Question: Complete table using 2020 tax rates. How much is the standard deduction for each description? *I need the 2020 filing requirements and standard deduction not

Complete table using 2020 tax rates. How much is the standard deduction for each "description"? *I need the 2020 filing requirements and standard deduction not 2019.

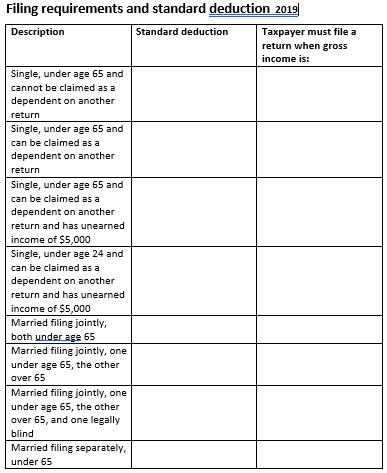

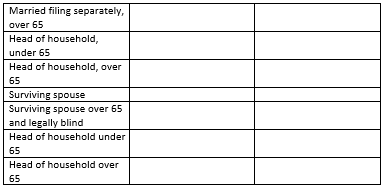

Filing requirements and standard deduction 2019 Description Standard deduction Taxpayer must file a return when gross income is: Single, under age 65 and cannot be claimed as a dependent on another return Single, under age 65 and can be claimed as a dependent on another return Single, under age 65 and can be claimed as a dependent on another return and has unearned income of $5,000 Single, under age 24 and can be claimed as a dependent on another return and has unearned income of $5,000 Married filing jointly, both under age 65 Married filing jointly, one under age 65, the other over 65 Married filing jointly, one under age 65, the other over 65, and one legally blind Married filing separately, under 65 Married filing separately, over 65 Head of household, under 65 Head of household, over 65 Surviving spouse Surviving spouse over 65 and legally blind Head of household under 65 Head of household over 65 Filing requirements and standard deduction 2019 Description Standard deduction Taxpayer must file a return when gross income is: Single, under age 65 and cannot be claimed as a dependent on another return Single, under age 65 and can be claimed as a dependent on another return Single, under age 65 and can be claimed as a dependent on another return and has unearned income of $5,000 Single, under age 24 and can be claimed as a dependent on another return and has unearned income of $5,000 Married filing jointly, both under age 65 Married filing jointly, one under age 65, the other over 65 Married filing jointly, one under age 65, the other over 65, and one legally blind Married filing separately, under 65 Married filing separately, over 65 Head of household, under 65 Head of household, over 65 Surviving spouse Surviving spouse over 65 and legally blind Head of household under 65 Head of household over 65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts