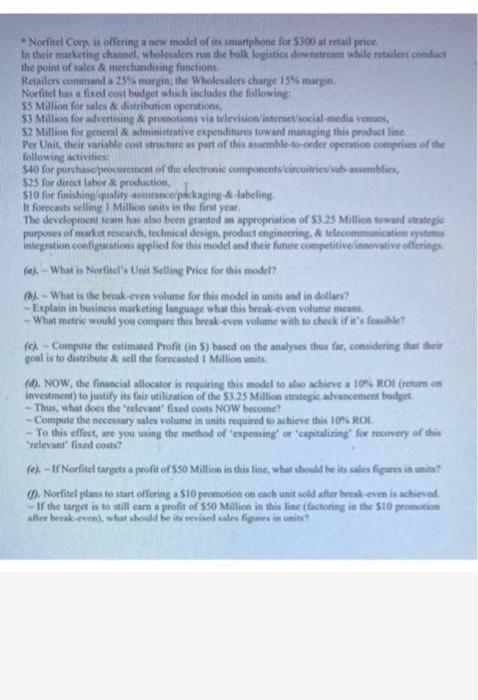

Question: COMPLETE ONLY D, E, F!!!! Noriel Corp, is offering a new model of its smartphone for $300 at retail price. In their marketing channel wholesalen

Noriel Corp, is offering a new model of its smartphone for $300 at retail price. In their marketing channel wholesalen run the bulk logistics downtrum while retailers conduct the point of sales & merchandising functions. Retailers command a 23% margin: the Wholesalers charge 15% margin. Nortitel bas a fixed cost budget which includes the following $5 Million for sales & distribution operations, $3 Million for advertising & promotions via television internet social-medis venues, $2 Million for general & administrative expenditures toward managing this product line Per Unit , their variable cout structure as part of this assemble-to-order operation comprises of the following activities $40 for purchase procurement of the electronic components/circuitries/subassemblies, $25 for direct labor & production, 510 for finishing quality as nce/packaging &-labeling It forecasts selline 1 Million units in the first year, The development team has also been granted an appropriation of $325 Million toward strategie purposes of market research, technical design, product engineering, & telecommunication systems integration configurations applied for this model and their future competitive innovative offering (al - What is Norfitel's Unit Selling Price for this model? (b). - What is the break even volume for this model in units and in dollars - Explain in business marketing language what this break-even volume means - What matric would you compare this break even volume with to check ifie's feasible? fe - Compute the estimated Profit (in 5) based on the analyses thus far, comidering that their goal is to distribute &sell the forecasted 1 Million units (O). NOW, the financial allocator is requiring this model to also achieve a 10% ROI (return on investment) to justify its fair utilization of the 53.25 Million strategie advancement budget Thus, what does the relevant fixed costs NOW become! -Compute the necessary sales volume in units required to achieve this 10% ROL - To this effect, are you using the method of expensing' or 'capitalizing for recovery of this "relevant fixed costs? (e) - If Norfitel targets a profit of 550 Million in this line, what should be its sales figures is unies? 6. Norfitel plans to start offering a $10 promotion on each unit sold after break even is achieved -If the target is to still cam a profit or SS0 Million in this line (factoring in the S10 promotion after break.evm), what should be its revised wales figures in umi? Noriel Corp, is offering a new model of its smartphone for $300 at retail price. In their marketing channel wholesalen run the bulk logistics downtrum while retailers conduct the point of sales & merchandising functions. Retailers command a 23% margin: the Wholesalers charge 15% margin. Nortitel bas a fixed cost budget which includes the following $5 Million for sales & distribution operations, $3 Million for advertising & promotions via television internet social-medis venues, $2 Million for general & administrative expenditures toward managing this product line Per Unit , their variable cout structure as part of this assemble-to-order operation comprises of the following activities $40 for purchase procurement of the electronic components/circuitries/subassemblies, $25 for direct labor & production, 510 for finishing quality as nce/packaging &-labeling It forecasts selline 1 Million units in the first year, The development team has also been granted an appropriation of $325 Million toward strategie purposes of market research, technical design, product engineering, & telecommunication systems integration configurations applied for this model and their future competitive innovative offering (al - What is Norfitel's Unit Selling Price for this model? (b). - What is the break even volume for this model in units and in dollars - Explain in business marketing language what this break-even volume means - What matric would you compare this break even volume with to check ifie's feasible? fe - Compute the estimated Profit (in 5) based on the analyses thus far, comidering that their goal is to distribute &sell the forecasted 1 Million units (O). NOW, the financial allocator is requiring this model to also achieve a 10% ROI (return on investment) to justify its fair utilization of the 53.25 Million strategie advancement budget Thus, what does the relevant fixed costs NOW become! -Compute the necessary sales volume in units required to achieve this 10% ROL - To this effect, are you using the method of expensing' or 'capitalizing for recovery of this "relevant fixed costs? (e) - If Norfitel targets a profit of 550 Million in this line, what should be its sales figures is unies? 6. Norfitel plans to start offering a $10 promotion on each unit sold after break even is achieved -If the target is to still cam a profit or SS0 Million in this line (factoring in the S10 promotion after break.evm), what should be its revised wales figures in umi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts