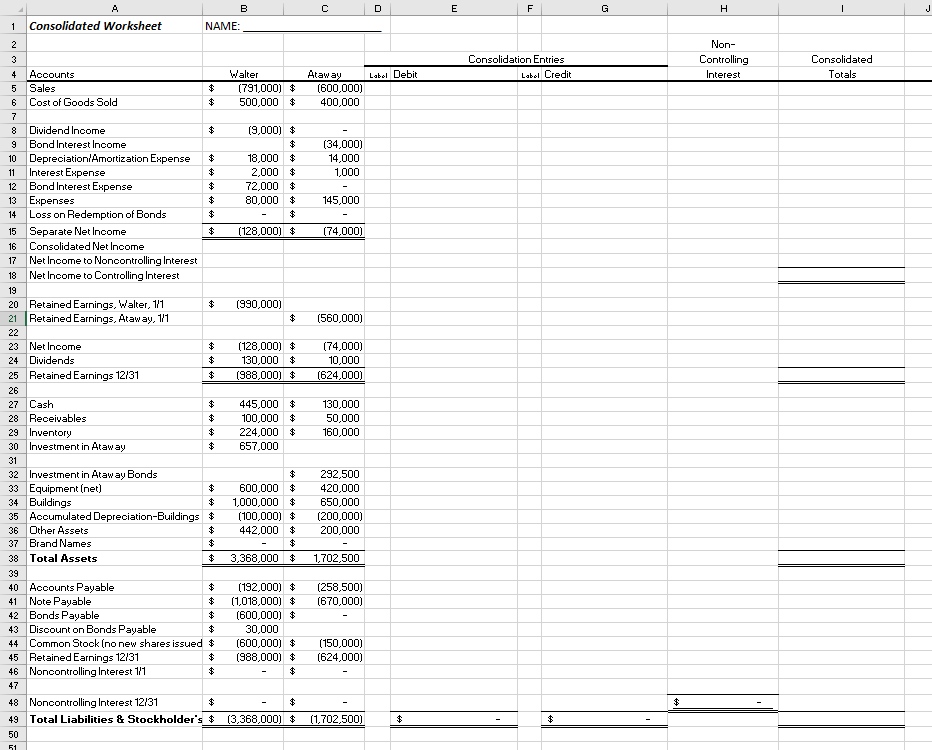

Question: Complete the Consolidated Worksheet using Excel (include all the consolidation entry labels and all the totals on the far right column and the bottom row).

Complete the Consolidated Worksheet using Excel (include all the consolidation entry labels and all the totals on the far right column and the bottom row).

Walter Corp. purchased 90% of Ataway Company on January 1, 2019, for $657,000 in cash. On that date, the 10% interest was assessed to have a $73,000 fair value.Also, at the acquisition date, Ataway held equipment (4-year remaining life) undervalued on the financial records by $20,000 and a long term note payable was overvalued by $40,000 (5 year term). The excess purchase price was assigned to previously unrecognized Brand Names with a 10-year life.

Walter uses the intitial value method to account for its investment in Ataway.During 2019, Ataway earned net income of $80,000 and paid no dividends.

Each year Ataway sells Walter inventory at a 20% gross profit rate. Intra-entity sales were $145,000 in 2019 and $160,000 in 2020. On January 1, 2020, 30% of the 2019 transfers were still on hand.On December 31, 2020, 40% of the 2020 transfers were still on hand. Ataway still owed Walter $20,000 on an account payable for this inventory.

Walter sold Ataway a building on January 2, 2019.It had a cost to Walter of $100,000 but had $90,000 in accumulated depreciation at the time of this transfer.The sale price was $25,000 in cash.At that time, the building had a 5 year remaining life (straight-line method is used).

On January 1, 2020, Walter reports $600,000 in bonds outstanding with a carrying amount of $564,000. On January 1, 2020, Ataway purchased half of these bonds on the open market for $291,000. They use straight-line amortization.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts