Question: Complete the cash flows statement. clearly show which numbers go on the left and which numbers go on the right. Using the following information prepare

Complete the cash flows statement. clearly show which numbers go on the left and which numbers go on the right.

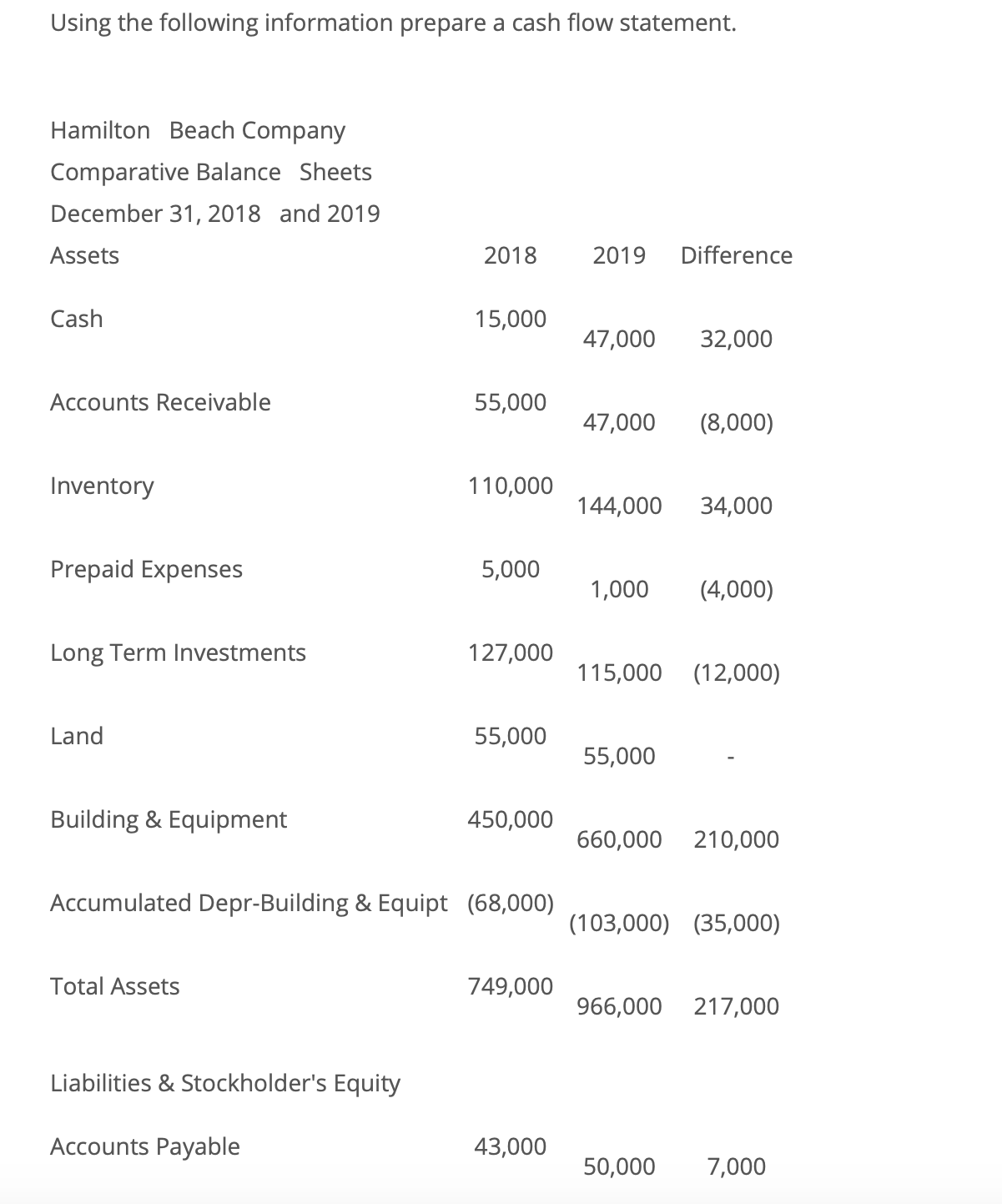

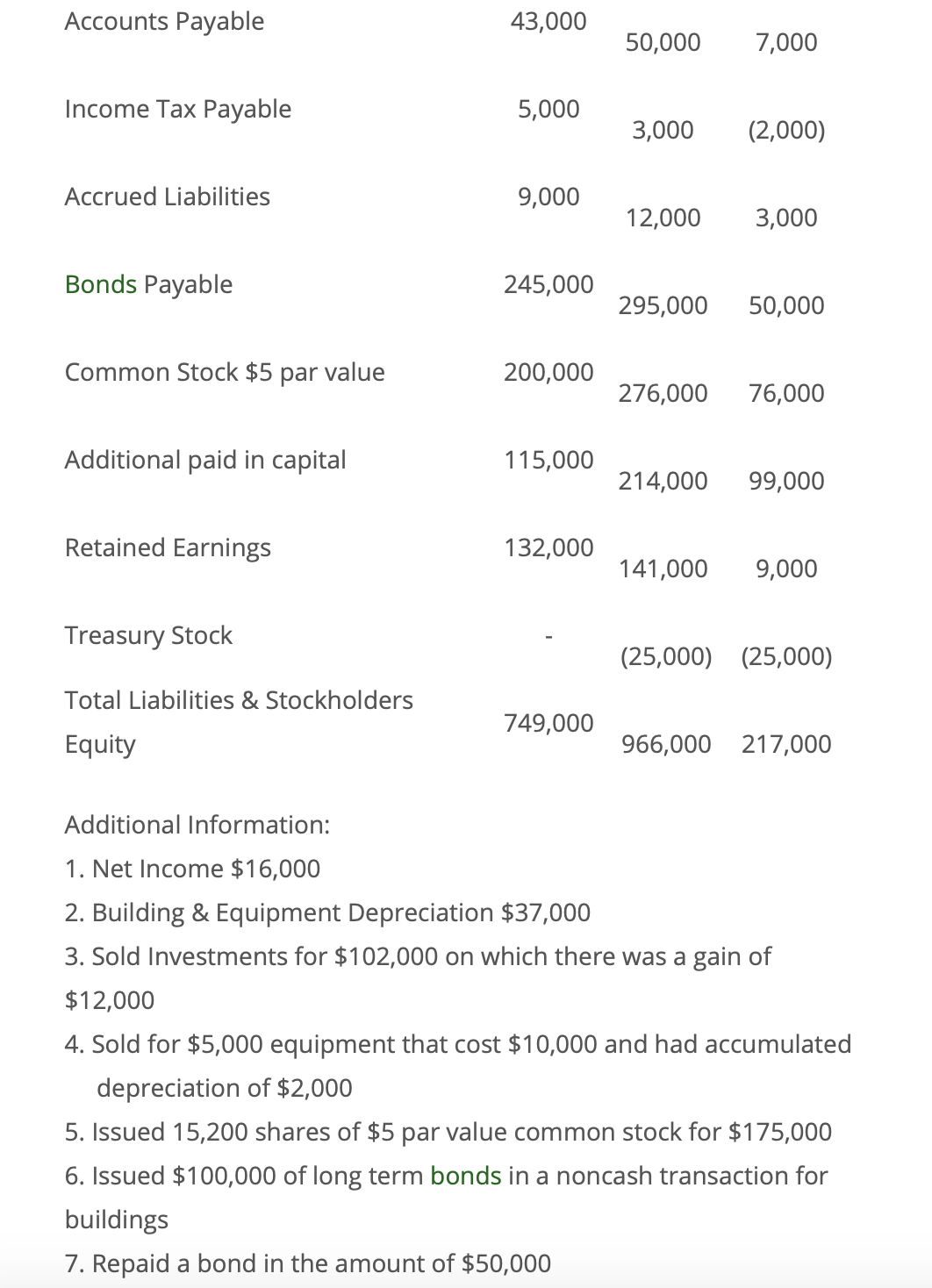

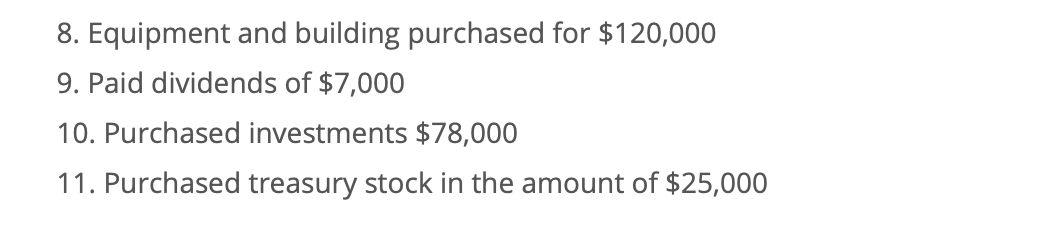

Using the following information prepare a cash flow statement. Hamilton Beach Company Comparative Balance Sheets December 31, 2018 and 2019 Assets 2018 2019 Difference Cash 15,000 47,000 32,000 Accounts Receivable 55,000 47,000 (8,000) Inventory 110,000 144,000 34,000 Prepaid Expenses 5,000 1,000 (4,000) Long Term Investments 127,000 115,000 (12,000) Land 55,000 55,000 - Building & Equipment 450,000 660,000 210,000 Accumulated Depr-Building & Equipt (68,000) (103,000) (35,000) Total Assets 749,000 966,000 217,000 Liabilities & Stockholder's Equity Accounts Payable 43,000 50,000 7,000 Accounts Payable 43,000 50,000 7,000 Income Tax Payable 5,000 3,000 (2,000) Accrued Liabilities 9,000 12,000 3,000 Bonds Payable 245,000 295,000 50,000 Common Stock $5 par value 200,000 276,000 76,000 Additional paid in capital 115,000 214,000 99,000 Retained Earnings 132,000 141,000 9,000 Treasury Stock - (25,000) (25,000) Total Liabilities & Stockholders 749,000 Equity 966,000 217,000 Additional Information: 1. Net Income $16,000 2. Building & Equipment Depreciation $37,000 3. Sold Investments for $102,000 on which there was a gain of $12,000 4. Sold for $5,000 equipment that cost $10,000 and had accumulated depreciation of $2,000 5. Issued 15,200 shares of $5 par value common stock for $175,000 6. Issued $100,000 of long term bonds in a noncash transaction for buildings 7. Repaid a bond in the amount of $50,000 8. Equipment and building purchased for $120,000 9. Paid dividends of $7,000 10. Purchased investments $78,000 11. Purchased treasury stock in the amount of $25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts