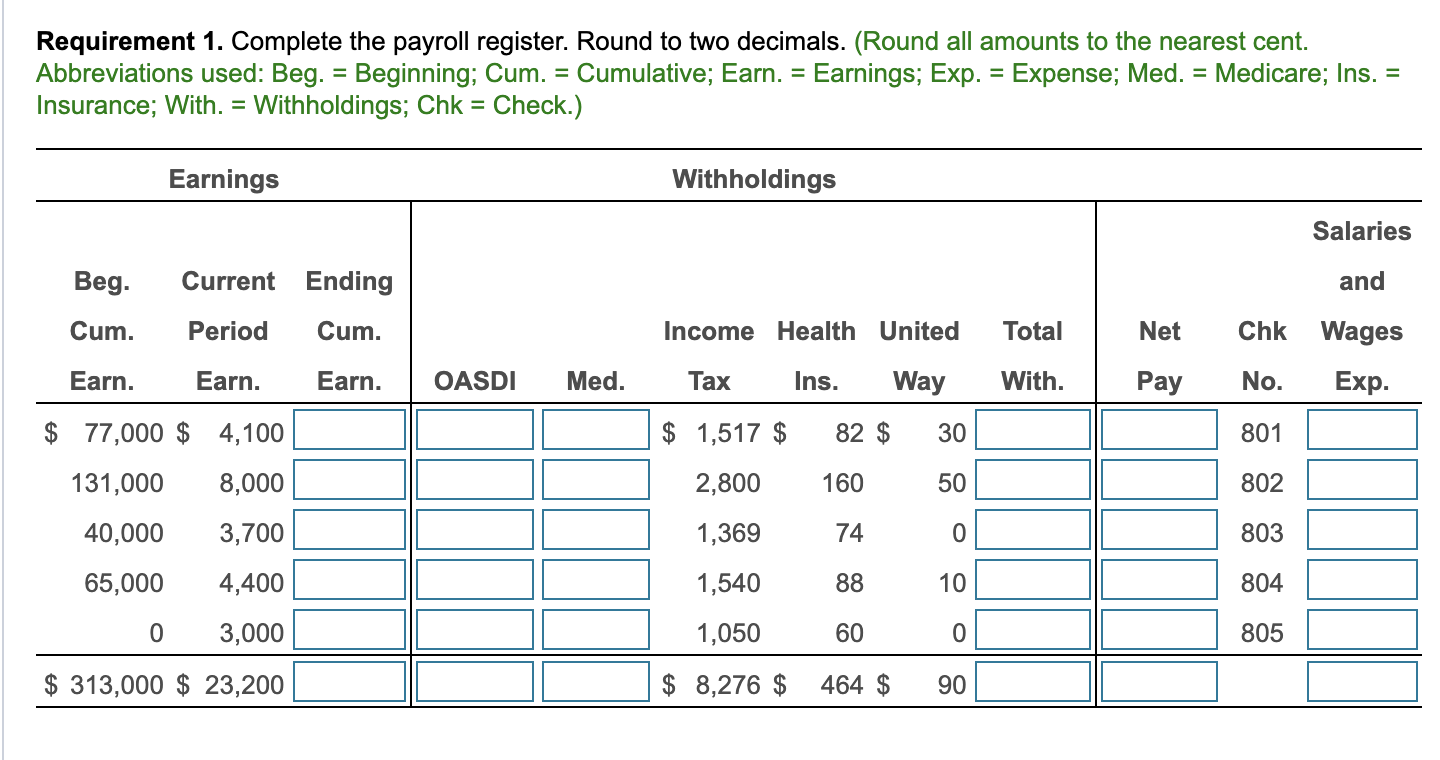

Question: Complete part 1 Requirement 1. Complete the payroll register. Round to two decimals. (Round all amounts to the nearest cent. Abbreviations used: Beg. = Beginning;

Complete part 1

Complete part 1

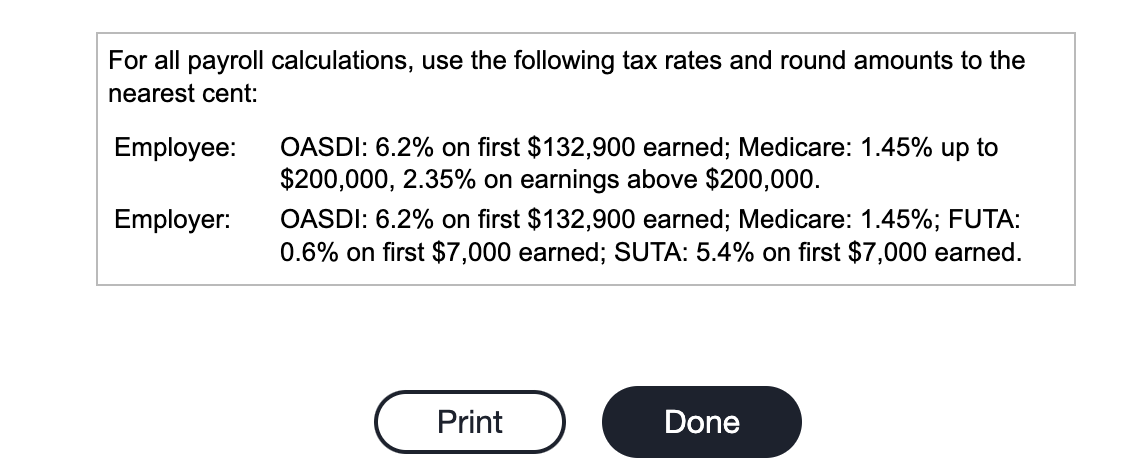

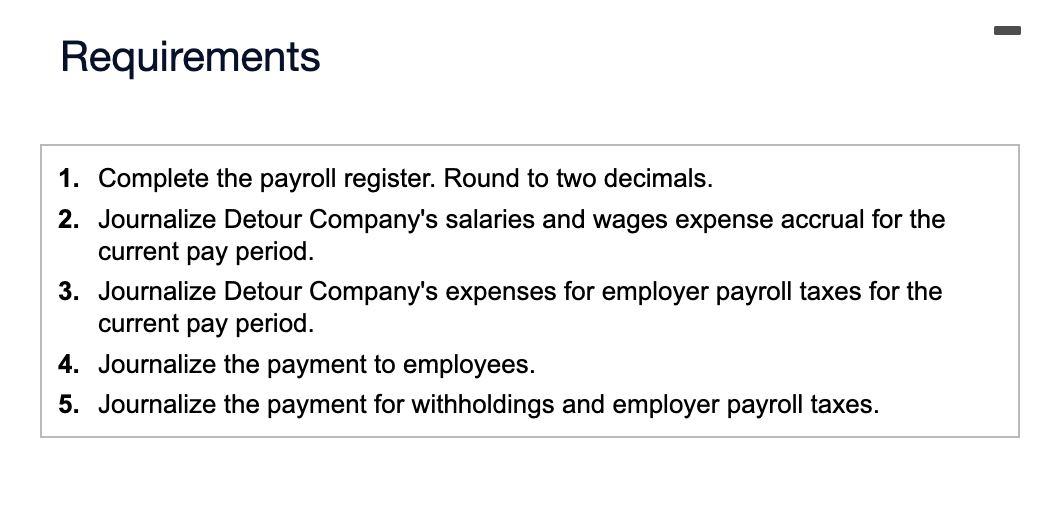

Requirement 1. Complete the payroll register. Round to two decimals. (Round all amounts to the nearest cent. Abbreviations used: Beg. = Beginning; Cum. = Cumulative; Earn. = Earnings; Exp. = Expense; Med. = Medicare; Ins. = Insurance; With. = Withholdings; Chk = Check.) For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000,2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Requirements 1. Complete the payroll register. Round to two decimals. 2. Journalize Detour Company's salaries and wages expense accrual for the current pay period. 3. Journalize Detour Company's expenses for employer payroll taxes for the current pay period. 4. Journalize the payment to employees. 5. Journalize the payment for withholdings and employer payroll taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts