Question: Complete Table 5 below. a.) What if the basis weakens and instead of the expected $20 per ton over, it is actually $10 per ton

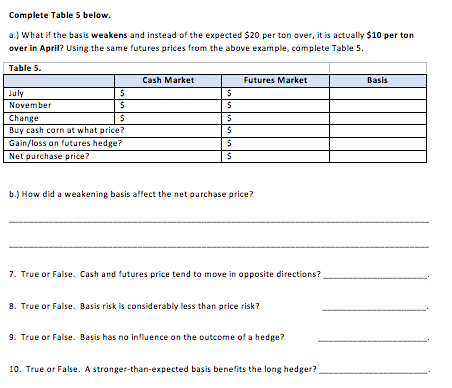

Complete Table 5 below. a.) What if the basis weakens and instead of the expected $20 per ton over, it is actually $10 per ton over in April? Using the same futures prices from the above example, complete Table 5. Table 5. Cash Market Futures Market Basis July $ November $ Change $ Buy cash corn at what price? Gain/loss on futures hedge? Net purchase price? S b.) How did a weakening basis affect the net purchase price? 7. True or False. Cash and futures price tend to move in opposite directions? 8. True or False. Basis risk is considerably less than price risk? 9. True or False. Basis has no influence on the outcome of a hedge? 10. True or False. A stronger-than-expected basis benefits the long hedger? Complete Table 5 below. a.) What if the basis weakens and instead of the expected $20 per ton over, it is actually $10 per ton over in April? Using the same futures prices from the above example, complete Table 5. Table 5. Cash Market Futures Market Basis July $ November $ Change $ Buy cash corn at what price? Gain/loss on futures hedge? Net purchase price? S b.) How did a weakening basis affect the net purchase price? 7. True or False. Cash and futures price tend to move in opposite directions? 8. True or False. Basis risk is considerably less than price risk? 9. True or False. Basis has no influence on the outcome of a hedge? 10. True or False. A stronger-than-expected basis benefits the long hedger

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts