Question: Complete table Refine Cash Balance and Consider Capital Structure Consider the following actual FY2019 data and a forecast of FY2020 selected balance sheet and income

Complete table

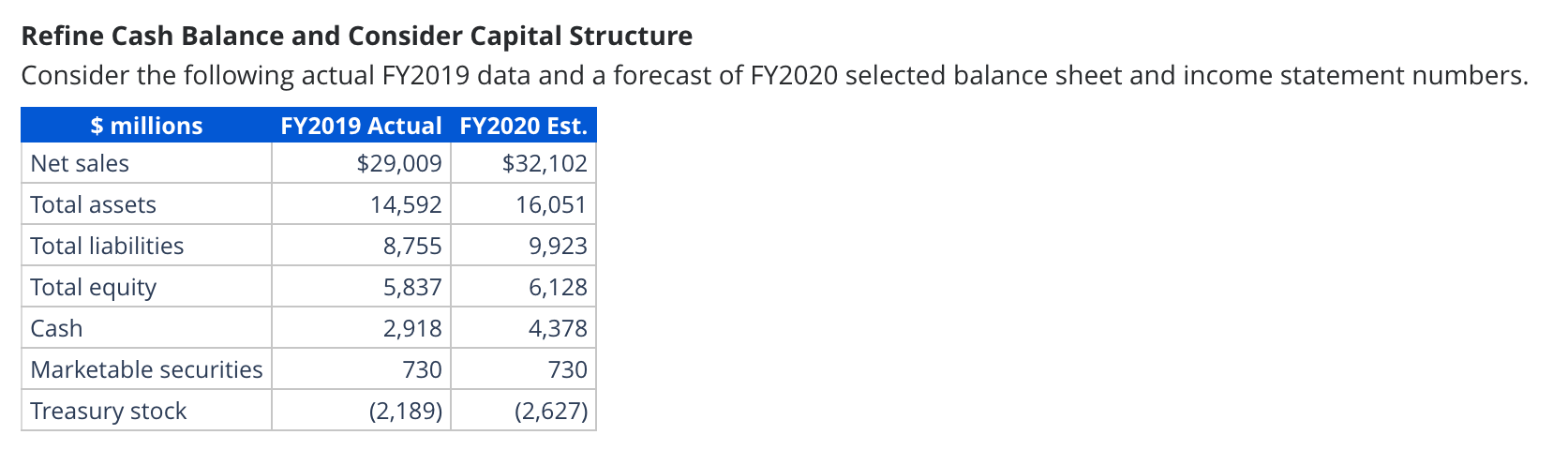

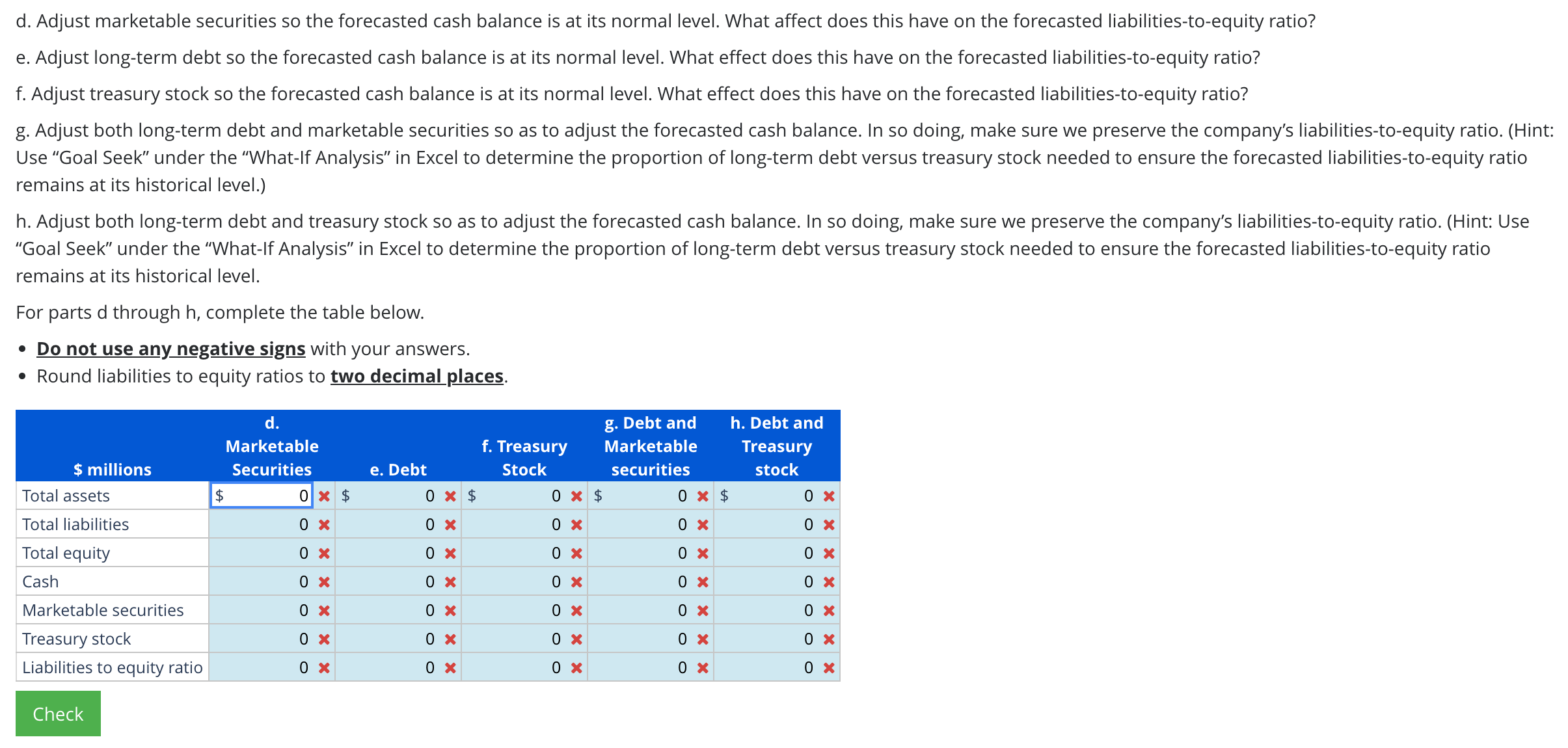

Refine Cash Balance and Consider Capital Structure Consider the following actual FY2019 data and a forecast of FY2020 selected balance sheet and income statement numbers. d. Adjust marketable securities so the forecasted cash balance is at its normal level. What affect does this have on the forecasted liabilities-to-equity ratio? e. Adjust long-term debt so the forecasted cash balance is at its normal level. What effect does this have on the forecasted liabilities-to-equity ratio? f. Adjust treasury stock so the forecasted cash balance is at its normal level. What effect does this have on the forecasted liabilities-to-equity ratio? g. Adjust both long-term debt and marketable securities so as to adjust the forecasted cash balance. In so doing, make sure we preserve the company's liabilities-to-equity ratio. (Hint: Use "Goal Seek" under the "What-If Analysis" in Excel to determine the proportion of long-term debt versus treasury stock needed to ensure the forecasted liabilities-to-equity ratio remains at its historical level.) h. Adjust both long-term debt and treasury stock so as to adjust the forecasted cash balance. In so doing, make sure we preserve the company's liabilities-to-equity ratio. (Hint: Use "Goal Seek" under the "What-If Analysis" in Excel to determine the proportion of long-term debt versus treasury stock needed to ensure the forecasted liabilities-to-equity ratio remains at its historical level. For parts d through h, complete the table below. - Do not use any negative signs with your answers. - Round liabilities to equity ratios to two decimal places. Refine Cash Balance and Consider Capital Structure Consider the following actual FY2019 data and a forecast of FY2020 selected balance sheet and income statement numbers. d. Adjust marketable securities so the forecasted cash balance is at its normal level. What affect does this have on the forecasted liabilities-to-equity ratio? e. Adjust long-term debt so the forecasted cash balance is at its normal level. What effect does this have on the forecasted liabilities-to-equity ratio? f. Adjust treasury stock so the forecasted cash balance is at its normal level. What effect does this have on the forecasted liabilities-to-equity ratio? g. Adjust both long-term debt and marketable securities so as to adjust the forecasted cash balance. In so doing, make sure we preserve the company's liabilities-to-equity ratio. (Hint: Use "Goal Seek" under the "What-If Analysis" in Excel to determine the proportion of long-term debt versus treasury stock needed to ensure the forecasted liabilities-to-equity ratio remains at its historical level.) h. Adjust both long-term debt and treasury stock so as to adjust the forecasted cash balance. In so doing, make sure we preserve the company's liabilities-to-equity ratio. (Hint: Use "Goal Seek" under the "What-If Analysis" in Excel to determine the proportion of long-term debt versus treasury stock needed to ensure the forecasted liabilities-to-equity ratio remains at its historical level. For parts d through h, complete the table below. - Do not use any negative signs with your answers. - Round liabilities to equity ratios to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts