Question: Complete the accounting cycle using long-term asset transactions Exercise 7-21 Complete the accounting cycle using long-term asset transactions (LO7-2, 7-4, 7-7 [The following information applies

Complete the accounting cycle using long-term asset transactions

![applies to the questions displayed below.] On January 1, 2018, the general](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ea703ec8a43_19066ea703e69004.jpg)

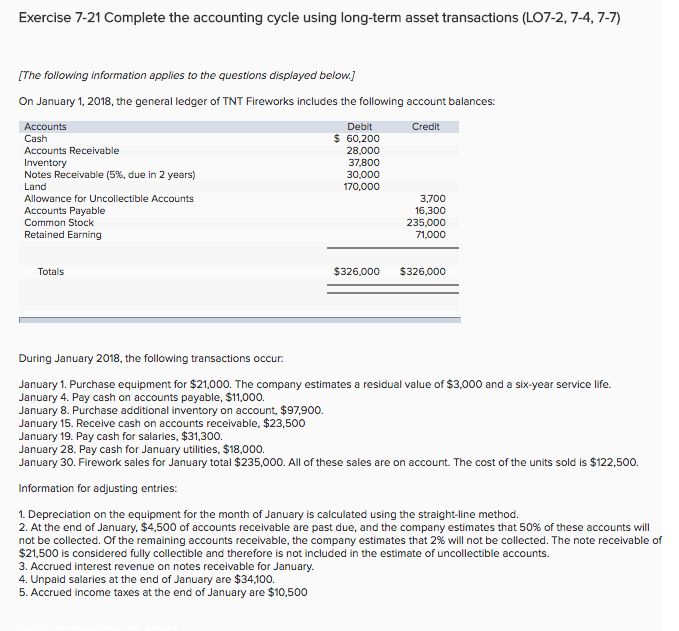

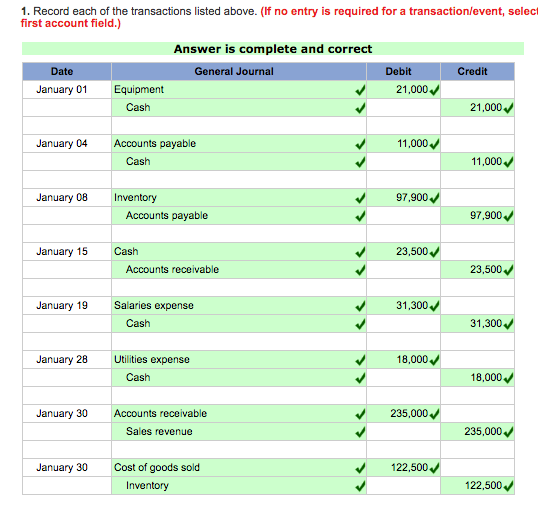

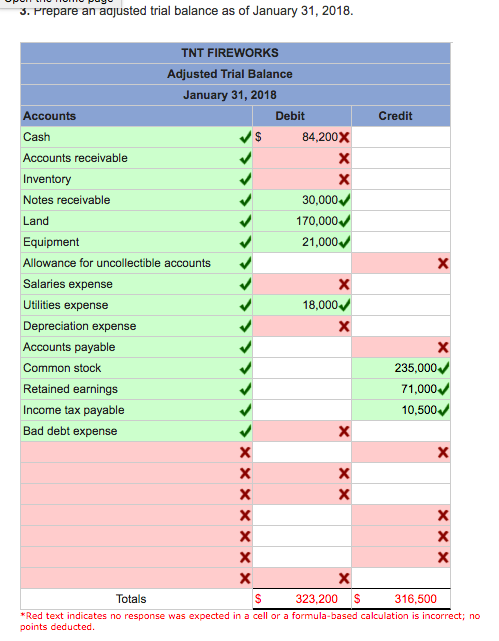

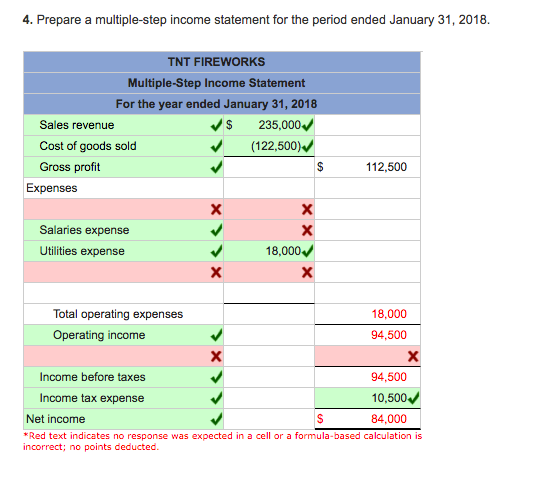

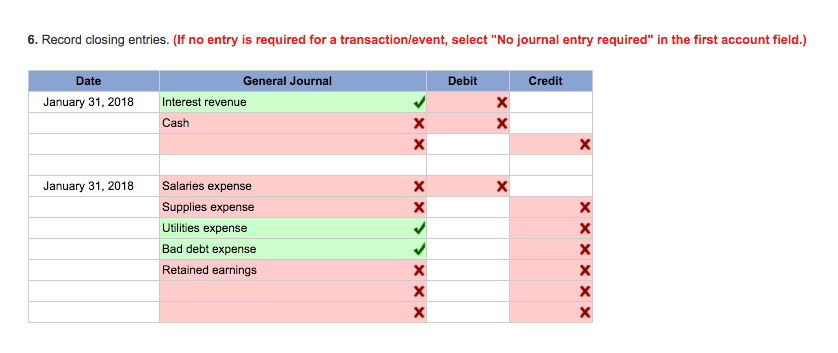

Exercise 7-21 Complete the accounting cycle using long-term asset transactions (LO7-2, 7-4, 7-7 [The following information applies to the questions displayed below.] On January 1, 2018, the general ledger of TNT Fireworks includes the following account balances: Credit Accounts 60,200 Cash Accounts Receivable 28.000 inventory 37.800 Notes Receivable (5%, due in 2 years) 30.000 and 170,000 Allowance for Uncollectible Accounts 3,700 Accounts Payable 16.300 Common Stock 235.000 Retained Earning 71.000 $326.000 $326.000 otals During January 2018, the following transactions occur: January 1. Purchase equipment for $21.000. The company estimates a residual value of $3,000 and a six-year service life January 4. Pay cash on accounts payable, $11,000. January 8. Purchase additional inventory on account, $97,900. January 15. Receive cash on accounts receivable, $23,500 January 19. Pay cash for salaries, $31.300. January 28. Pay cash for January utilities, $18,000. January 30. Firework sales for January total $235,000. All of these sales are on account. The cost of the units sold is $122,500 Information for adjusting entries: 1. Depreciation on the equipment for the month of January is calculated using the straight-line method. 2. At the end of January, $4,500 of accounts receivable are past due, and the company estimates that 50% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 2% will not be collected. The note receivable of $21,500 is considered fully collectible and therefore is not included in the estimate of uncollectible accounts. 3. Accrued interest revenue on notes receivable for January. 4. Unpaid salaries at the end of January are $34.100. 5. Accrued income taxes at the end of January are $10.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts