Question: Complete P4-9 on page 148. You will need to construct: 1) a cash receipts schedule, 2) a cash disbursements schedule, and finally the cash budget.

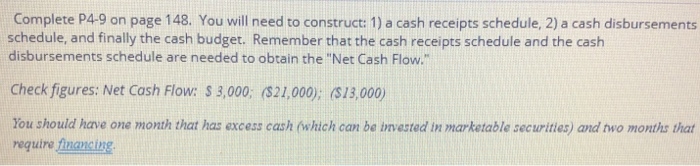

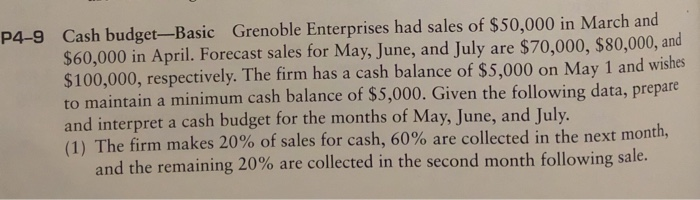

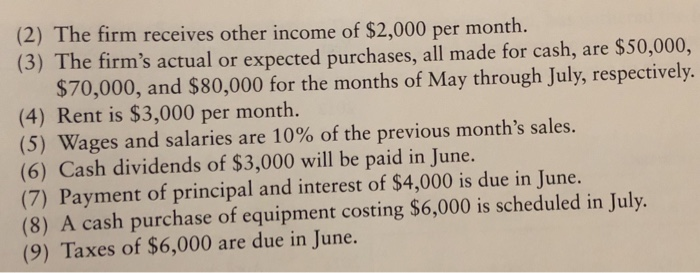

Complete P4-9 on page 148. You will need to construct: 1) a cash receipts schedule, 2) a cash disbursements schedule, and finally the cash budget. Remember that the cash receipts schedule and the cash disbursements schedule are needed to obtain the "Net Cash Flow." Check figures: Net Cash Flow: $ 3,000; ($21,000); ($13,000) You should have one month that has excess cash (which can be invested in marketable securities) and two months that require financing P4-9 Cash budget-Basic Grenoble Enterprises had sales of $50,000 in March and $60,000 in April. Forecast sales for May, June, and July are $70,000, $80,000, and $100,000, respectively. The firm has a cash balance of $5,000 on May 1 and wishes to maintain a minimum cash balance of $5,000. Given the following data, prepare and interpret a cash budget for the months of May, June, and July. (1) The firm makes 20% of sales for cash, 60% are collected in the next month, and the remaining 20% are collected in the second month following sale. (2) The firm receives other income of $2,000 per month. (3) The firm's actual or expected purchases, all made for cash, are $50,000, $70,000, and $80,000 for the months of May through July, respectively. (4) Rent is $3,000 per month. (5) Wages and salaries are 10% of the previous month's sales. (6) Cash dividends of $3,000 will be paid in June. (7) Payment of principal and interest of $4,000 is due in June. (8) A cash purchase of equipment costing $6,000 is scheduled in July. (9) Taxes of $6,000 are due in June

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts