Question: Complete question B). Show formulas and fully explain problem for full credit. 7) (14 points) Suppose you are a trader at Citigroup and you notice

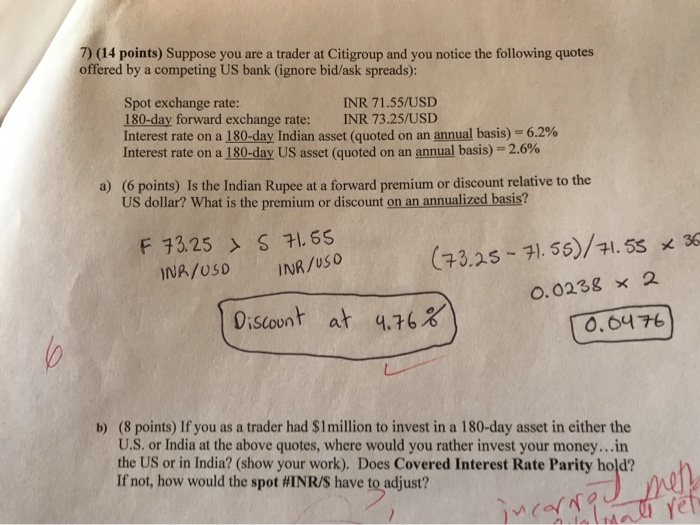

7) (14 points) Suppose you are a trader at Citigroup and you notice the following quotes offered by a competing US bank (ignore bid/ask spreads): INR 71.55/USD Spot exchange rate: 180-day forward exchange rate: INR 73.25/USD Interest rate on a 180-day Indian asset (quoted on an annual basis)-6.2% Interest rate on a 180-day US asset (quoted on an annual basis)-2.0 (6 points) Is the Indian Rupee at a forward premium or discount relative to the US dollar? What is the premium or discount on an annualized basis? a) S 7165 F 73.25 (732.5)55)/1.55 x 36 INR/USDINR/USO Discount at 4.76 0.6476 b) (8 points) If you as a trader had $1million to invest in a 180-day asset in either the U.S. or India at the above quotes, where would you rather invest your money...in the US or in India? (show your work). Does Covered Interest Rate Parity hold? If not, how would the spot #INRS have toadjust? 7) (14 points) Suppose you are a trader at Citigroup and you notice the following quotes offered by a competing US bank (ignore bid/ask spreads): INR 71.55/USD Spot exchange rate: 180-day forward exchange rate: INR 73.25/USD Interest rate on a 180-day Indian asset (quoted on an annual basis)-6.2% Interest rate on a 180-day US asset (quoted on an annual basis)-2.0 (6 points) Is the Indian Rupee at a forward premium or discount relative to the US dollar? What is the premium or discount on an annualized basis? a) S 7165 F 73.25 (732.5)55)/1.55 x 36 INR/USDINR/USO Discount at 4.76 0.6476 b) (8 points) If you as a trader had $1million to invest in a 180-day asset in either the U.S. or India at the above quotes, where would you rather invest your money...in the US or in India? (show your work). Does Covered Interest Rate Parity hold? If not, how would the spot #INRS have toadjust

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts