Question: Complete requirements 2-4 Data: Requirements 2. Post the journal entries to the T-accounts that have been set up for you. Identify all items by date.

Complete requirements 2-4

Data:

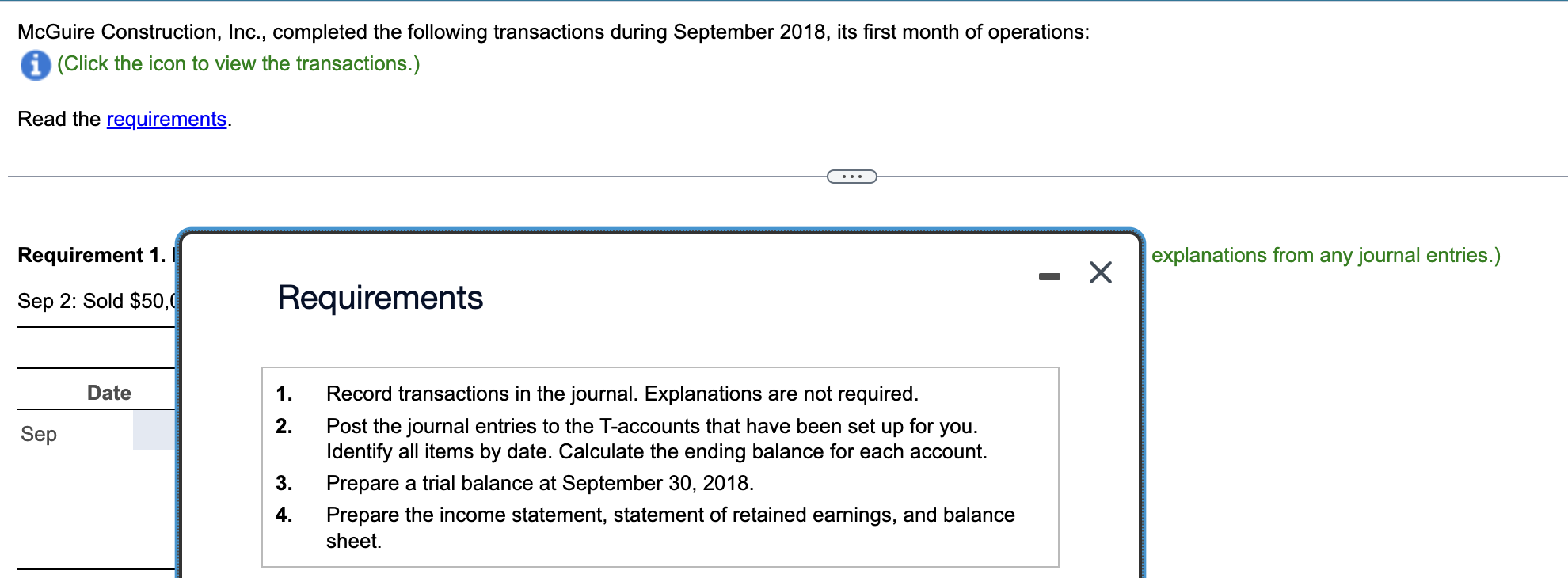

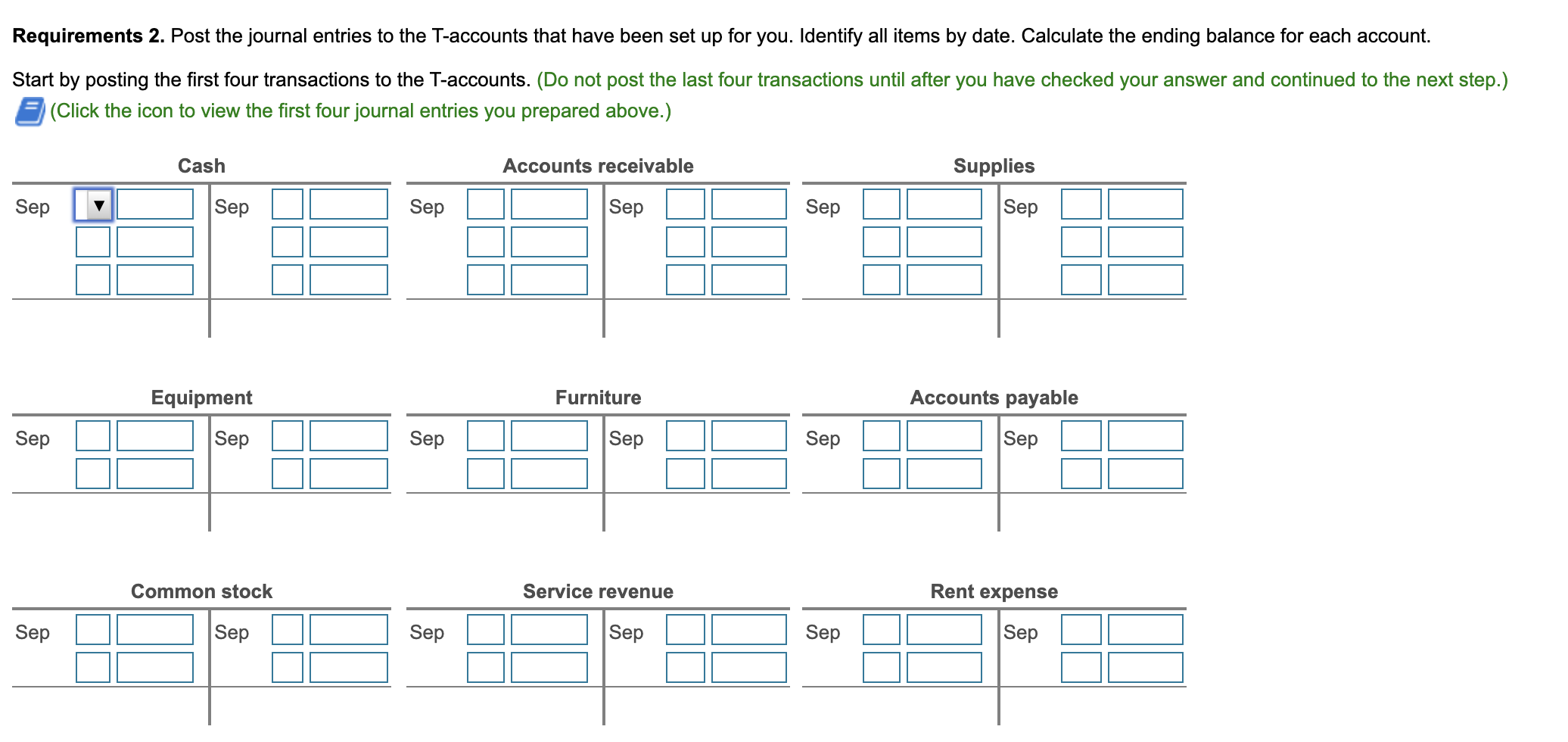

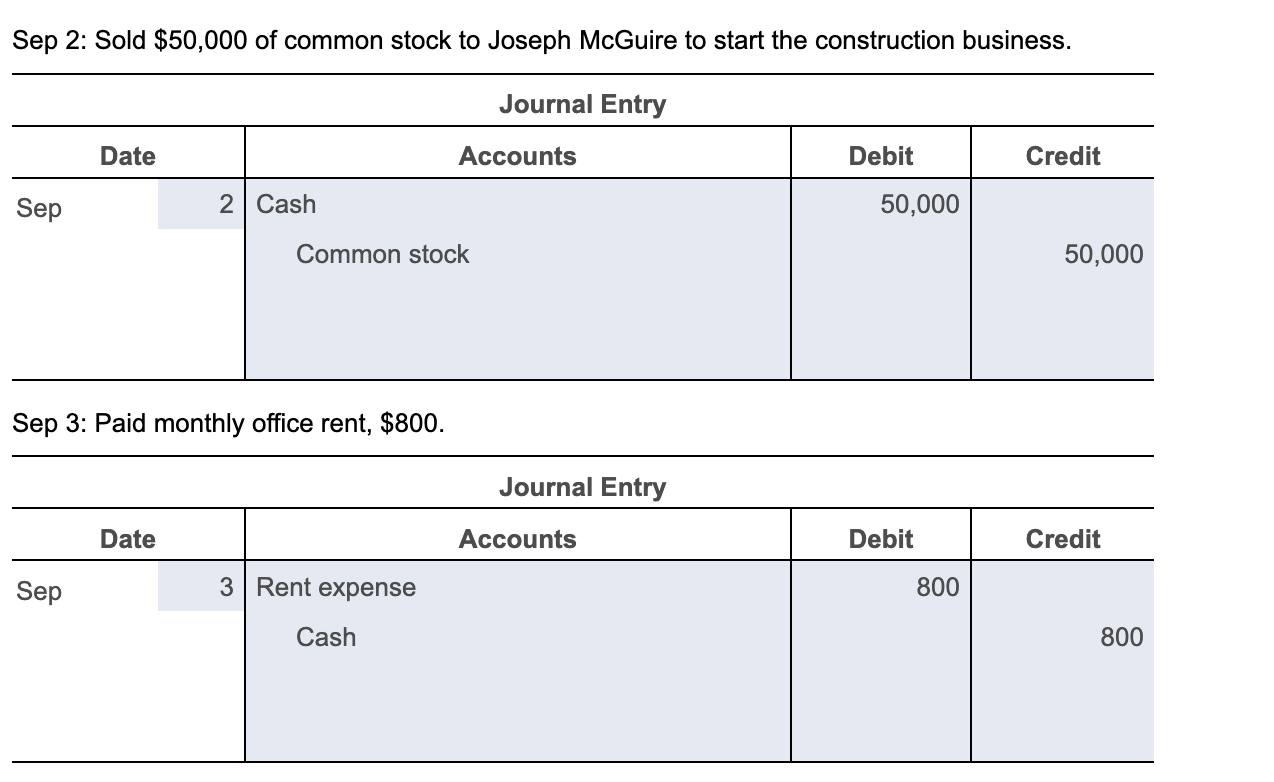

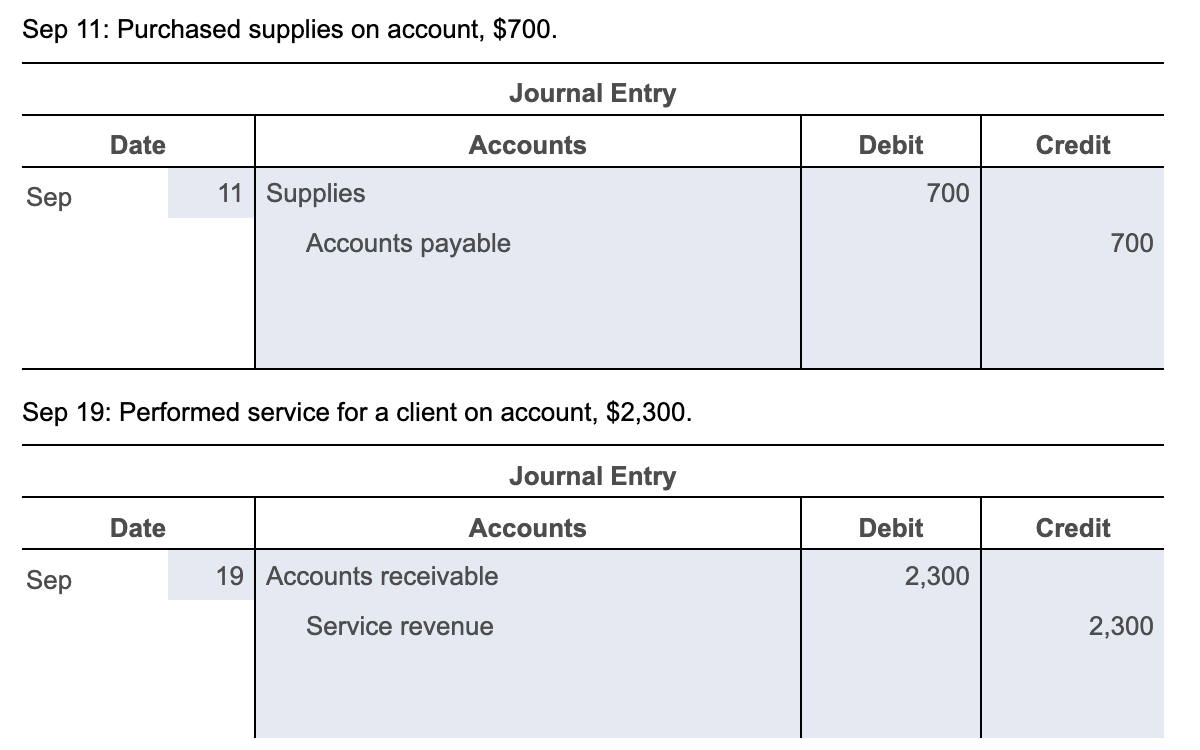

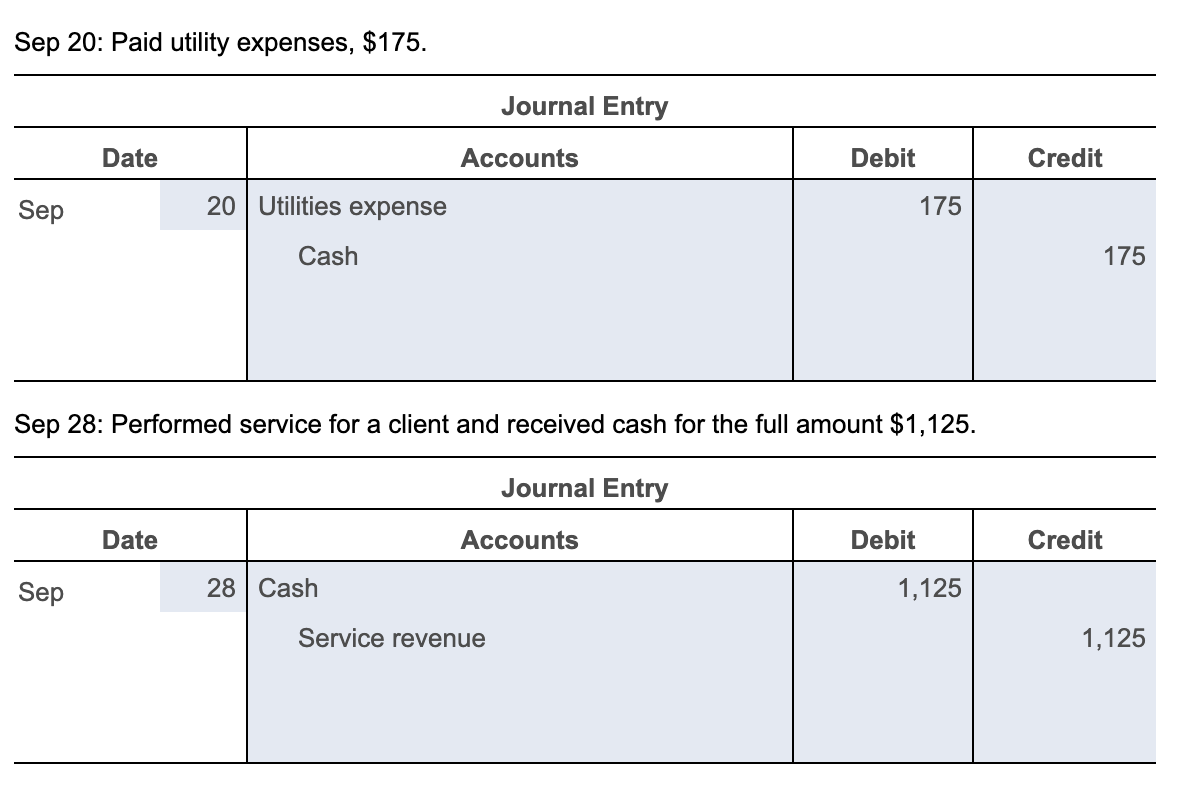

Requirements 2. Post the journal entries to the T-accounts that have been set up for you. Identify all items by date. Calculate the ending balance for each account. Start by posting the first four transactions to the T-accounts. (Do not post the last four transactions until after you have checked your answer and continued to the next step.) (Click the icon to view the first four journal entries you prepared above.) McGuire Construction, Inc., completed the following transactions during September 2018, its first month of operations: (Click the icon to view the transactions.) Read the requirements. Requirements 1. Record transactions in the journal. Explanations are not required. 2. Post the journal entries to the T-accounts that have been set up for you. Identify all items by date. Calculate the ending balance for each account. 3. Prepare a trial balance at September 30, 2018. 4. Prepare the income statement, statement of retained earnings, and balance sheet. Sep 11: Purchased supplies on account, $700. Sen 6: Paid cash for a new comnuter. $1.600. Sep 2: Sold $50,000 of common stock to Joseph McGuire to start the construction business. Sep 20: Paid utility expenses, $175

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts