Question: complete part A, B, and C Complete A, B, and C A On December 31, 2020 Chelsea Company's inventory burned. Sales and purchases for the

complete part A, B, and C

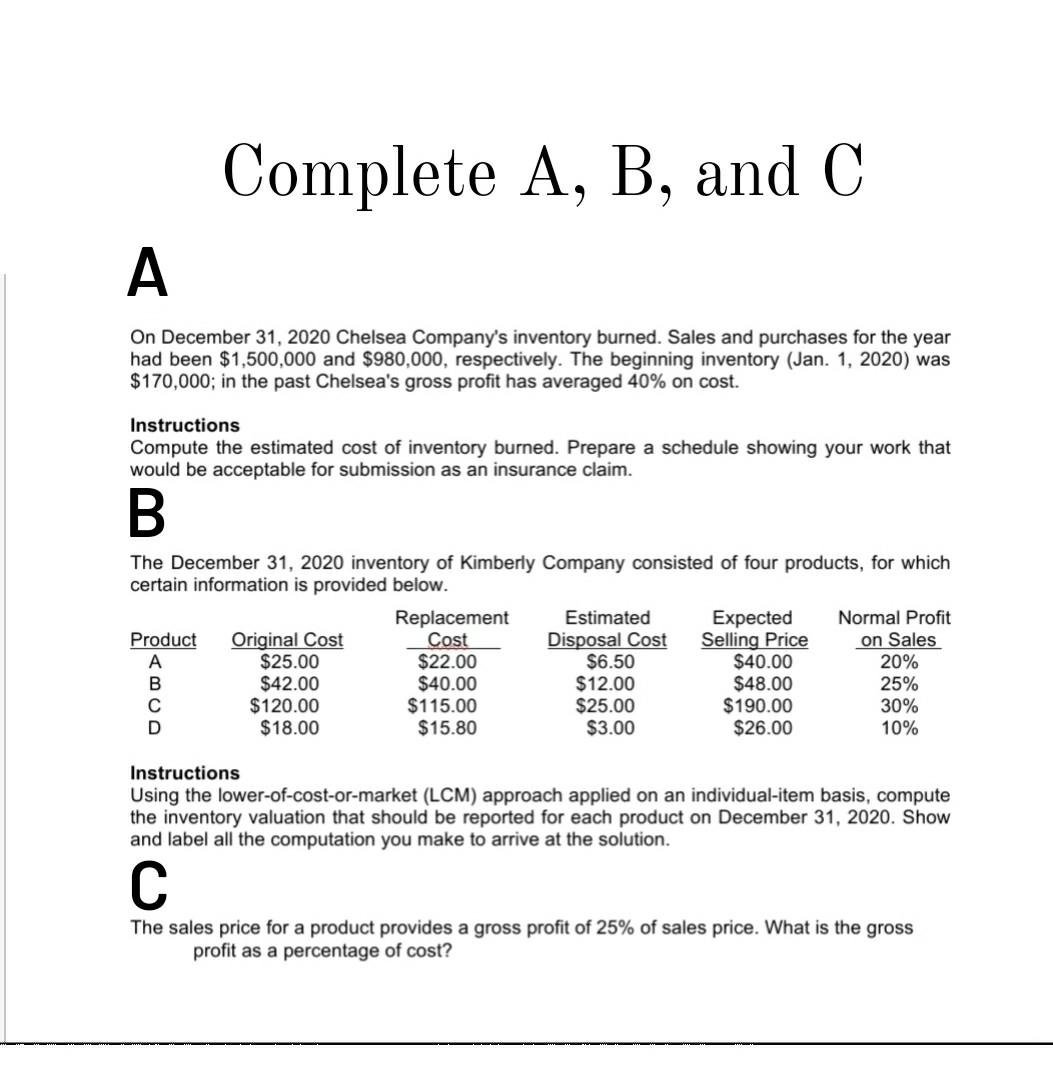

Complete A, B, and C A On December 31, 2020 Chelsea Company's inventory burned. Sales and purchases for the year had been $1,500,000 and $980,000, respectively. The beginning inventory (Jan. 1, 2020) was $170,000; in the past Chelsea's gross profit has averaged 40% on cost. Instructions Compute the estimated cost of inventory burned. Prepare a schedule showing your work that would be acceptable for submission as an insurance claim. B The December 31, 2020 inventory of Kimberly Company consisted of four products, for which certain information is provided below. Replacement Estimated Expected Normal Profit Product Original Cost Cost Disposal Cost Selling Price on Sales $25.00 $22.00 $6.50 $40.00 20% B $42.00 $40.00 $12.00 $48.00 25% $120.00 $115.00 $25.00 $190.00 30% D $18.00 $15.80 $3.00 $26.00 10% Instructions Using the lower-of-cost-or-market (LCM) approach applied on an individual-item basis, compute the inventory valuation that should be reported for each product on December 31, 2020. Show and label all the computation you make to arrive at the solution. The sales price for a product provides a gross profit of 25% of sales price. What is the gross profit as a percentage of cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts