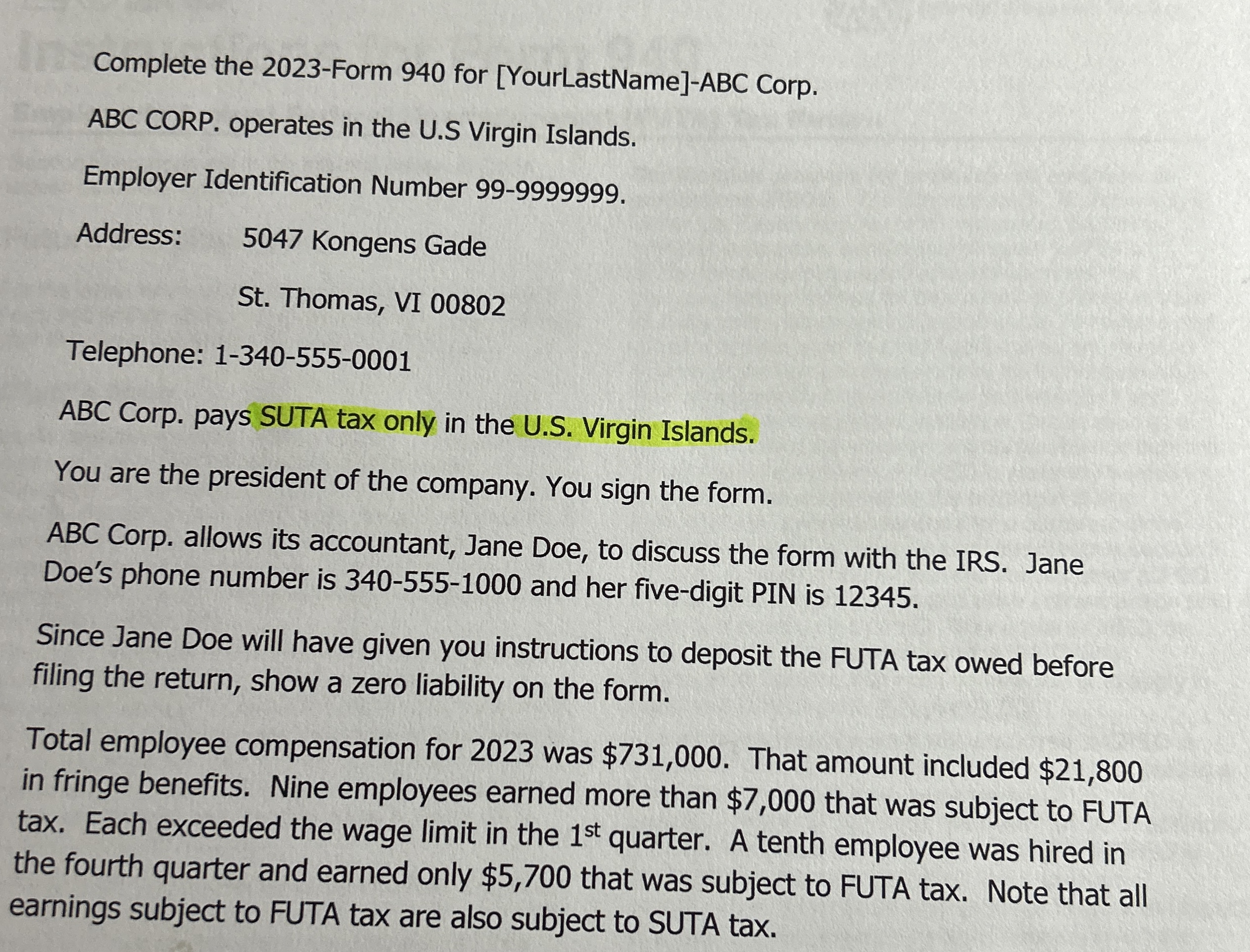

Question: Complete the 2 0 2 3 - Form 9 4 0 for [ YourLastName ] - ABC Corp. ABC CORP. operates in the U .

Complete the Form for YourLastNameABC Corp.

ABC CORP. operates in the US Virgin Islands.

Employer Identification Number

Address: Kongens Gade

St Thomas, VI

Telephone:

ABC Corp. pays SUTA tax only in the US Virgin Islands.

You are the president of the company. You sign the form.

ABC Corp. allows its accountant, Jane Doe, to discuss the form with the IRS. Jane Doe's phone number is and her fivedigit PIN is

Since Jane Doe will have given you instructions to deposit the FUTA tax owed before filing the return, show a zero liability on the form.

Total employee compensation for was $ That amount included $ in fringe benefits. Nine employees earned more than $ that was subject to FUTA tax. Each exceeded the wage limit in the quarter. A tenth employee was hired in the fourth quarter and earned only $ that was subject to FUTA tax. Note that all earnings subject to FUTA tax are also subject to SUTA tax.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock