Question: complete the columns see the instructions as well Based on the following transactions, complete the table shown below. a. The business issued shares to shareholders

complete the columns

see the instructions as well

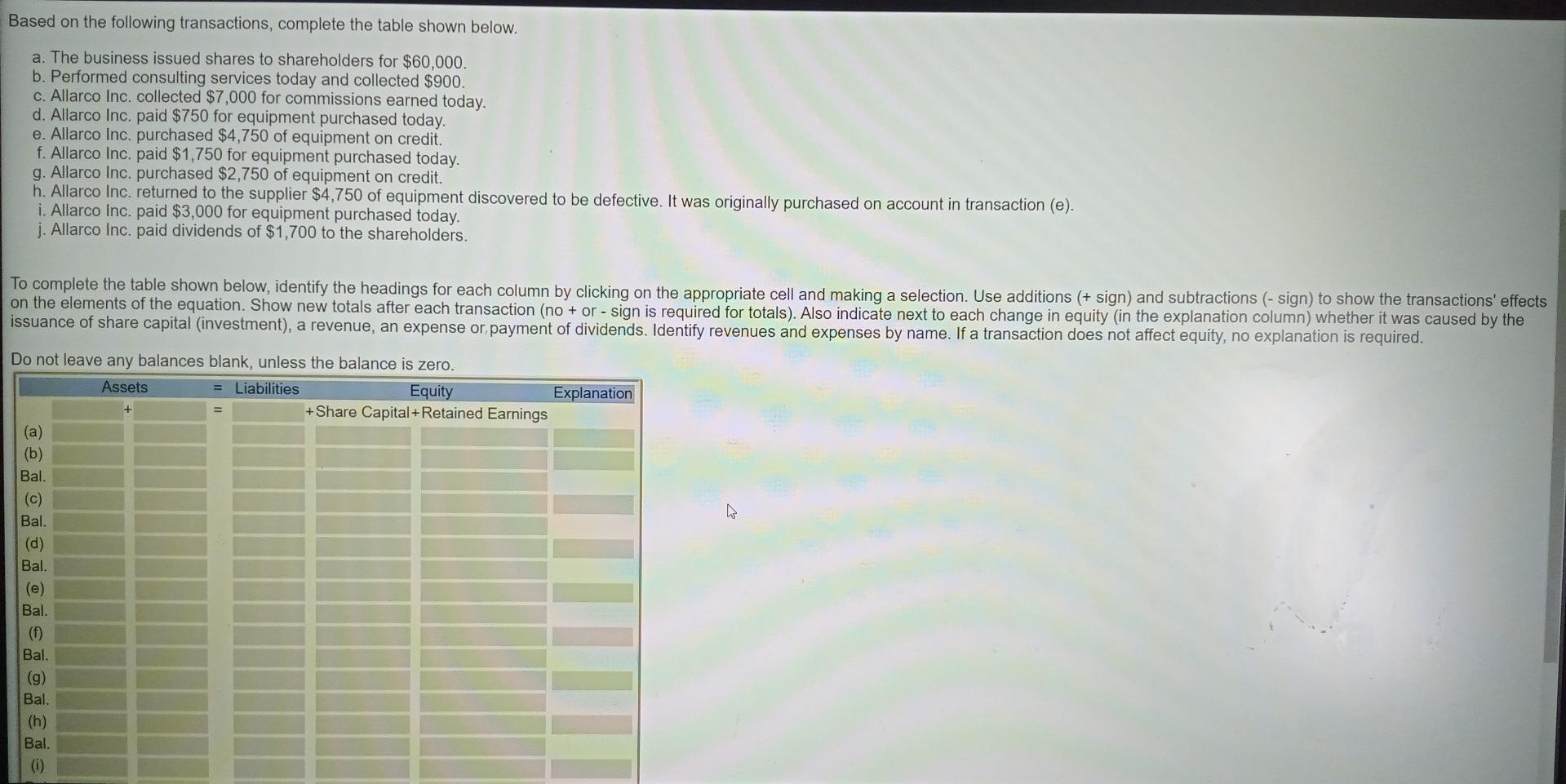

Based on the following transactions, complete the table shown below. a. The business issued shares to shareholders for $60,000. b. Performed consulting services today and collected $900. c. Allarco Inc. collected $7,000 for commissions earned today. d. Allarco Inc. paid $750 for equipment purchased today. e. Allarco Inc. purchased $4,750 of equipment on credit. f. Allarco Inc. paid $1,750 for equipment purchased today. g. Allarco Inc. purchased $2,750 of equipment on credit. h. Allarco Inc. returned to the supplier $4,750 of equipment discovered to be defective. It was originally purchased on account in transaction (e). i. Allarco Inc. paid $3,000 for equipment purchased today. j. Allarco Inc. paid dividends of $1,700 to the shareholders. To complete the table shown below, identify the headings for each column by clicking on the appropriate cell and making a selection. Use additions (+ sign) and subtractions - sign) to show the transactions' effects on the elements of the equation. Show new totals after each transaction (no + or - sign is required for totals). Also indicate next to each change in equity (in the explanation column) whether it was caused by the issuance of share capital investment), a revenue, an expense or payment of dividends. Identify revenues and expenses by name. If a transaction does not affect equity, no explanation is required. Do not leave any balances blank, unless the balance is zero. Assets = Liabilities Equity Explanation +Share Capital +Retained Earnings (a) (b) Bal. (c) Bal. (d) Bal. (e) Bal. (f) Bal. (g) Bal. (h) Bal. (0) Based on the following transactions, complete the table shown below. a. The business issued shares to shareholders for $60,000. b. Performed consulting services today and collected $900. c. Allarco Inc. collected $7,000 for commissions earned today. d. Allarco Inc. paid $750 for equipment purchased today. e. Allarco Inc. purchased $4,750 of equipment on credit. f. Allarco Inc. paid $1,750 for equipment purchased today. g. Allarco Inc. purchased $2,750 of equipment on credit. h. Allarco Inc. returned to the supplier $4,750 of equipment discovered to be defective. It was originally purchased on account in transaction (e). i. Allarco Inc. paid $3,000 for equipment purchased today. j. Allarco Inc. paid dividends of $1,700 to the shareholders. To complete the table shown below, identify the headings for each column by clicking on the appropriate cell and making a selection. Use additions (+ sign) and subtractions (-sign) to show the transactions' effects on the elements of the equation. Show new totals after each transaction (no + or - sign is required for totals). Also indicate next to each change in equity (in the explanation column) whether it was caused by the issuance of share capital investment), a revenue, an expense or payment of dividends. Identify revenues and expenses by name. If a transaction does not affect equity, no explanation is required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts