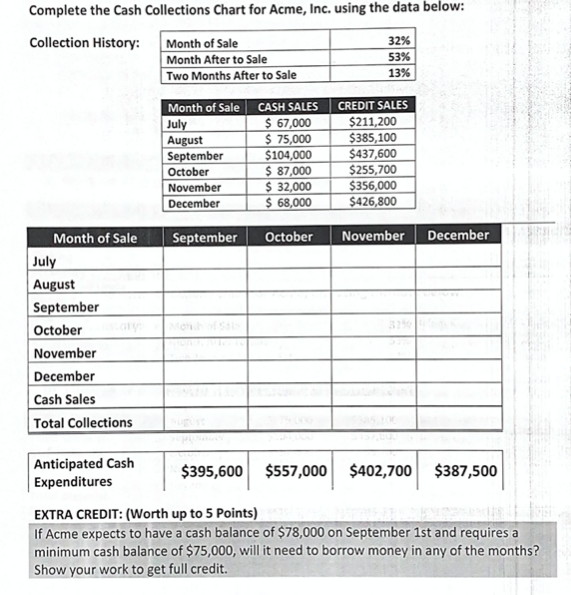

Question: Complete the Cash Collections Chart for Acme, Inc. using the data below: Collection History: Month of Sale 32% Month After to Sale 53% Two

Complete the Cash Collections Chart for Acme, Inc. using the data below: Collection History: Month of Sale 32% Month After to Sale 53% Two Months After to Sale 13% Month of Sale CASH SALES CREDIT SALES July $ 67,000 $211,200 $ 75,000 $385,100 August September $104,000 $437,600 October $ 87,000 $255,700 November $ 32,000 $356,000 December $ 68,000 $426,800 Month of Sale September October November December July August September October November December Cash Sales Total Collections Anticipated Cash $395,600 $557,000 $402,700 $387,500 Expenditures EXTRA CREDIT: (Worth up to 5 Points) If Acme expects to have a cash balance of $78,000 on September 1st and requires a minimum cash balance of $75,000, will it need to borrow money in any of the months? Show your work to get full credit.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Month of sale July August September October November December Cash sales Total Collec... View full answer

Get step-by-step solutions from verified subject matter experts