Question: Complete the common-sized income statement, a common sized balance sheet, and a statement of cash flows for 2015 please Data table 2015 $ 158 416

Complete the common-sized income statement, a common sized balance sheet, and a statement of cash flows for 2015 please

Complete the common-sized income statement, a common sized balance sheet, and a statement of cash flows for 2015 please

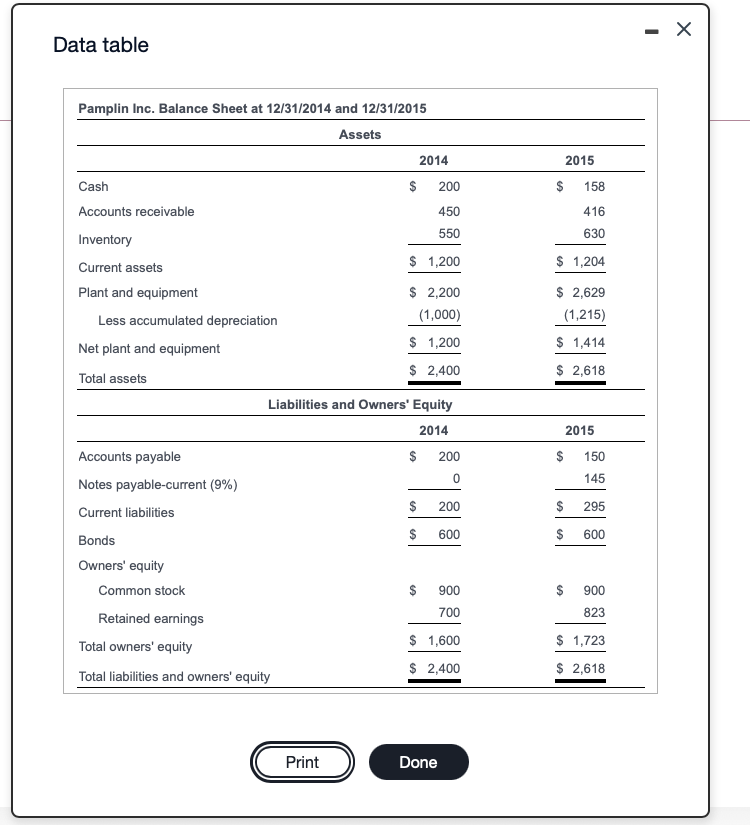

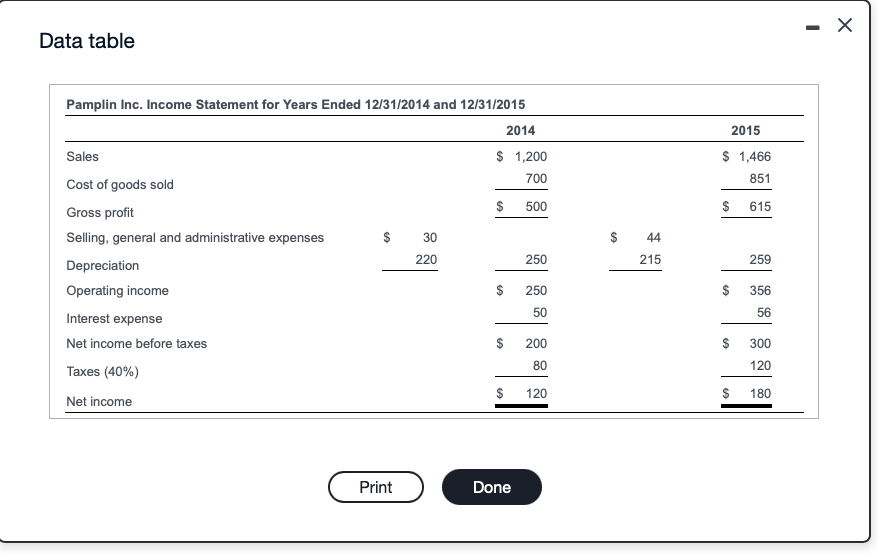

Data table 2015 $ 158 416 630 $ 1,204 $ 2,629 (1,215) $ 1,414 $ 2,618 Pamplin Inc. Balance Sheet at 12/31/2014 and 12/31/2015 Assets 2014 Cash $ 200 Accounts receivable 450 550 Inventory Current assets $ 1,200 Plant and equipment $ 2,200 Less accumulated depreciation (1,000) Net plant and equipment $ 1,200 $ 2,400 Total assets Liabilities and Owners' Equity 2014 Accounts payable $ 200 0 Notes payable-current (9%) 200 Current liabilities Bonds $ 600 Owners' equity Common stock $ 900 Retained earnings 700 Total owners' equity $ 1,600 $ 2,400 Total liabilities and owners' equity 2015 $ 150 145 $ $ 295 $ 600 900 823 $ 1,723 $ 2,618 Print Done - Data table 2015 $ 1,466 851 $ 615 $ 44 Pamplin Inc. Income Statement for Years Ended 12/31/2014 and 12/31/2015 2014 Sales $ 1,200 700 Cost of goods sold $ 500 Gross profit Selling, general and administrative expenses $ 30 220 250 Depreciation Operating income 250 Interest expense 50 Net income before taxes $ 200 Taxes (40%) Net income 215 259 $ $ 356 56 $ 300 80 120 120 $ 180 Print Done b. Complete a common-sized income statement, a common-sized balance sheet, and a statement of cash flows for 2015. Complete the common-sized income statement: (Round to one decimal place.) Common-sized income statement Sales $ 1,466 % Cost of goods sold 851 615 Gross profit $ % $ 44 % Selling, general, and administrative expenses Depreciation Operating income 215 $ 356 % 56 Interest expense Net income before taxes $ % 300 120 Taxes (40%) Net income $ 180 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts