Question: COMPLETE ONLY PART D IN RED Bertrand Ltd . for a piece of excavation equipment. The following information relates to the agreement. The term of

COMPLETE ONLY PART D IN RED

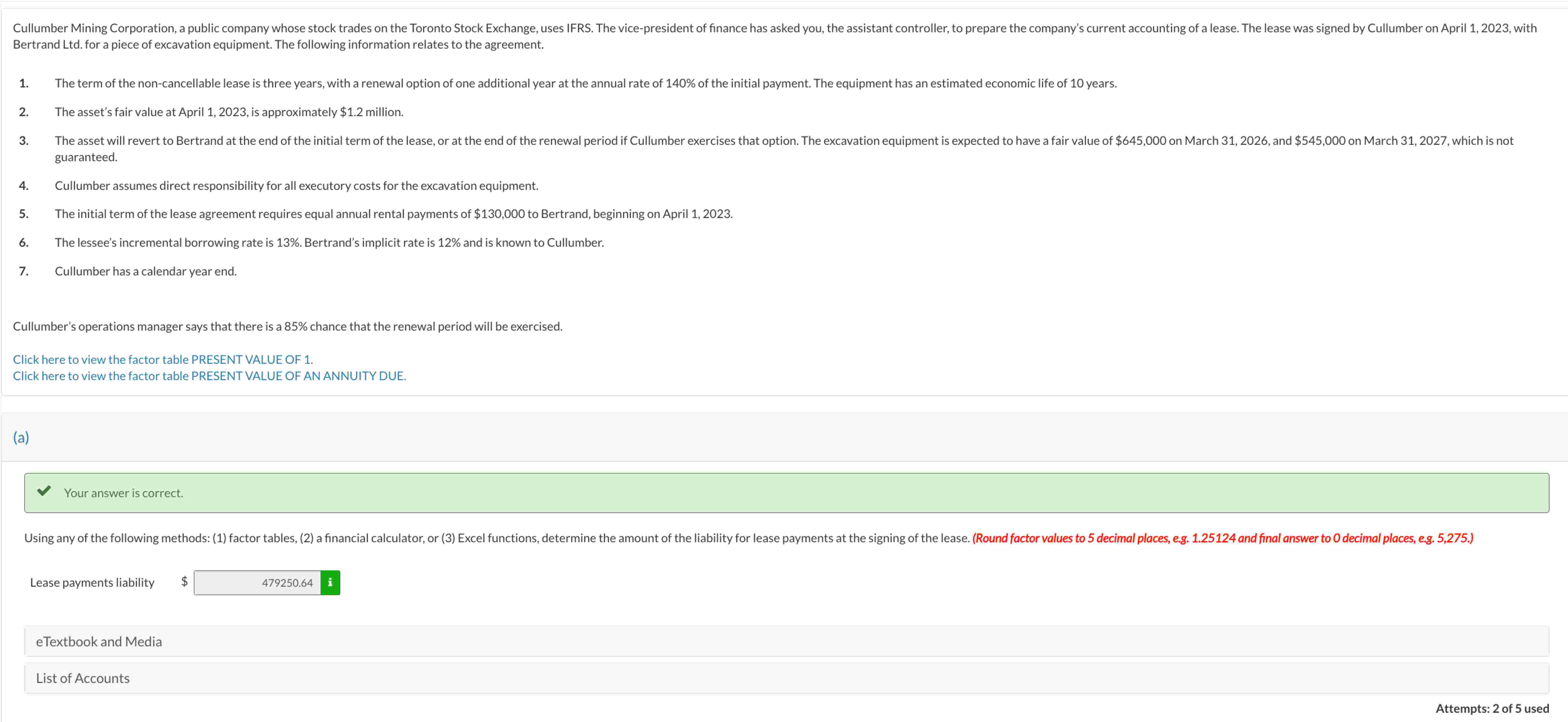

Bertrand Ltd for a piece of excavation equipment. The following information relates to the agreement.

The term of the noncancellable lease is three years, with a renewal option of one additional year at the annual rate of of the initial payment. The equipment has an estimated economic life of years.

The asset's fair value at April is approximately $ million.

guaranteed.

Cullumber assumes direct responsibility for all executory costs for the excavation equipment.

The initial term of the lease agreement requires equal annual rental payments of $ to Bertrand, beginning on April

The lessee's incremental borrowing rate is Bertrand's implicit rate is and is known to Cullumber.

Cullumber has a calendar year end.

Cullumber's operations manager says that there is a chance that the renewal period will be exercised.

Click here to view the factor table PRESENT VALUE OF

Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE.

a

Your answer is correct.

Lease payments liability $

eTextbook and Media

List of Accounts

Attempts: of used

Use a spreadsheet to prepare an amortization schedule for Cullumber for the lease term including the expected lease renewal. Round answers to decimal places, eg

eTextbook and Media

List of Accounts

Prepare all of Cullumber's journal entries for fiscal years and to record the lease agreement and the lease payments. List all debit entries before credit entries. Credit account titles are automatically in

Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem. Round answers to decimal places, eg

Date

Debit

To record interest.

Depreciation Expense

Accumulated Depreciation RightofUse Asset

To record depreciation expense.

Interest Expense

Lease Liability

Cash

Interest Expense

Lease Liability

To record interest.

Depreciation Expense

Accumulated Depreciation RightofUse Asset

Credit

Credit

Cash

Interest Expense

Lease Liability

Lease Liability

Your answer is partially correct.

Provide Cullumber's SFP disclosure for all of the amounts that would appear concerning the lease at December Round answers to decimal places, eg

CULLUMBER MINING CORPORATION

Statement of Financial Position Partial

December

Property, Plant, and Equipment

RightofUse Asset

$

Accumulated Depreciation RightofUse Asset

Liabilities

Current Liabilities

Lease Liability

Lease Liability

$

eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock