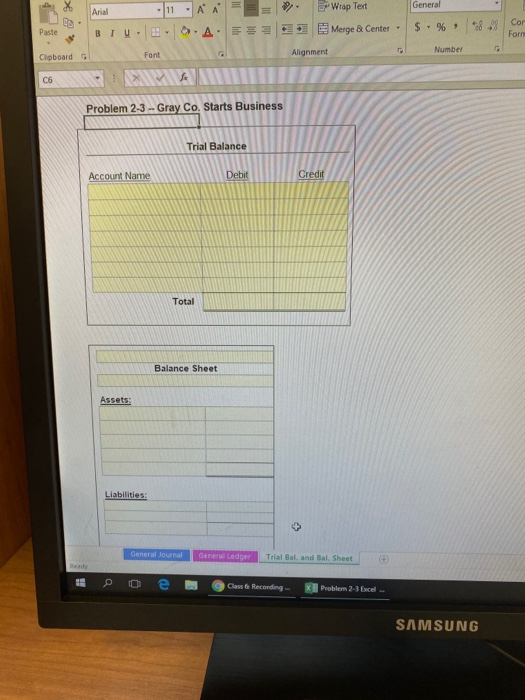

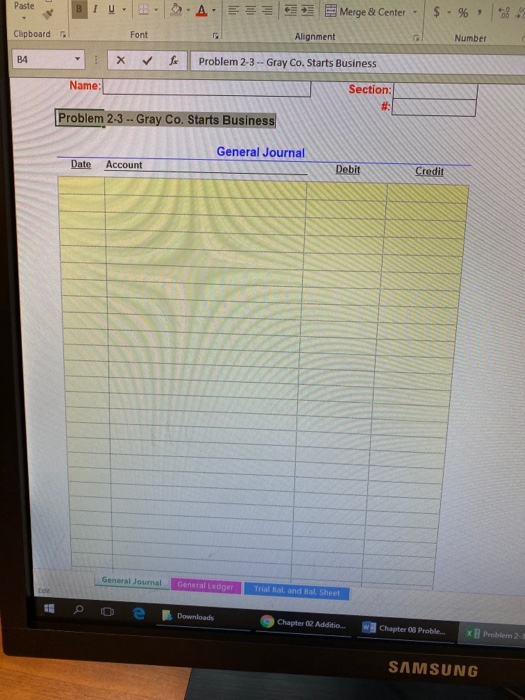

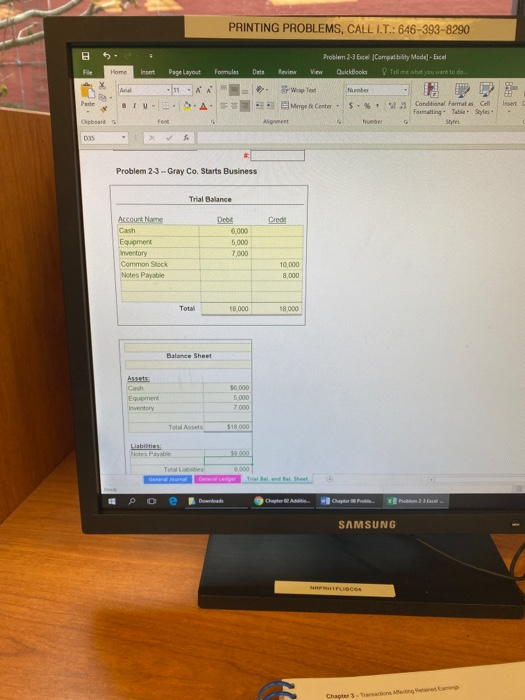

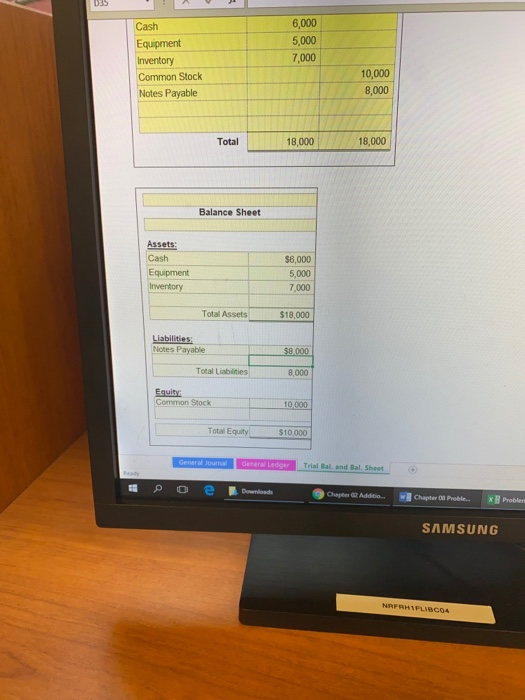

Question: complete journal leadger and trial banlance and bal sheet please thank you UN COTING 27 SOLID FOOTING 25 Chapter 3 Recording Transactions Affecting Retained Earnings

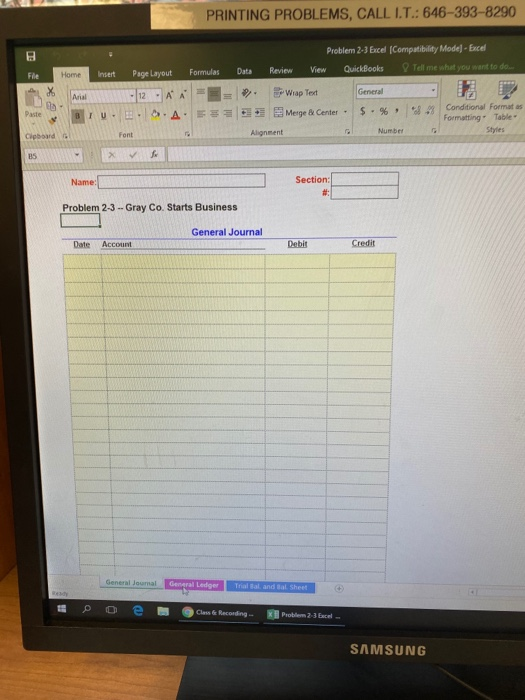

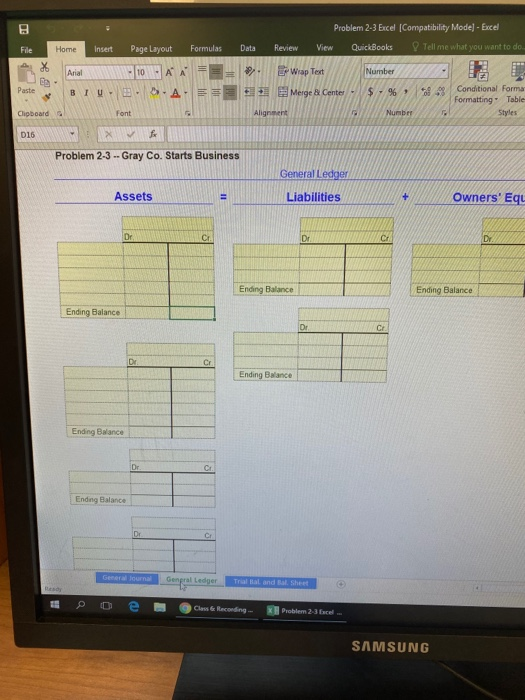

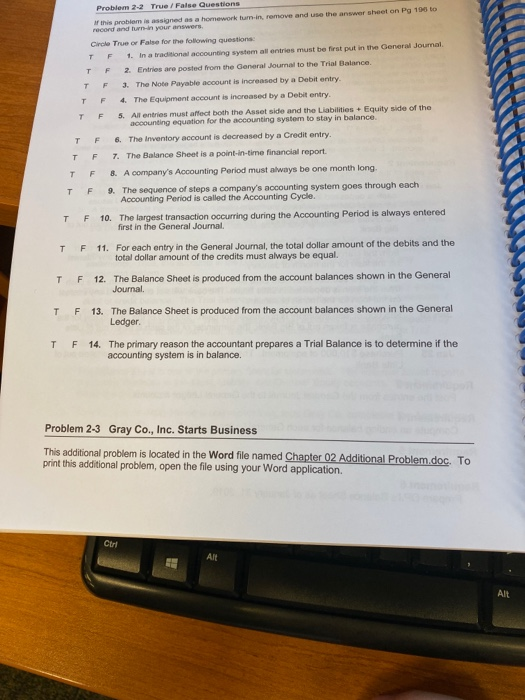

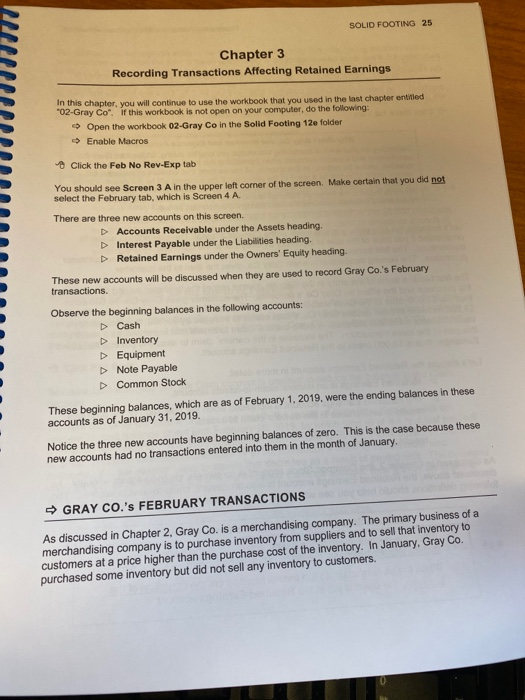

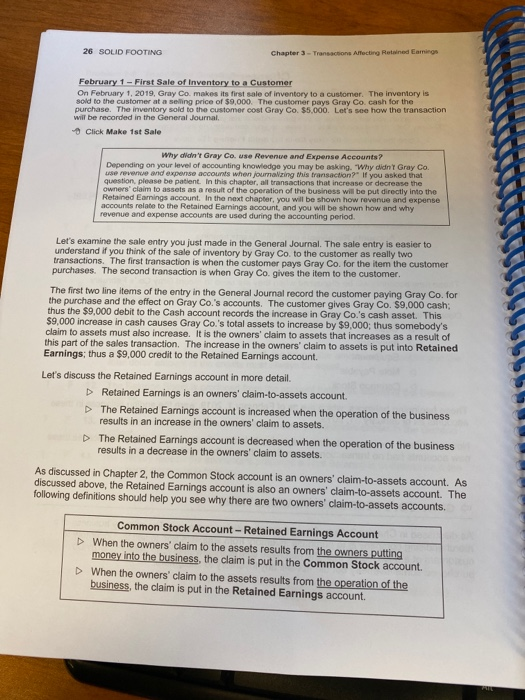

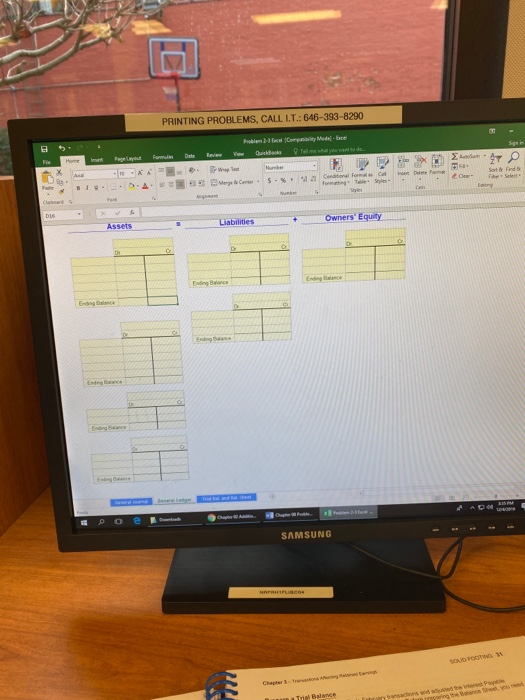

UN COTING 27 SOLID FOOTING 25 Chapter 3 Recording Transactions Affecting Retained Earnings TIPPPPPPP In this chapter, you will continue to use the workbook that you used in the last chapter entitled "02-Gray Co". If this workbook is not open on your computer, do the following: - Open the workbook 02-Gray Co in the Solid Footing 12e folder -Enable Macros Click the Feb No Rev-Exp tab You should see Screen 3 A in the upper left corner of the screen. Make certain that you did not select the February tab, which is Screen 4 A. There are three new accounts on this screen. Accounts Receivable under the Assets heading. Interest Payable under the Liabilities heading. D Retained Earnings under the Owners' Equity heading. These new accounts will be discussed when they are used to record Gray Co.'s February transactions. Observe the beginning balances in the following accounts: Cash Inventory Equipment > Note Payable > Common Stock These beginning balances, which are as of February 1, 2019, were the ending balances in these accounts as of January 31, 2019. Notice the three new accounts have beginning balances of zero. This is the case because these new accounts had no transactions entered into them in the month of January GRAY CO.'s FEBRUARY TRANSACTIONS As discussed in Chapter 2, Gray Co. is a merchandising company. The primary business of a merchandising company is to purchase inventory from suppliers and to sell that inventory to customers at a price higher than the purchase cost of the inventory. In January, Gray Co. purchased some inventory but did not sell any inventory to customers. NARRIFLINCOH SOUD FOOTNO 29 28 SOUD FOOTING The counts Receivable w decree by $2.000 The i re by . con total is an increase of 52.100 This . and the and February 7-Pay Wages to Employees On February Copa $1.000 meter tower of work Cik Pay Wages de Ca t herinthathu The $1.000 decrease in Gray Cosmolasses by 1 o u ut of paying wa s a $1.000 debit to the Reaned Earnings account Click Post to Ledger The Retained Earrings accoun t y $2.500 of the S4 500 The 12.000 debt This reflects the increase in the owners to ber nion in this case the person of the business February 11 - Purchase inventory Notice the curent balance in you r counter. Gray Conde won with 7000 of inventory on February 1. Gray Co n ventory c ome with a con $5.000, and on February 10, Gay Co the romaning 12.000 af hvery to another one Consegnty Gray Co now needs to purchase a nal wary became shoes in its Observe the effect on the Cash account and the land Fansing out February 10 - Sate of Inventory to a Customer on Credit On February 10, 2018, Guy a sale of inventory to somer. The inventory so the customer a n d price of $4.500 The inventory that is sold to the customer contray to On February 11, 2018, Gray Courses actionalitory. The inventory to 7 500 and is paid for with cash Click Buy Inventory The debt to inventory increases the Inventory count. The credit toch decreases the Cash This sale is very t h February 1 sale with one important e The customer does motorsty have the cash to pay for the purchase. The customer indic a t she will be able to pay portion of the purchase price near the end of February and the remainder of the purchase price around the middle of March Gray Co decides to make these to the customer based on the customer's p o pay in the near future. This is called mangas on credo Gending credit customer For Gray Co, the customer's promise to pay there is b ut gives Gray Catheright to receive cash af om fredale T e rghe covecanthu s called an Accounts Receivable. Observed to this sale when it occurs and not when this received, which is consistent with the coa of accounting duced in Chapter 2 on Pg 21) Let's see how this sale action would be recorded in the General Journal Click Make 2nd Sale Clock Post Ledger Look at the inventory account and the Cash out to the elect of posting this entry GUGGGGGGGGITTITT INUTI The first two line s of the entry in the General Joumal record the customerging Gray C her prometo pay in the future for the purchase. The $4.500 dobit to the Accounts Receivable account records the increase in Gray Co u nt receivable as This $4.500 Increase in the Accounts Recewable account causes Grey Co s sets to increase by $4.500 thus someody's daml a incase the owner diame tras a result of this part of the sales transaction thus a $4.500 credit to the Re d Earnings account February 26 - Pay Wages to Employees On February 26, Gray Co. pays $900 cash to workers for their work during the last three weeks of February. Before you click the blue Pay Wages buton and without looking at the wages payment entry on February 7, sell you know who will be the February 26 wage payment entry. Cik Pay Wages Did you go the entry come? Click Post to Ledger Notice the elect on the General Ledger accounts The last two lines of the entry in the General Journal record Gray Coving the inventory tem to the customer. This portion of the sale entry is the same as the second portion of the February 1 sale anty. The only ofference is that the cost of the inventory sold to customer is $2.000 The $2.000 credit to inventory reduces the inventory account and the $2.000 debit to the Retained Earnings account reduces the owners claim to February 27 - Collect Cash from a customer On February 10 Gray Co made a $4.500 sale to a customer and that time, did not receive cash from the customer instead of getting cash from the customer. Gray Corolved from the Customer a promise to pay Cash to Gray Co sometime in the future. Look at the February 10 entry and observe that the customer's promise to pay was put into the Accounts Receivable account Lor's now post the sale entry to the General Ledger accounts Click Post to Ledger PRINTING PROBLEMS, CALL I.T.: 646-393-8290 Home Insert Page Layout Formulas 12 = . .A. = Problem 2-3 Excel (Compatibility Mode] - Excel Oats Review View QuickBooks Tell me what you want to do . Wap Test Merge & Center - $ .% Conditional Formatas Formatting Table Alignment Number Styles BIU- Name: Section: Problem 2-3 - Gray Co. Starts Business General Journal Date Account Debit Credit eral Journal General Ledger Trial al and Bal Sheet O e Class & Recording - Problem 2-3 facel - SAMSUNG Home Insert Data File A Page Layout 10A Formulas = % Problem 2-3 Excel (Compatibility Mode] - Excel Review View QuickBooks y Tell me what you want to do Wiap Text Number Merge & Center - $ % *.99 Conditional Forma Formatting Table Numbre Styles Paste BLU- + + Clipboard Alignment D16 Problem 2-3 -- Gray Co. Starts Business General Ledger Assets Liabilities Owners' Eqy Dr Ending Balance Ending Balance Ending Balance Ending Bwance Ending Bwance General Journal General Ledger Trial Land Rol Sheet Class Recording Problem 2-3 SAMSUNG E . General Arial B IU. 11 . ANE .A. E Wap Text Merge & Center. Paste F $ % & Cor Forn Number Clipboard Font Alignment AMIT Problem 2-3 - Gray Co. Starts Business Trial Balance Account Name Debit Credit Total Balance Sheet Liabilities: General Journal General Ledger Trial Bal, and Bal. Sheet 9 0 e Class & Recordings Problem 2-3 Excel SAMSUNG 11 Problem 2-2 True / False Questions If this problem is assigned as a homework turn-in, remove and use the answer sheet on Pg 100 to record and in your answers. Circle True or False for the following questions T F . In a traditional accounting system all entries must be first put in the General Journal T F 2 . Entries are posted from the General Journal to the Trial Balance T F 3. The Note Payable account is increased by a Debit entry. T F 4. The Equipment account is increased by a Debit entry. T F 5. All entries must affect both the Asset side and the Liabilities + Equity side of the accounting equation for the accounting system to stay in balance T F 6. The Inventory account is decreased by a Credit entry. F 7 The Balance Sheet is a point-in-time financial report. F 8. A company's Accounting Period must always be one month long F 9. The sequence of steps a company's accounting system goes through each Accounting Period is called the Accounting Cycle. T T T T F 10. The largest transaction occurring during the Accounting Period is always entered first in the General Journal T F 11. For each entry in the General Journal, the total dollar amount of the debits and the total dollar amount of the credits must always be equal T F 12. The Balance Sheet is produced from the account balances shown in the General Journal T F 13. The Balance Sheet is produced from the account balances shown in the General Ledger T F 14. The primary reason the accountant prepares a Trial Balance is to determine if the accounting system is in balance. Problem 2-3 Gray Co., Inc. Starts Business This additional problem is located in the Word file named Chapter 02 Additional Problem doc. To print this additional problem, open the file using your Word application. Chapter 3 - Transactions A cting Retained amings SOUD FOOTING 27 The last two line items of the entry in the General Journal record Gray Co giving the inventory item to the customer. When the item is taken out of Gray Co.'s inventory and given to the customer Gray Co.'s Inventory account must be decreased by the cost of the item. The item given to the customer cost Gray Co. 55.000 thus the $5.000 credit to the Inventory account. This $5,000 decrease in inventory causes Gray Co.'s total assets to decrease by $5.000, thus somebody's claim to assets must also decrease. It is the owners' claim to assets that decreases as a result of this part of the sale transaction. The decrease in the owners' claim to assets is put into Retained Earnings: thus a $5.000 debt to the Retained Earnings account Let's now post the sale entry to the General Ledger accounts Click Post to Ledger Observe the following: The Cash account increases by $9,000, and the inventory account decreases by $5.000. The net effect on total assets is an increase of $4,000. This increase in total assets is the result of Gray Co. selling an inventory item that cost $5,000 to a customer for $9,000. The Retained Earnings account increases by $4.000 as a result of the $9.000 credit and the $5,000 debit. This reflects the increase in the owners' claim to assets as a result of the operation of the business. In this case, the operation of the business is selling inventory to a customer February 2-Pay Rent for the Month of February During January, Gray Co. rented a building from where it will run its business. The landlord, the owner of the building, gave Gray Co. free rent for January. On February 2, the landlord stops by the store to collect the rent for the month of February, Gray Co, pays the landlord $700 cash for the February rent CELLULUI Click Pay Rent Because cash was paid out, the Cash account is credited to reduce the balance in the Cash account The rent that Gray Co. paid is only for one month, the month of February. Gray Co. will not prepare its next Balance Sheet until February 28, 2019, by which time all of the rent just paid will have been fully used up. The $700 decrease in cash causes Gray Co.'s total assets to decrease by $700. Because total assets decrease by $700, somebody's claim to assets must also decrease. It is the owners' claim to assets that decrease as a result of paying rent. The decrease in the owners' claim to assets is put in the Retained Earnings account: thus a $700 debit to the Retained Earnings account. Let's now post the rent payment entry to the General Ledger accounts. Click Post to Ledger Notice the Cash account decreases by $700 and no other asset account increases. As a result, total assets decrease by $700. Notice the Retained Earnings account decreases by $700 as a result of the $700 debit. This reflects the decrease in the owners' claim to assets as a result of the operation of the business. In this case, the operation of the business is paying rent. 28 SOLID FOOTING Chapter 3 - Transactions Alecting and Earnings February 7-Pay Wages to Employees On February 7. Gray Co, pays $1,000 to its workers for their first week of work Click Pay Wages Because cash is paid out, the Cash account is credited to reduce the balance in the Cash account The $1.000 decrease in cash causes Gray Co.'s total assets to decrease by $1.000; thus somebody's claim to assets must also decrease it is the owners' claim to assets that decreases as a result of paying wages, thus a $1.000 debit to the Retained Earnings account Click Post to Ledger Observe the effect on the Cash account and the Retained Earnings account February 10 - Sale of Inventory to a Customer on Credit On February 10, 2019, Gray Co, makes a sale of inventory to a customer. The inventory is sold to the customer at a selling price of $4,500. The inventory that is sold to the customer cost Gray Co. $2.000 This sale is very similar to the February 1 sale with one important difference. This customer does not currently have the cash to pay for the purchase. The customer indicates that she will be able to pay a portion of the purchase price near the end of February and the remainder of the purchase price around the middle of March Gray Co, decides to make the sale to the customer based on the customer's promise to pay in the near future. This is called making a sale on creditor extending credit to a customer. For Gray Co., the customer's promise to pay in the future is an asset because it gives Gray Co, the right to receive cash at some future date. This asset (the right to receive cash in the future) is called an Accounts Receivable. Observe that Gray Co, records this sale when it occurs and not when cash is received, which is consistent with the accrual basis of accounting (introduced in Chapter 2 on Pa 211 Let's see how this sale transaction would be recorded in the General Journal Click Make 2nd Sale The first two line items of the entry in the General Journal record the customer giving Gray Co, her promise to pay in the future for the purchase. The $4,500 debit to the Accounts Receivable account records the increase in Gray Co.'s account receivable asset. This $4,500 increase in the Accounts Receivable account causes Gray Co.'s total assets to increase by $4,500; thus somebody's claim to assets must also increase. It is the owners' claim to assets that increases as a result of this part of the sales transaction; thus a $4,500 credit to the Retained Earnings account. The last two line items of the entry in the General Journal record Gray Co, giving the inventory item to the customer. This portion of the sale entry is the same as the second portion of the February 1 sale entry. The only difference is that the cost of the inventory sold to this customer is $2,000. The $2,000 credit to inventory reduces the Inventory account, and the $2.000 debit to the Retained Earnings account reduces the owners' claim to assets. Let's now post the sale entry to the General Ledger accounts. Click Post to Ledger Chapter 3 - www.ons Acting med meg SOLID FOOTING 29 Observe the following The Accounts Receivable account increases by $4.500, and the inventory account decreases by $2.000. The net effect on total assets is an increase of $2.500. This increase in total assets is the result of selling an inventory item that cost Gray Co. $2.000 to a customer for $4,500 The Retained Earnings account increases by $2.500 as a result of the S4 500 credit and the $2.000 debit. This reflects the increase in the owners' claim to assets as a result of the operation of the business. In this case, the operation of the business is seling inventory to a customer February 11 - Purchase Inventory Notice the current balance in Gray Co.'s Inventory account is zero. Gray Co started the month with $7,000 of inventory. On February 1, Gray Co sold inventory to a customer with a cost of $6,000, and on February 10, Gray Co sold the remaining $2,000 of inventory to another customer Consequently. Gray Co now needs to purchase additional Inwentory because the shelves in its store are empty On February 11, 2019, Gray Co. purchases additional inventory. The inventory cost $7.500 and is paid for with cash - Click Buy Inventory The debit to inventory increases the Inventory account. The credit to cash decreases the Cash account Click Post to Ledger Look at the Inventory account and the Cash account to see the effect of posting this entry. February 26 - Pay Wages to Employees On February 28, Gray Co, pays $900 cash to its workers for their work during the last three weeks of February. Before you click the blue Pay Wages button and without looking at the wages payment entry on February 7, see if you know what will be the February 28 wages payment entry. Click Pay Wages Did you get the entry correct? Click Post to Ledger Notice the effect on the General Ledger accounts. February 27 - Collect Cash from a Customer On February 10. Gray Co. made a $4,500 sale to a customer and, at that time, did not receive cash from the customer. Instead of getting cash from the customer. Gray Co, received from the customer a promise to pay cash to Gray Co, sometime in the future. Look at the February 10 entry and observe that the customer's promise to pay was put into the Accounts Receivable account. | che Post Ledger Prepare the balance sheel ability, and y ou Click Prepare the balance Short February Record the interest bus on the Bank Loan On y co went to the brand go a loan for the in Scots when you made January's As m otive for Cray Colore on the band did not chay CHROM E LLLLLLLLLLLLLLLL Observe the ig Bang Shot The heading t h e women in the for the point in hapo 2018 Gray Co has four types of Cash Mounts Receiva , to t The total amount of motyw 27.00 The band y 's 45. This to w n in Ines Note Payable 8.000 r m The owners have to wyo's 13.00. Thi on bolne teme Common $10.000 R ed Eaming These and the limi ts we in balance Interest on the bank loan started on February. At the end of February. On C owes the bank one month of interest on February 20. Gray Ceca the bank ind out how much interest Gray Ca can wat until the end of March to actually pay February's interest W wes The bank indicate that the interest on the loan for the month of February is 340, h ispeld to the bank at the end of February for February's Gray Co does med to make an entry for the interest owed to the bank Observe that Gray Co records the interest due on the bank loan even though no cash was paid to the bank s consistent with the crual basis of accounting introduced in Chapter 2 on Pg21) e A Closer Look at the change in the Retained Ears Balance During February, the balance in the Retained Laings a t goes om begg or tonending bolonot 660, ore. You can see that to the increased by S860 asull of the son of our w o r ry Click Adjusting The $40 credit to the interest Payable account records the bank's como Gray Coasts that is the result of the interest on the loan Observe the following: This entry increases the bank's claim to Gray C assets. Total assets do not change as a result of this entry. As a result, somebody's claim to assets must decrease is the owners claim to that must be decreased thus the $40 debit to the R ed Eamings account By looking at the root and debitories in the R ed Carrings a n d the trading each entry back to the General Journal you can determine the cand each andr e each decrease in the owners claim to the On the op of the following pagesaving shows each increase and each decrease in the Retained amings out This tingin shows the cause of each increase or decrease Click Post to Ledger Look at the Interest Payable account and the Retained Eamings account to see the effect of posting this entry This type of entry is called an adusting entry. The entry is not the result of a transaction, but we the result of the passage of time causing interest to be due to the bank. Adjusting entries are important because they Tune-up' the balances in the accounts prior to the preparation of financial statements Chapters 7 and 8 wil be devoted entirely to adjusting entries Paste BTU - S.A. E Merge & Center - $ . % 8 Clipboard Font Alignment al Number B4 X for Problem 2-3 -- Gray Co. Starts Business Section: Problem 2-3 - Gray Co. Starts Business General Journal Date Account Credit General Joumal General Ledger Trial and Bal Sheet o e Download Chow Addit Chapter 8 Proble Problem 2 SAMSUNG PRINTING PROBLEMS, CALL I.T.: 646-393-8290 Sot -4 1 Owners' Equity Liabilities SAMSUNG OUDT Tom Bali Tinder www PRINTING PROBLEMS, CALL I.T.: 646-393-8290 Home Inert Formula Onts Page Layout - 11 - A A Problem 2-3 Excel (Compability Mode] - Excel Review View QuickBooks Tell me what you want to do p let Merge Center S . Conditional Formats Cell Formatting Table Styles s Insert Problem 2-3 - Gray Co. Starts Business Trial Balance Account Name Debe 7 000 Equipment Tentory Common Stock Notes Payable 18000 18000 518 000 General Genel T endel Sheet O e Download SAMSUNG 035 Cash Equipment Inventory Common Stock Notes Payable 6,000 5,000 7,000 10,000 8,000 Total 18,000 18,000 Balance Sheet Assets: Cash Equipment $6,000 5,000 7,000 Inventory Total Assets $18.000 Liabilities: Notes Payable $8.000 Total Liabilities 8.000 Equity Common Stock 10.000 Total Equity $10.000 General Journal Cereral Ledger Trial Bal and Bal Sheet D e Downloads 9 Chapter 2 Addition Chapter 8 Proble x Probler SAMSUNG NRFRIFLISC04 UN COTING 27 SOLID FOOTING 25 Chapter 3 Recording Transactions Affecting Retained Earnings TIPPPPPPP In this chapter, you will continue to use the workbook that you used in the last chapter entitled "02-Gray Co". If this workbook is not open on your computer, do the following: - Open the workbook 02-Gray Co in the Solid Footing 12e folder -Enable Macros Click the Feb No Rev-Exp tab You should see Screen 3 A in the upper left corner of the screen. Make certain that you did not select the February tab, which is Screen 4 A. There are three new accounts on this screen. Accounts Receivable under the Assets heading. Interest Payable under the Liabilities heading. D Retained Earnings under the Owners' Equity heading. These new accounts will be discussed when they are used to record Gray Co.'s February transactions. Observe the beginning balances in the following accounts: Cash Inventory Equipment > Note Payable > Common Stock These beginning balances, which are as of February 1, 2019, were the ending balances in these accounts as of January 31, 2019. Notice the three new accounts have beginning balances of zero. This is the case because these new accounts had no transactions entered into them in the month of January GRAY CO.'s FEBRUARY TRANSACTIONS As discussed in Chapter 2, Gray Co. is a merchandising company. The primary business of a merchandising company is to purchase inventory from suppliers and to sell that inventory to customers at a price higher than the purchase cost of the inventory. In January, Gray Co. purchased some inventory but did not sell any inventory to customers. NARRIFLINCOH SOUD FOOTNO 29 28 SOUD FOOTING The counts Receivable w decree by $2.000 The i re by . con total is an increase of 52.100 This . and the and February 7-Pay Wages to Employees On February Copa $1.000 meter tower of work Cik Pay Wages de Ca t herinthathu The $1.000 decrease in Gray Cosmolasses by 1 o u ut of paying wa s a $1.000 debit to the Reaned Earnings account Click Post to Ledger The Retained Earrings accoun t y $2.500 of the S4 500 The 12.000 debt This reflects the increase in the owners to ber nion in this case the person of the business February 11 - Purchase inventory Notice the curent balance in you r counter. Gray Conde won with 7000 of inventory on February 1. Gray Co n ventory c ome with a con $5.000, and on February 10, Gay Co the romaning 12.000 af hvery to another one Consegnty Gray Co now needs to purchase a nal wary became shoes in its Observe the effect on the Cash account and the land Fansing out February 10 - Sate of Inventory to a Customer on Credit On February 10, 2018, Guy a sale of inventory to somer. The inventory so the customer a n d price of $4.500 The inventory that is sold to the customer contray to On February 11, 2018, Gray Courses actionalitory. The inventory to 7 500 and is paid for with cash Click Buy Inventory The debt to inventory increases the Inventory count. The credit toch decreases the Cash This sale is very t h February 1 sale with one important e The customer does motorsty have the cash to pay for the purchase. The customer indic a t she will be able to pay portion of the purchase price near the end of February and the remainder of the purchase price around the middle of March Gray Co decides to make these to the customer based on the customer's p o pay in the near future. This is called mangas on credo Gending credit customer For Gray Co, the customer's promise to pay there is b ut gives Gray Catheright to receive cash af om fredale T e rghe covecanthu s called an Accounts Receivable. Observed to this sale when it occurs and not when this received, which is consistent with the coa of accounting duced in Chapter 2 on Pg 21) Let's see how this sale action would be recorded in the General Journal Click Make 2nd Sale Clock Post Ledger Look at the inventory account and the Cash out to the elect of posting this entry GUGGGGGGGGITTITT INUTI The first two line s of the entry in the General Joumal record the customerging Gray C her prometo pay in the future for the purchase. The $4.500 dobit to the Accounts Receivable account records the increase in Gray Co u nt receivable as This $4.500 Increase in the Accounts Recewable account causes Grey Co s sets to increase by $4.500 thus someody's daml a incase the owner diame tras a result of this part of the sales transaction thus a $4.500 credit to the Re d Earnings account February 26 - Pay Wages to Employees On February 26, Gray Co. pays $900 cash to workers for their work during the last three weeks of February. Before you click the blue Pay Wages buton and without looking at the wages payment entry on February 7, sell you know who will be the February 26 wage payment entry. Cik Pay Wages Did you go the entry come? Click Post to Ledger Notice the elect on the General Ledger accounts The last two lines of the entry in the General Journal record Gray Coving the inventory tem to the customer. This portion of the sale entry is the same as the second portion of the February 1 sale anty. The only ofference is that the cost of the inventory sold to customer is $2.000 The $2.000 credit to inventory reduces the inventory account and the $2.000 debit to the Retained Earnings account reduces the owners claim to February 27 - Collect Cash from a customer On February 10 Gray Co made a $4.500 sale to a customer and that time, did not receive cash from the customer instead of getting cash from the customer. Gray Corolved from the Customer a promise to pay Cash to Gray Co sometime in the future. Look at the February 10 entry and observe that the customer's promise to pay was put into the Accounts Receivable account Lor's now post the sale entry to the General Ledger accounts Click Post to Ledger PRINTING PROBLEMS, CALL I.T.: 646-393-8290 Home Insert Page Layout Formulas 12 = . .A. = Problem 2-3 Excel (Compatibility Mode] - Excel Oats Review View QuickBooks Tell me what you want to do . Wap Test Merge & Center - $ .% Conditional Formatas Formatting Table Alignment Number Styles BIU- Name: Section: Problem 2-3 - Gray Co. Starts Business General Journal Date Account Debit Credit eral Journal General Ledger Trial al and Bal Sheet O e Class & Recording - Problem 2-3 facel - SAMSUNG Home Insert Data File A Page Layout 10A Formulas = % Problem 2-3 Excel (Compatibility Mode] - Excel Review View QuickBooks y Tell me what you want to do Wiap Text Number Merge & Center - $ % *.99 Conditional Forma Formatting Table Numbre Styles Paste BLU- + + Clipboard Alignment D16 Problem 2-3 -- Gray Co. Starts Business General Ledger Assets Liabilities Owners' Eqy Dr Ending Balance Ending Balance Ending Balance Ending Bwance Ending Bwance General Journal General Ledger Trial Land Rol Sheet Class Recording Problem 2-3 SAMSUNG E . General Arial B IU. 11 . ANE .A. E Wap Text Merge & Center. Paste F $ % & Cor Forn Number Clipboard Font Alignment AMIT Problem 2-3 - Gray Co. Starts Business Trial Balance Account Name Debit Credit Total Balance Sheet Liabilities: General Journal General Ledger Trial Bal, and Bal. Sheet 9 0 e Class & Recordings Problem 2-3 Excel SAMSUNG 11 Problem 2-2 True / False Questions If this problem is assigned as a homework turn-in, remove and use the answer sheet on Pg 100 to record and in your answers. Circle True or False for the following questions T F . In a traditional accounting system all entries must be first put in the General Journal T F 2 . Entries are posted from the General Journal to the Trial Balance T F 3. The Note Payable account is increased by a Debit entry. T F 4. The Equipment account is increased by a Debit entry. T F 5. All entries must affect both the Asset side and the Liabilities + Equity side of the accounting equation for the accounting system to stay in balance T F 6. The Inventory account is decreased by a Credit entry. F 7 The Balance Sheet is a point-in-time financial report. F 8. A company's Accounting Period must always be one month long F 9. The sequence of steps a company's accounting system goes through each Accounting Period is called the Accounting Cycle. T T T T F 10. The largest transaction occurring during the Accounting Period is always entered first in the General Journal T F 11. For each entry in the General Journal, the total dollar amount of the debits and the total dollar amount of the credits must always be equal T F 12. The Balance Sheet is produced from the account balances shown in the General Journal T F 13. The Balance Sheet is produced from the account balances shown in the General Ledger T F 14. The primary reason the accountant prepares a Trial Balance is to determine if the accounting system is in balance. Problem 2-3 Gray Co., Inc. Starts Business This additional problem is located in the Word file named Chapter 02 Additional Problem doc. To print this additional problem, open the file using your Word application. Chapter 3 - Transactions A cting Retained amings SOUD FOOTING 27 The last two line items of the entry in the General Journal record Gray Co giving the inventory item to the customer. When the item is taken out of Gray Co.'s inventory and given to the customer Gray Co.'s Inventory account must be decreased by the cost of the item. The item given to the customer cost Gray Co. 55.000 thus the $5.000 credit to the Inventory account. This $5,000 decrease in inventory causes Gray Co.'s total assets to decrease by $5.000, thus somebody's claim to assets must also decrease. It is the owners' claim to assets that decreases as a result of this part of the sale transaction. The decrease in the owners' claim to assets is put into Retained Earnings: thus a $5.000 debt to the Retained Earnings account Let's now post the sale entry to the General Ledger accounts Click Post to Ledger Observe the following: The Cash account increases by $9,000, and the inventory account decreases by $5.000. The net effect on total assets is an increase of $4,000. This increase in total assets is the result of Gray Co. selling an inventory item that cost $5,000 to a customer for $9,000. The Retained Earnings account increases by $4.000 as a result of the $9.000 credit and the $5,000 debit. This reflects the increase in the owners' claim to assets as a result of the operation of the business. In this case, the operation of the business is selling inventory to a customer February 2-Pay Rent for the Month of February During January, Gray Co. rented a building from where it will run its business. The landlord, the owner of the building, gave Gray Co. free rent for January. On February 2, the landlord stops by the store to collect the rent for the month of February, Gray Co, pays the landlord $700 cash for the February rent CELLULUI Click Pay Rent Because cash was paid out, the Cash account is credited to reduce the balance in the Cash account The rent that Gray Co. paid is only for one month, the month of February. Gray Co. will not prepare its next Balance Sheet until February 28, 2019, by which time all of the rent just paid will have been fully used up. The $700 decrease in cash causes Gray Co.'s total assets to decrease by $700. Because total assets decrease by $700, somebody's claim to assets must also decrease. It is the owners' claim to assets that decrease as a result of paying rent. The decrease in the owners' claim to assets is put in the Retained Earnings account: thus a $700 debit to the Retained Earnings account. Let's now post the rent payment entry to the General Ledger accounts. Click Post to Ledger Notice the Cash account decreases by $700 and no other asset account increases. As a result, total assets decrease by $700. Notice the Retained Earnings account decreases by $700 as a result of the $700 debit. This reflects the decrease in the owners' claim to assets as a result of the operation of the business. In this case, the operation of the business is paying rent. 28 SOLID FOOTING Chapter 3 - Transactions Alecting and Earnings February 7-Pay Wages to Employees On February 7. Gray Co, pays $1,000 to its workers for their first week of work Click Pay Wages Because cash is paid out, the Cash account is credited to reduce the balance in the Cash account The $1.000 decrease in cash causes Gray Co.'s total assets to decrease by $1.000; thus somebody's claim to assets must also decrease it is the owners' claim to assets that decreases as a result of paying wages, thus a $1.000 debit to the Retained Earnings account Click Post to Ledger Observe the effect on the Cash account and the Retained Earnings account February 10 - Sale of Inventory to a Customer on Credit On February 10, 2019, Gray Co, makes a sale of inventory to a customer. The inventory is sold to the customer at a selling price of $4,500. The inventory that is sold to the customer cost Gray Co. $2.000 This sale is very similar to the February 1 sale with one important difference. This customer does not currently have the cash to pay for the purchase. The customer indicates that she will be able to pay a portion of the purchase price near the end of February and the remainder of the purchase price around the middle of March Gray Co, decides to make the sale to the customer based on the customer's promise to pay in the near future. This is called making a sale on creditor extending credit to a customer. For Gray Co., the customer's promise to pay in the future is an asset because it gives Gray Co, the right to receive cash at some future date. This asset (the right to receive cash in the future) is called an Accounts Receivable. Observe that Gray Co, records this sale when it occurs and not when cash is received, which is consistent with the accrual basis of accounting (introduced in Chapter 2 on Pa 211 Let's see how this sale transaction would be recorded in the General Journal Click Make 2nd Sale The first two line items of the entry in the General Journal record the customer giving Gray Co, her promise to pay in the future for the purchase. The $4,500 debit to the Accounts Receivable account records the increase in Gray Co.'s account receivable asset. This $4,500 increase in the Accounts Receivable account causes Gray Co.'s total assets to increase by $4,500; thus somebody's claim to assets must also increase. It is the owners' claim to assets that increases as a result of this part of the sales transaction; thus a $4,500 credit to the Retained Earnings account. The last two line items of the entry in the General Journal record Gray Co, giving the inventory item to the customer. This portion of the sale entry is the same as the second portion of the February 1 sale entry. The only difference is that the cost of the inventory sold to this customer is $2,000. The $2,000 credit to inventory reduces the Inventory account, and the $2.000 debit to the Retained Earnings account reduces the owners' claim to assets. Let's now post the sale entry to the General Ledger accounts. Click Post to Ledger Chapter 3 - www.ons Acting med meg SOLID FOOTING 29 Observe the following The Accounts Receivable account increases by $4.500, and the inventory account decreases by $2.000. The net effect on total assets is an increase of $2.500. This increase in total assets is the result of selling an inventory item that cost Gray Co. $2.000 to a customer for $4,500 The Retained Earnings account increases by $2.500 as a result of the S4 500 credit and the $2.000 debit. This reflects the increase in the owners' claim to assets as a result of the operation of the business. In this case, the operation of the business is seling inventory to a customer February 11 - Purchase Inventory Notice the current balance in Gray Co.'s Inventory account is zero. Gray Co started the month with $7,000 of inventory. On February 1, Gray Co sold inventory to a customer with a cost of $6,000, and on February 10, Gray Co sold the remaining $2,000 of inventory to another customer Consequently. Gray Co now needs to purchase additional Inwentory because the shelves in its store are empty On February 11, 2019, Gray Co. purchases additional inventory. The inventory cost $7.500 and is paid for with cash - Click Buy Inventory The debit to inventory increases the Inventory account. The credit to cash decreases the Cash account Click Post to Ledger Look at the Inventory account and the Cash account to see the effect of posting this entry. February 26 - Pay Wages to Employees On February 28, Gray Co, pays $900 cash to its workers for their work during the last three weeks of February. Before you click the blue Pay Wages button and without looking at the wages payment entry on February 7, see if you know what will be the February 28 wages payment entry. Click Pay Wages Did you get the entry correct? Click Post to Ledger Notice the effect on the General Ledger accounts. February 27 - Collect Cash from a Customer On February 10. Gray Co. made a $4,500 sale to a customer and, at that time, did not receive cash from the customer. Instead of getting cash from the customer. Gray Co, received from the customer a promise to pay cash to Gray Co, sometime in the future. Look at the February 10 entry and observe that the customer's promise to pay was put into the Accounts Receivable account. | che Post Ledger Prepare the balance sheel ability, and y ou Click Prepare the balance Short February Record the interest bus on the Bank Loan On y co went to the brand go a loan for the in Scots when you made January's As m otive for Cray Colore on the band did not chay CHROM E LLLLLLLLLLLLLLLL Observe the ig Bang Shot The heading t h e women in the for the point in hapo 2018 Gray Co has four types of Cash Mounts Receiva , to t The total amount of motyw 27.00 The band y 's 45. This to w n in Ines Note Payable 8.000 r m The owners have to wyo's 13.00. Thi on bolne teme Common $10.000 R ed Eaming These and the limi ts we in balance Interest on the bank loan started on February. At the end of February. On C owes the bank one month of interest on February 20. Gray Ceca the bank ind out how much interest Gray Ca can wat until the end of March to actually pay February's interest W wes The bank indicate that the interest on the loan for the month of February is 340, h ispeld to the bank at the end of February for February's Gray Co does med to make an entry for the interest owed to the bank Observe that Gray Co records the interest due on the bank loan even though no cash was paid to the bank s consistent with the crual basis of accounting introduced in Chapter 2 on Pg21) e A Closer Look at the change in the Retained Ears Balance During February, the balance in the Retained Laings a t goes om begg or tonending bolonot 660, ore. You can see that to the increased by S860 asull of the son of our w o r ry Click Adjusting The $40 credit to the interest Payable account records the bank's como Gray Coasts that is the result of the interest on the loan Observe the following: This entry increases the bank's claim to Gray C assets. Total assets do not change as a result of this entry. As a result, somebody's claim to assets must decrease is the owners claim to that must be decreased thus the $40 debit to the R ed Eamings account By looking at the root and debitories in the R ed Carrings a n d the trading each entry back to the General Journal you can determine the cand each andr e each decrease in the owners claim to the On the op of the following pagesaving shows each increase and each decrease in the Retained amings out This tingin shows the cause of each increase or decrease Click Post to Ledger Look at the Interest Payable account and the Retained Eamings account to see the effect of posting this entry This type of entry is called an adusting entry. The entry is not the result of a transaction, but we the result of the passage of time causing interest to be due to the bank. Adjusting entries are important because they Tune-up' the balances in the accounts prior to the preparation of financial statements Chapters 7 and 8 wil be devoted entirely to adjusting entries Paste BTU - S.A. E Merge & Center - $ . % 8 Clipboard Font Alignment al Number B4 X for Problem 2-3 -- Gray Co. Starts Business Section: Problem 2-3 - Gray Co. Starts Business General Journal Date Account Credit General Joumal General Ledger Trial and Bal Sheet o e Download Chow Addit Chapter 8 Proble Problem 2 SAMSUNG PRINTING PROBLEMS, CALL I.T.: 646-393-8290 Sot -4 1 Owners' Equity Liabilities SAMSUNG OUDT Tom Bali Tinder www PRINTING PROBLEMS, CALL I.T.: 646-393-8290 Home Inert Formula Onts Page Layout - 11 - A A Problem 2-3 Excel (Compability Mode] - Excel Review View QuickBooks Tell me what you want to do p let Merge Center S . Conditional Formats Cell Formatting Table Styles s Insert Problem 2-3 - Gray Co. Starts Business Trial Balance Account Name Debe 7 000 Equipment Tentory Common Stock Notes Payable 18000 18000 518 000 General Genel T endel Sheet O e Download SAMSUNG 035 Cash Equipment Inventory Common Stock Notes Payable 6,000 5,000 7,000 10,000 8,000 Total 18,000 18,000 Balance Sheet Assets: Cash Equipment $6,000 5,000 7,000 Inventory Total Assets $18.000 Liabilities: Notes Payable $8.000 Total Liabilities 8.000 Equity Common Stock 10.000 Total Equity $10.000 General Journal Cereral Ledger Trial Bal and Bal Sheet D e Downloads 9 Chapter 2 Addition Chapter 8 Proble x Probler SAMSUNG NRFRIFLISC04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts