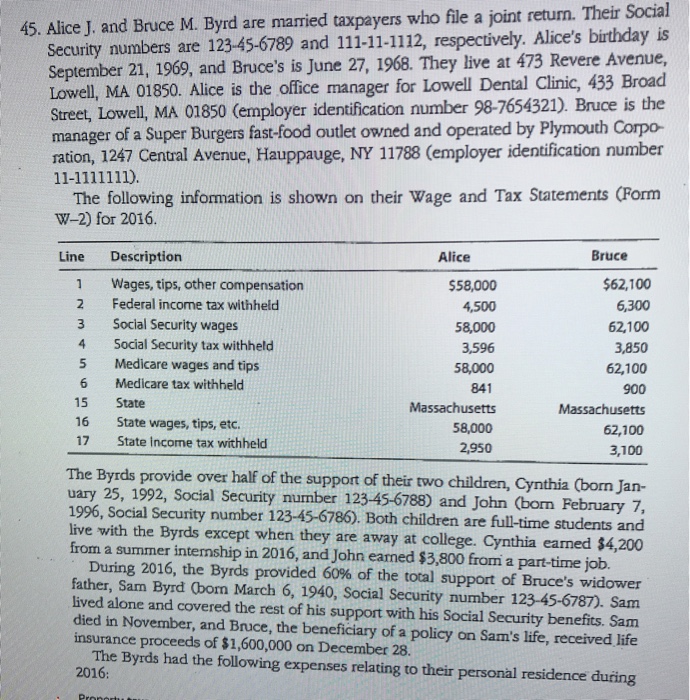

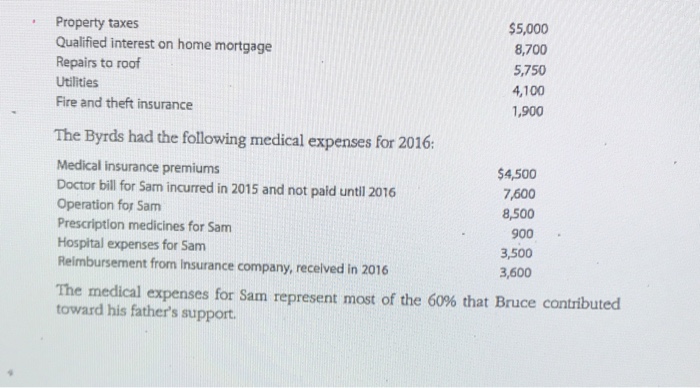

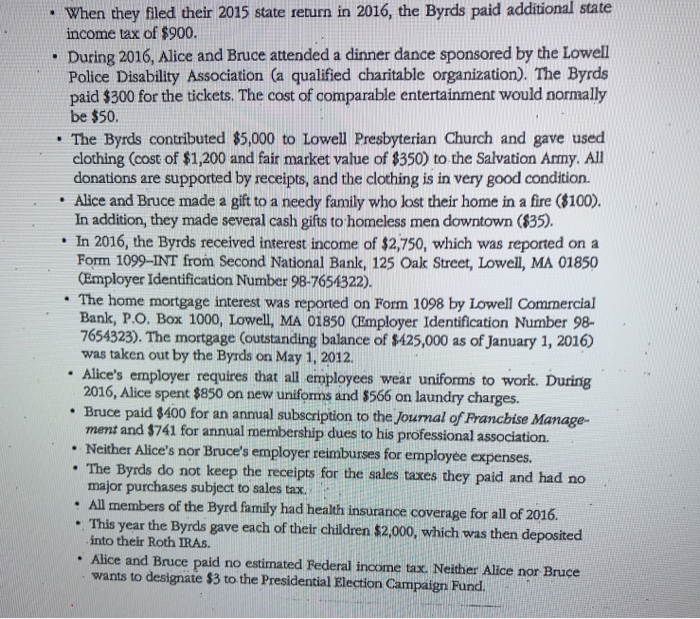

45. Alice J. and Bruce M. Byrd are married taxpayers who file a joint retun. Their Social Security numbers are 123-45-6789 and 111-11-1112, respectively. Alice's birthday is September 21, 1969, and Bruce's is June 27, 1968. They live at 473 Revere Avenue Lowell, MA 01850. Alice is the office manager for Lowell Dental Clinic, 433 Broa Street, Lowell, MA 01850 (employer identification number 98-7654321). Bruce is the manager of a Super Burgers fast-food outlet owned and operated by Plymouth Corpo- ration, 1247 Cental Avenue, Hauppauge, NY 11788 (employer identification number The following information is shown on their Wage and Tax Statements (Form W-2) for 2016. Line Descriptiorn Alice Bruce 1 Wages, tips, other compensation 2 Federal income tax withheltd 3 Social Security wages 4 Social Security tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 15 State 16 State wages, tips, etc. 17 State Income tax withheld 558,000 4,500 58,000 3,596 58,000 841 Massachusetts 58,000 2,950 $62,100 6,300 62,100 3,850 62,100 900 Massachusetts 62,100 3,100 The Byrds provide over half of the support of their two children, Cynthia (born Jan- uary 25, 1992, Social Security number 123-45-6788) and John (born February 7, live with the Byrds except when they are away at college. Cynthia eamed $4,200 1996, Social Security number 123-45-6786. Both children are full-time students and from a summer intemship in 2016, and John earned $3,800 from a part-time job. During 2016, the Byrds provided 60% of the total support of Bruce's widower father, Sam Byrd Obom March 6, 1940, Social Security number 123-45-6787). Sam lived alone and covered the rest of his support with his Social Security benefits. Sam died in November, and Bruce, the beneficiary of a policy on Sam's life, received life insurance proceeds of $1,600,000 on December 28. The Byrds had the following expenses relating to their personal residence during 2016: 45. Alice J. and Bruce M. Byrd are married taxpayers who file a joint retun. Their Social Security numbers are 123-45-6789 and 111-11-1112, respectively. Alice's birthday is September 21, 1969, and Bruce's is June 27, 1968. They live at 473 Revere Avenue Lowell, MA 01850. Alice is the office manager for Lowell Dental Clinic, 433 Broa Street, Lowell, MA 01850 (employer identification number 98-7654321). Bruce is the manager of a Super Burgers fast-food outlet owned and operated by Plymouth Corpo- ration, 1247 Cental Avenue, Hauppauge, NY 11788 (employer identification number The following information is shown on their Wage and Tax Statements (Form W-2) for 2016. Line Descriptiorn Alice Bruce 1 Wages, tips, other compensation 2 Federal income tax withheltd 3 Social Security wages 4 Social Security tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 15 State 16 State wages, tips, etc. 17 State Income tax withheld 558,000 4,500 58,000 3,596 58,000 841 Massachusetts 58,000 2,950 $62,100 6,300 62,100 3,850 62,100 900 Massachusetts 62,100 3,100 The Byrds provide over half of the support of their two children, Cynthia (born Jan- uary 25, 1992, Social Security number 123-45-6788) and John (born February 7, live with the Byrds except when they are away at college. Cynthia eamed $4,200 1996, Social Security number 123-45-6786. Both children are full-time students and from a summer intemship in 2016, and John earned $3,800 from a part-time job. During 2016, the Byrds provided 60% of the total support of Bruce's widower father, Sam Byrd Obom March 6, 1940, Social Security number 123-45-6787). Sam lived alone and covered the rest of his support with his Social Security benefits. Sam died in November, and Bruce, the beneficiary of a policy on Sam's life, received life insurance proceeds of $1,600,000 on December 28. The Byrds had the following expenses relating to their personal residence during 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts