Question: complete parts A-C (second picture with numbers placed in chart are NOT CORRECT go based off of original questions please ) JN Electronics is considening

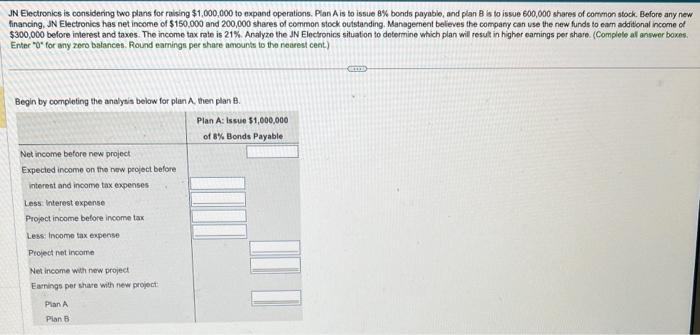

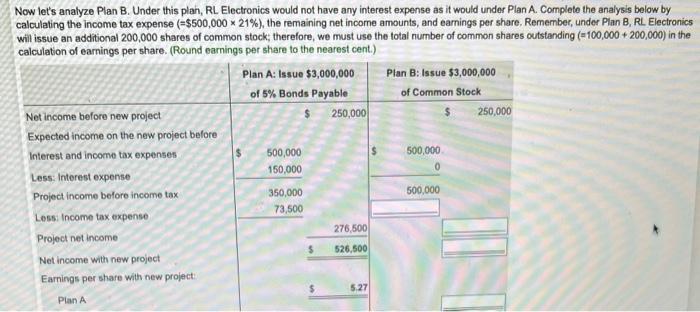

JN Electronics is considening two plans for ralsing $1,000,000 to expand operations. Plan A is to issue 8% bonds payable, and plan B is to issue 600,000 shares of corrmon stock. Before any new financing. JN Electronics has net income of $150,000 and 200,000 sheres of common stock outstanding. Managernent beleves the company can use the new funds to eam additonal income of $300,000 before interest and taxes. The income tax rate is 21%. Analyze the JN Electronics situation to dotermine which plan will resut in higher eamings per share. (Complele al answer boxes. Enter "0" for any zero balances. Round earnings per share amounts to the nearest cent) Begin by comploting the analyzis below for plan A. then plan B. Now let's analyze Plan B. Under this plan, RL Electronics would not have any interest expense as it would under Plan A. Complete the analysis below by calculating the income tax expense (=$500,00021%), the remaining net incorne amounts, and earnings per share. Remember, under Plan B, RL. Electronics will issue an additional 200,000 shares of common stock; therefore, we must use the total number of common shares 0 tstanding (=100,000+200,000 ) in the calculation of earnings per share. (Round earnings per share to the nearest cent.) Review your analysis in the preceding step. Which plan results in higher eamings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts