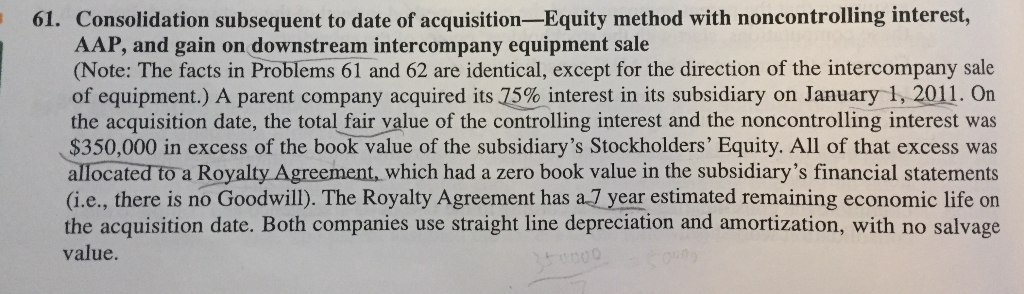

Question: Complete the consolidating entries according to the C-E-A-D-I sequence. Please show all work and explain. The correct answer for the [C] entry is: Equity income

Complete the consolidating entries according to the C-E-A-D-I sequence. Please show all work and explain.

The correct answer for the [C] entry is:

Equity income from subsidiary (Debit) 89,500

Income attributable to NCI (Debit) 25,000

Dividends (Credit) 30,000

Equity Investment (Credit) 67,000

Noncontrolling Interest (Credit) 17,500

![work and explain. The correct answer for the [C] entry is: Equity](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66e11aaa5e4f9_45766e11aa9a8705.jpg)

61. Consolidation subsequent to date of acquisition-Equity method with noncontrolling interest, AAP, and gain on downstream intercompany equipment sale (Note: The facts in Problems 61 and 62 are identical, except for the direction of the intercompany sale of equipment.) A parent company acquired its 75% interest in its subsidiary on January 1, 2011 . on the acquisition date, the total fair value of the controlling interest and the noncontrolling interest was $350,000 in excess of the book value of the subsidiary's Stockholders' Equity. All of that excess was allocated to a Royalty Agreement, which had a zero book value in the subsidiary's financial statements (i.e., there is no Goodwill). The Royalty Agreement has a 7 year estimated remaining economic life on the acquisition date. Both companies use straight line depreciation and amortization, with no salvage value. In January 2014, the parent sold Equipment to the subsidiary for a cash price of $250,000. The par- ent acquired the equipment at a cost of $480,000 and depreciated the equipment over its 10-year useful life using the straight-line method (no salvage value). The parent had depreciated the equipment for 6 years at the time of sale. The subsidiary retained the depreciation policy of the parent and depreciated the equipment over its remaining 4 year useful life. Following are pre-consolidation financial statements of the parent and its subsidiary for the year ended December 31, 2016. The parent uses the equity method to account for its Equity Investment. Parent Subsidiary Parent Gubeidiery Balance sheet: Income statement: 250,000 $619,500 530,000 420,000 550,000 3,500,000 ,000,000 400,000 Inventory.... 900,000 Gross profit. Income (loss) from subsidiary 1,000,000 89,500 PPE, net. . . . $567,500 $150,000 Total assets. Statement of retained earnings: $1,792,500 $200,000 Accounts payable. 300,000 1,500,000 1,100,000 100,000 150,000 320,000 400,000 Net income. Dividends . 567,500 150,000 Other current liabilities (100,000) (30,000) Long-term liabilities . 200,000 $2,260,000$320,000 Common stock... EOY retained earnings... APIC Retained earnings Total liabilities and equity . .. . . 2,260,000 320. $6,000,000 $2,220,000 61. Consolidation subsequent to date of acquisition-Equity method with noncontrolling interest, AAP, and gain on downstream intercompany equipment sale (Note: The facts in Problems 61 and 62 are identical, except for the direction of the intercompany sale of equipment.) A parent company acquired its 75% interest in its subsidiary on January 1, 2011 . on the acquisition date, the total fair value of the controlling interest and the noncontrolling interest was $350,000 in excess of the book value of the subsidiary's Stockholders' Equity. All of that excess was allocated to a Royalty Agreement, which had a zero book value in the subsidiary's financial statements (i.e., there is no Goodwill). The Royalty Agreement has a 7 year estimated remaining economic life on the acquisition date. Both companies use straight line depreciation and amortization, with no salvage value. In January 2014, the parent sold Equipment to the subsidiary for a cash price of $250,000. The par- ent acquired the equipment at a cost of $480,000 and depreciated the equipment over its 10-year useful life using the straight-line method (no salvage value). The parent had depreciated the equipment for 6 years at the time of sale. The subsidiary retained the depreciation policy of the parent and depreciated the equipment over its remaining 4 year useful life. Following are pre-consolidation financial statements of the parent and its subsidiary for the year ended December 31, 2016. The parent uses the equity method to account for its Equity Investment. Parent Subsidiary Parent Gubeidiery Balance sheet: Income statement: 250,000 $619,500 530,000 420,000 550,000 3,500,000 ,000,000 400,000 Inventory.... 900,000 Gross profit. Income (loss) from subsidiary 1,000,000 89,500 PPE, net. . . . $567,500 $150,000 Total assets. Statement of retained earnings: $1,792,500 $200,000 Accounts payable. 300,000 1,500,000 1,100,000 100,000 150,000 320,000 400,000 Net income. Dividends . 567,500 150,000 Other current liabilities (100,000) (30,000) Long-term liabilities . 200,000 $2,260,000$320,000 Common stock... EOY retained earnings... APIC Retained earnings Total liabilities and equity . .. . . 2,260,000 320. $6,000,000 $2,220,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts