Question: Complete Problems 13-2B, 13-3B and 13-4B on the proper tab. You can complete the problems in Excel and submit the Excel spreadsheet in Canvas or

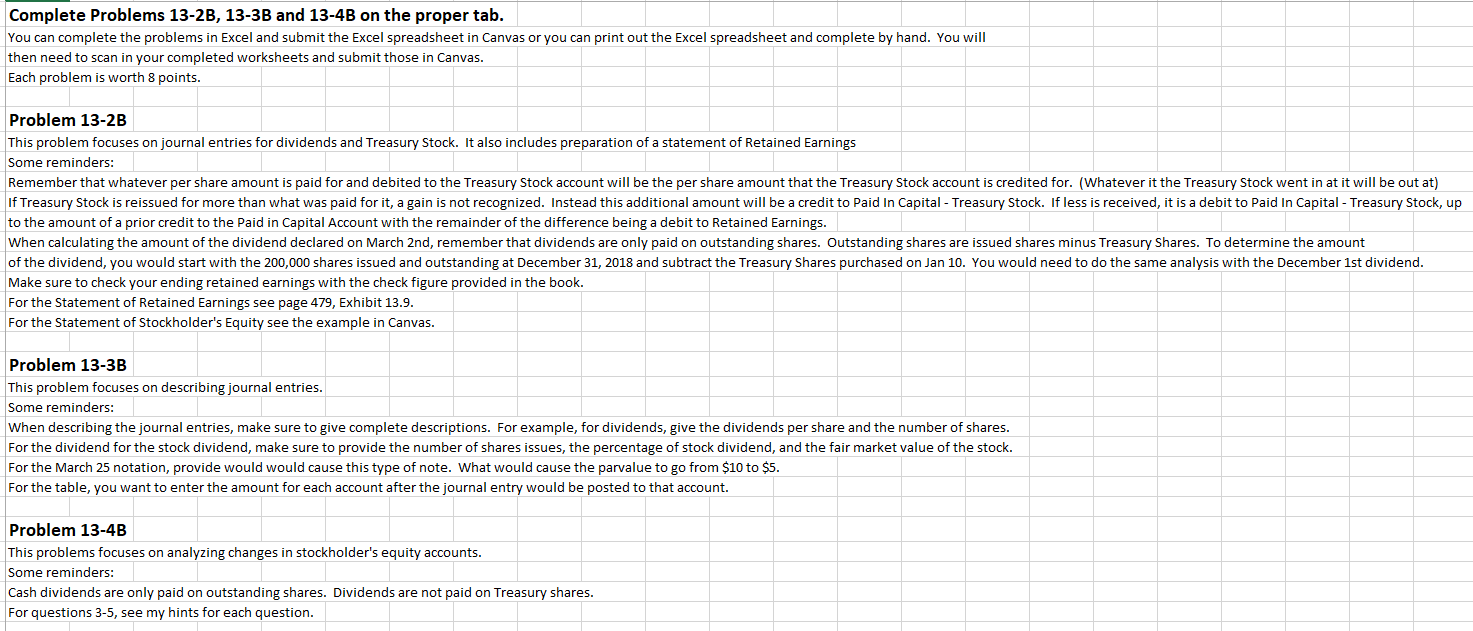

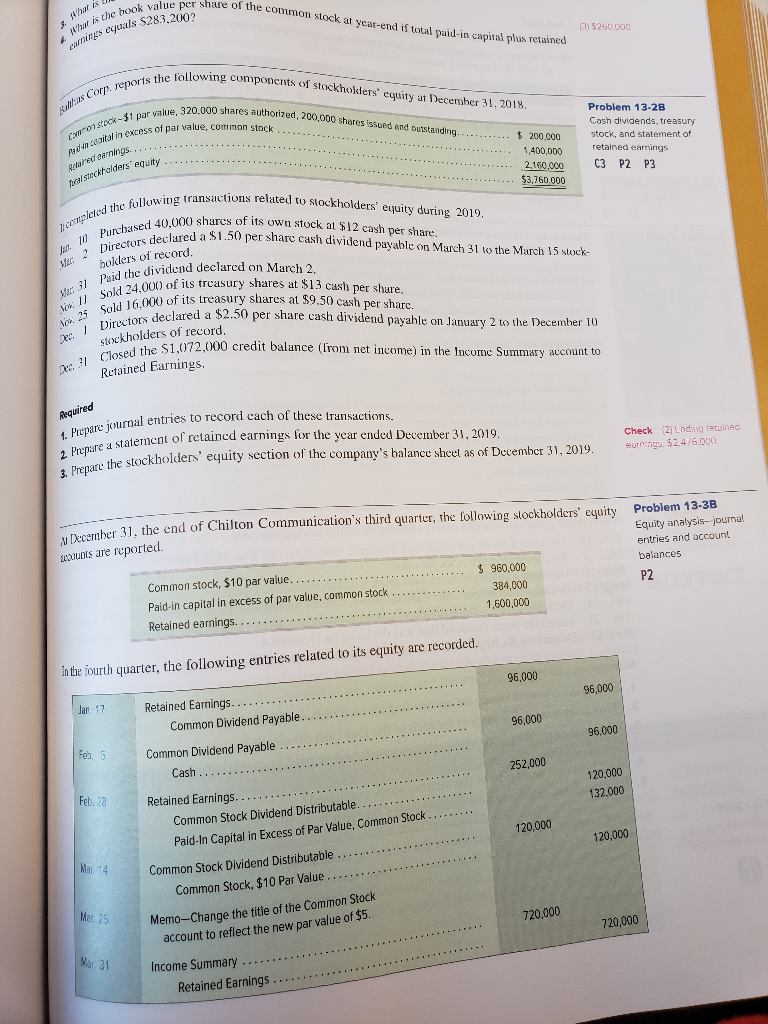

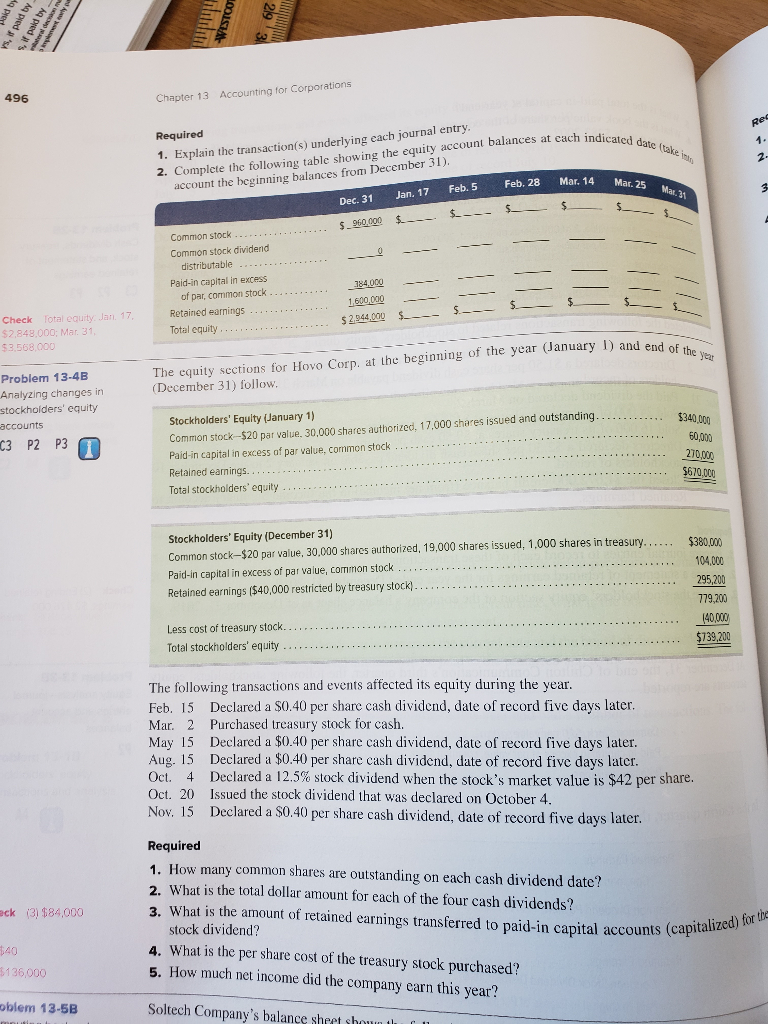

Complete Problems 13-2B, 13-3B and 13-4B on the proper tab. You can complete the problems in Excel and submit the Excel spreadsheet in Canvas or you can print out the Excel spreadsheet and complete by hand. You will then need to scan in your completed worksheets and submit those in Canvas. Each problem is worth 8 points. Problem 13-2B This problem focuses on journal entries for dividends and Treasury Stock. It also includes preparation of a statement of Retained Earnings Some reminders: Remember that whatever per share amount is paid for and debited to the Treasury Stock account will be the per share amount that the Treasury Stock account is credited for. (Whatever it the Treasury Stock went in at it will be out at) If Treasury Stock is reissued for more than what was paid for it, a gain is not recognized. Instead this additional amount will be a credit to Paid In Capital - Treasury Stock. If less is received, it is a debit to Paid In Capital - Treasury Stock, up to the amount of a prior credit to the Paid in Capital Account with the remainder of the difference being a debit to Retained Earnings. When calculating the amount of the dividend declared on March 2nd, remember that dividends are only paid on outstanding shares. Outstanding shares are issued shares minus Treasury Shares. To determine the amount of the dividend, you would start with the 200,000 shares issued and outstanding at December 31, 2018 and subtract the Treasury Shares purchased on Jan 10. You would need to do the same analysis with the December 1st dividend. Make sure to check your ending retained earnings with the check figure provided in the book. For the Statement of Retained Earnings see page 479, Exhibit 13.9. For the Statement of Stockholder's Equity see the example in Canvas. Problem 13-3B This problem focuses on describing journal entries. Some reminders: When describing the journal entries, make sure to give complete descriptions. For example, for dividends, give the dividends per share and the number of shares. For the dividend for the stock dividend, make sure to provide the number of shares issues, the percentage of stock dividend, and the fair market value of the stock. For the March 25 notation, provide would would cause this type of note. What would cause the parvalue to go from $10 to $5. For the table, you want to enter the amount for each account after the journal entry would be posted to that account. Problem 13-4B This problems focuses on analyzing changes in stockholder's equity accounts. Some reminders: Cash dividends are only paid on outstanding shares. Dividends are not paid on Treasury shares. For questions 3-5, see my hints for each question. per share of the common stock at year-end if total gaid-in capital plus retained ut is the book value wings equals $28.3.2002 12) $250.000 the following components of stockholders' equity at December 31, 2018 Was Correports the 320,000 shares authored, 200,000 shares issued and outstanding........... - $ 200.000 stock-$1 par value 32 excess of par value, common stock Problem 13-2B Cash dividends, treasury stock, and statement of retained earnings C3 P2 P3 . ........ pard to carta in excep redeamings. eckholders' equity ...... 1,400,000 2,160,000 $3,760.000 Total stockholm pleted the following 10 Purchased 40,000, Directors deckare ing transactions related to stockholders' equity during 2019, 40000 shares of its own stock at $12 cash per share. clared a $1.50 per sharc cash dividend payablc on March 31 to the March 15 stock- boller's of record. Mar 37 om 11 Dom 25 Paid the Sold 24 (W Sold 16./ the dividend declared on March 2. 24000 of ils treasury shares at $13 cash per shure. 16000 of its treasury shares at $9.50 cash per sharc. s declared a $2.50 per share cash dividend payable on January 2 to the December 10 stockholders of record. I the $1,072,000 credit balance (lirom net income) in the Income Summary account to Closed the $1 Del Retained Earnings. Required journal entries to record each of these transactions. tatemcot of retained earnings for the year ended December 31, 2019. he stockholders' equity section of the company's balance sheet as of December 31, 2019. 1. Prepare journal entri 2. Prepare a statemcolo 3. Prepare the stockholders Check 2) Lnding retuined eunings $2.476.000 kr 31. the end of Chilton Communication's third quarter, the following stockholders' cyuity Problem 13-38 Equity analysis- Journal entries and account balances mots are reported P2 Common stock, $10 par value............ Paid-in capital in excess of par value, common stock ..... Retained earnings...... $ 960,000 384,000 1,600,000 In the fourth quarter, the following entries related to its equity are recorded. 96,000 96,000 Jan. 17 96,000 96.000 Feh. 5 252,000 Retained Earnings... ...................................... Common Dividend Payable.... Common Dividend Payable... Cash ....................... Retained Earnings...... Common Stock Dividend Distributable..... Paid-In Capital in Excess of Par Value, Common Stock ..... 120.000 132.000 Feb. 28 120.000 120,000 Mar 14 Common Stock Dividend Distributable ..... Common Stock, $10 Par Value ..... Memo-Change the title of the Common Stock account to reflect the new par value of $5. Mar. 25 720.000 720,000 Mar. 31 Income Summary ... Retained Earnings .... Paid by dec paid by s, paid by vs, STCO 496 Chapter 13 Accounting for Corporations indicated date take in Required 1. Explain the transaction(s) underlying each journal entry. 2. Complete the following table showing the equity account balances at each indir account the beginning balances from December 31). Dec. 31 Jan. 17 Feb. 5 Feb. 28 Mar, 14 4 Mar 25 Mar 31 $ --- $_ $ 960.000 $ Common stock ........... Common stock dividend distributable ..... Paid-in capital in excess of par, common stock ... Retained earnings ........ Total equity........! 184.000 = = 1,600,000 $._ $ $ 2944.000 Check Total equity Jan 17 $2.848.000: Mar 31 $2.568.000 ry I) and end of the year The equity sections for Hovo Corp, at the beginning of the year (January 1) and a (December 31) follow. Problem 13-4B Analyzing changes in stockholders' equity accounts C3 P2 P3 $340,000 60,000 Stockholders' Equity (January 1) Common stock-$20 par value. 30,000 shares authorized, 17,000 shares issued and outstanding. Paid-in capital in excess of par value, common stock Retained earnings.......... Total stockholders' equity.... 270.000 $670.000 Stockholders' Equity (December 31) Common stock-$20 par value, 30,000 shares authorized, 19,000 shares issued, 1.000 shares in treasury.... Paid-in capital in excess of par value, common stock .... Retained earnings ($40,000 restricted by treasury stock)........... $380,000 104.000 295,200 779,200 140,000 $739,200 Less cost of treasury stock............ Total stockholders' equity .............. The following transactions and events affected its equity during the year. Feb. 15 Declared a $0,40 per share cash dividend, date of record five days later. Mar. 2 Purchased treasury stock for cash. May 15 Declared a $0.40 per share cash dividend, date of record five days later. Aug. 15 Declared a $0.40 per share cash dividend, date of record five days later. Oct 4 Declared a 12.5% stock dividend when the stock's market value is $42 per shal Oct. 20 Issued the stock dividend that was declared on October 4. Nov. 15 Declared a $0.40 per share cash dividend, date of record five days later. Required 1. How many common shares are outstanding on each cash dividend date? 2. What is the total dollar amount for each of the four cash dividends? 3. What is the amount of retained earnings transferred to paid-in capital accounts (capita stock dividend? ack (3) $84,000 nts (capitalized) for the $40 $136,000 4. What is the per share cost of the treasury stock purchased? 5. How much net income did the company carn this year? oblem 13-5B Soltech Company's balance sheet shown

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts