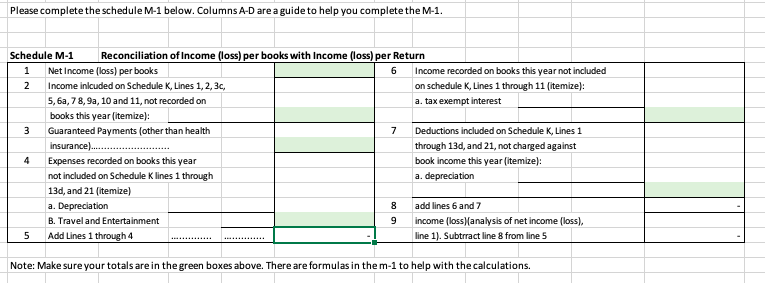

Question: Complete Schedule M-1 Please complete the schedule M1 below. Columns A-D are a guide to help you complete the M1. Schedule M-1 Reconciliation of Income

Complete Schedule M-1

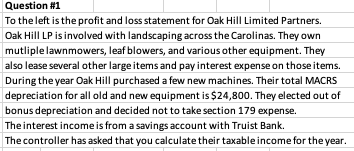

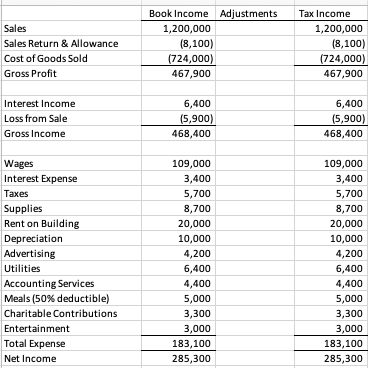

Please complete the schedule M1 below. Columns A-D are a guide to help you complete the M1. Schedule M-1 Reconciliation of Income (loss) per books with Income (loss) per Return Note: Make sure your totals are in the green boxes above. There are formulas in the m1 to help with the calculations. Question \#1 To the left is the profit and loss statement for Oak Hill Limited Partners. Oak Hill LP is involved with landscaping across the Carolinas. They own mutliple lawnmowers, leaf blowers, and various other equipment. They also lease several other large items and pay interest expense on those items. During the year Oak Hill purchased a few new machines. Their total MACRS depreciation for all old and new equipment is $24,800. They elected out of bonus depreciation and decided not to take section 179 expense. The interest income is from a savings account with Truist Bank. The controller has asked that you calculate their taxable income for the year. Please complete the schedule M1 below. Columns A-D are a guide to help you complete the M1. Schedule M-1 Reconciliation of Income (loss) per books with Income (loss) per Return Note: Make sure your totals are in the green boxes above. There are formulas in the m1 to help with the calculations. Question \#1 To the left is the profit and loss statement for Oak Hill Limited Partners. Oak Hill LP is involved with landscaping across the Carolinas. They own mutliple lawnmowers, leaf blowers, and various other equipment. They also lease several other large items and pay interest expense on those items. During the year Oak Hill purchased a few new machines. Their total MACRS depreciation for all old and new equipment is $24,800. They elected out of bonus depreciation and decided not to take section 179 expense. The interest income is from a savings account with Truist Bank. The controller has asked that you calculate their taxable income for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts