Question: Complete full assignment please. Johnny, a cash-basis taxpayer, owns two rental properties. For each of the transactions described below, determine the amount of income from

Complete full assignment please.

Complete full assignment please.

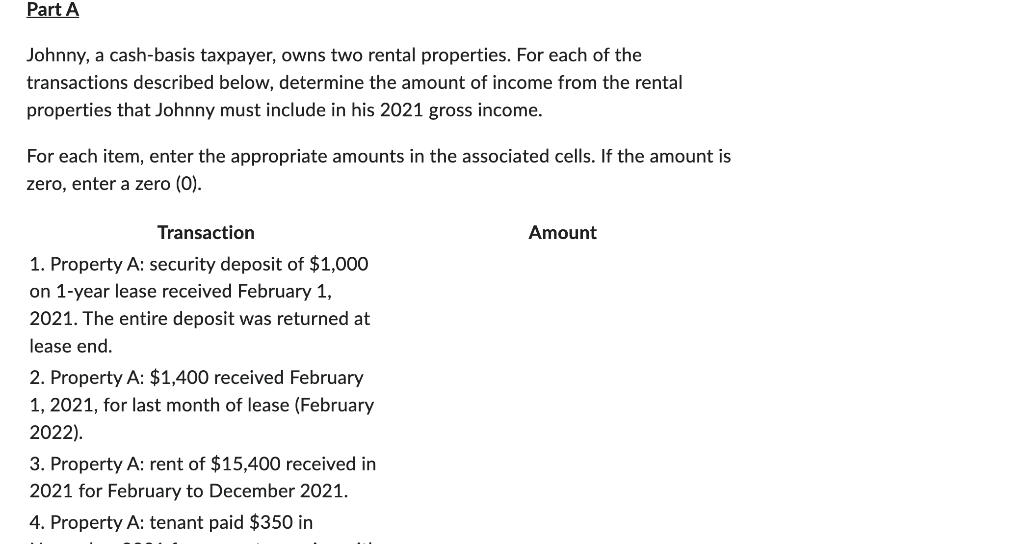

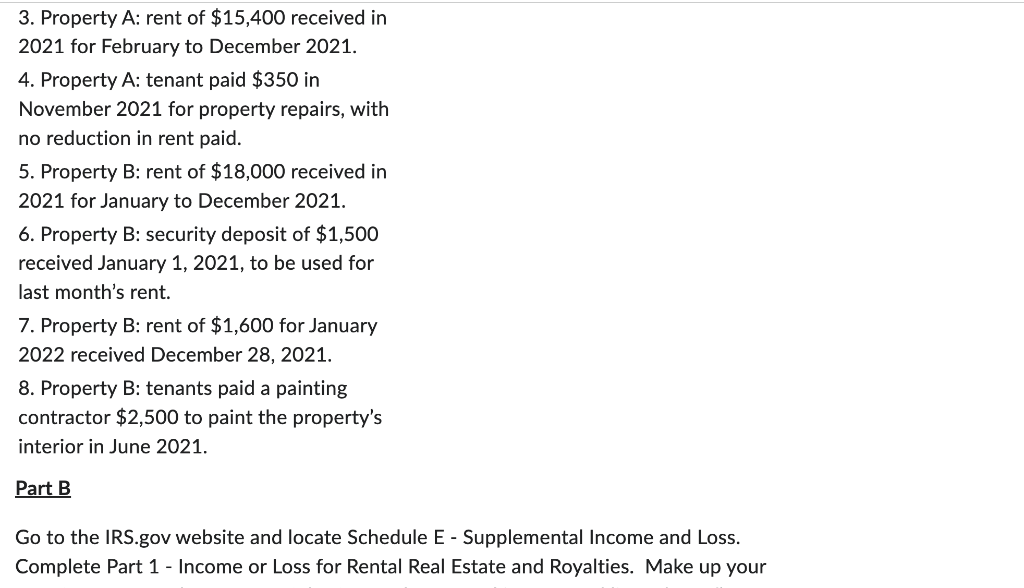

Johnny, a cash-basis taxpayer, owns two rental properties. For each of the transactions described below, determine the amount of income from the rental properties that Johnny must include in his 2021 gross income. For each item, enter the appropriate amounts in the associated cells. If the amount is zero, enter a zero (0) 3. Property A : rent of $15,400 received in 2021 for February to December 2021. 4. Property A: tenant paid $350 in November 2021 for property repairs, with no reduction in rent paid. 5. Property B: rent of $18,000 received in 2021 for January to December 2021. 6. Property B: security deposit of $1,500 received January 1, 2021, to be used for last month's rent. 7. Property B: rent of $1,600 for January 2022 received December 28,2021. 8. Property B: tenants paid a painting contractor $2,500 to paint the property's interior in June 2021. Part B Go to the IRS.gov website and locate Schedule E - Supplemental Income and Loss. Complete Part 1 - Income or Loss for Rental Real Estate and Royalties. Make up your 8. Property B: tenants paid a painting contractor $2,500 to paint the property's interior in June 2021. Part B Go to the IRS.gov website and locate Schedule E - Supplemental Income and Loss. Complete Part 1 - Income or Loss for Rental Real Estate and Royalties. Make up your own facts to complete Part 1 of the form. Show rental income and list at least five expenses related to the rental property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts