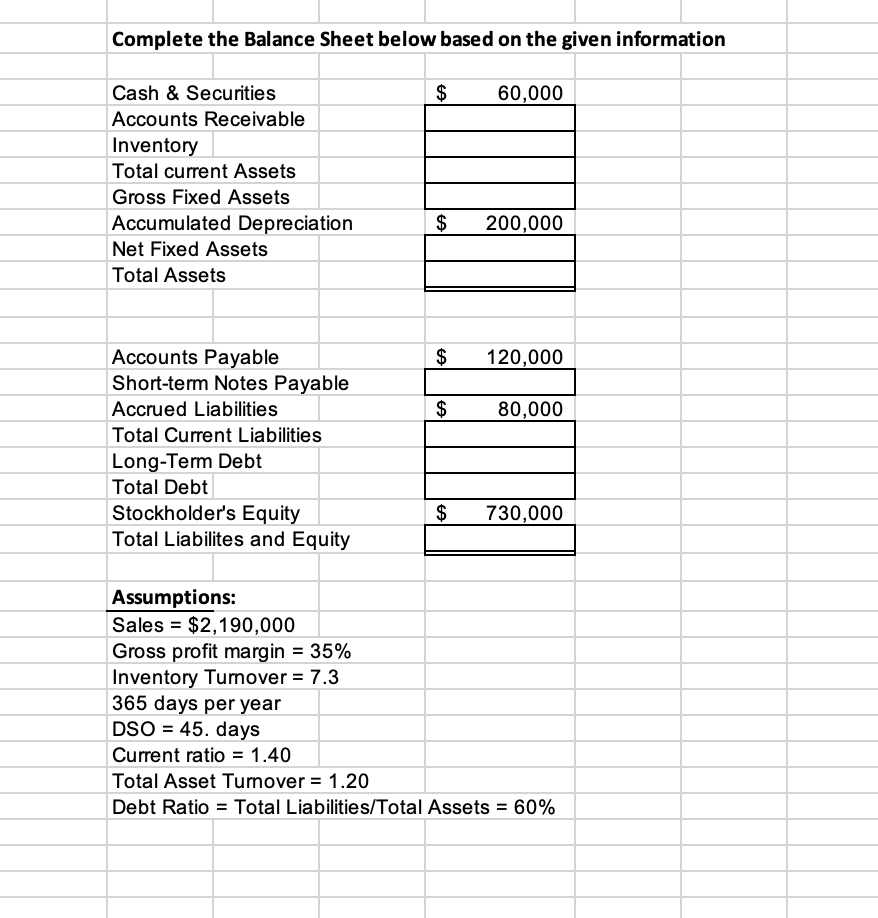

Question: Complete the Balance Sheet below based on the given information Cash & Securities $ 60,000 Accounts Receivable Inventory Total current Assets Gross Fixed Assets Accumulated

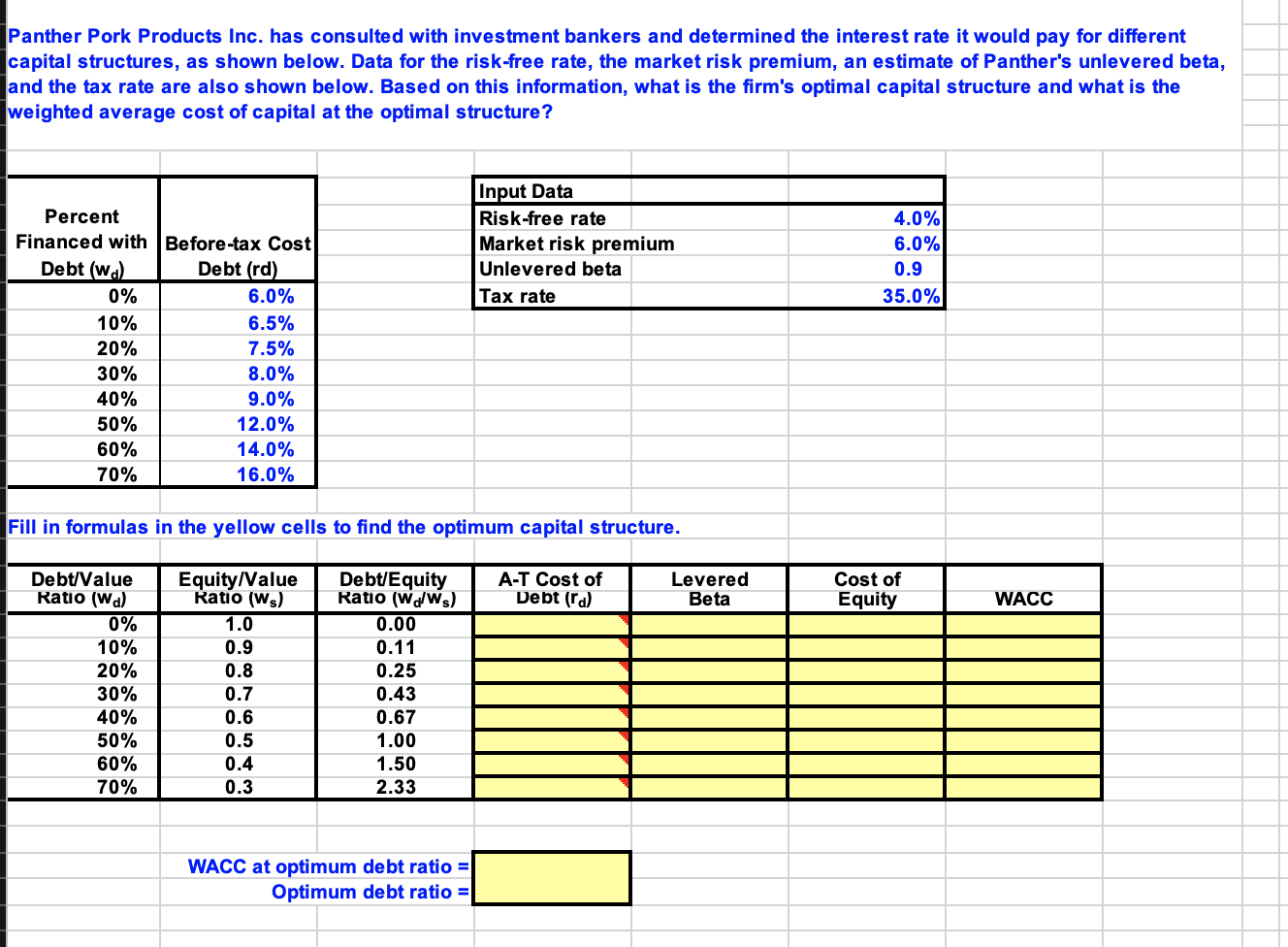

Complete the Balance Sheet below based on the given information Cash & Securities $ 60,000 Accounts Receivable Inventory Total current Assets Gross Fixed Assets Accumulated Depreciation $ 200,000 Net Fixed Assets Total Assets $ 120,000 Accounts Payable Short-term Notes Payable Accrued Liabilities $ 80,000 Total Current Liabilities Long-Term Debt Total Debt $ 730,000 Stockholder's Equity Total Liabilites and Equity Assumptions: Sales $2,190,000 Gross profit margin = 35% Inventory Turnover = 7.3 365 days per year DSO 45. days Current ratio=1.40 Total Asset Tumover = 1.20 Debt Ratio = Total Liabilities/Total Assets = 60% Panther Pork Products Inc. has consulted with investment bankers and determined the interest rate it would pay for different capital structures, as shown below. Data for the risk-free rate, the market risk premium, an estimate of Panther's unlevered beta, and the tax rate are also shown below. Based on this information, what is the firm's optimal capital structure and what is the weighted average cost of capital at the optimal structure? Input Data Risk-free rate Percent 4.0% Financed with Before-tax Cost 6.0% Market risk premium Unlevered beta Debt (wa) Debt (rd) 0.9 0% 6.0% Tax rate 35.0% 10% 6.5% 20% 7.5% 30% 8.0% 40% 9.0% 50% 12.0% 60% 14.0% 70% 16.0% Fill in formulas in the yellow cells to find the optimum capital structure. Debt/Value Equity/Value Katio (WS) Debt/Equity Ratio (W/Ws) A-T Cost of Debt (rd) Levered Beta Ratio (Wd) 1.0 0.00 0.9 0.11 0.8 0.25 0.7 0.43 0.6 0.67 0.5 1.00 0.4 1.50 0.3 2.33 WACC at optimum debt ratio = Optimum debt ratio = 0% 10% 20% 30% 40% 50% 60% 70% Cost of Equity WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts