Question: Complete the Data Case Presented in Chapter 4. Your submission should be a one-page executive summary of what you found in your analysis with two

Complete the Data Case Presented in Chapter 4.

Your submission should be a one-page executive summary of what you found in your analysis with two external citations and a copy of the Microsoft Excel spreadsheet that you used to complete your analysis. Graphs and figures should be presented as appendices (i.e. not presented within the body of the executive summary).

Assume today is March 16, 2016. Natasha Kingery is 30 years old and has a Bachelor of Science degree in computer science. She is currently employed as a Tier 2 field service representative for a telephony corporation located in Seattle, Washington, and earns $38,000 a year that she anticipates will grow at 3% per year. Natasha hopes to retire at age 65 and has just begun to think about the future.

Natasha has $75,000 that she recently inherited from her aunt. She invested this money in 30-year Treasury Bonds. She is considering whether she should further her education and would use her inheritance to pay for it.

If Natasha lacked the cash to pay for her tuition upfront, she could borrow the money. More intriguingly, she could sell a fraction of her future earnings, an idea that has received attention from researchers and entrepreneurs; see M. Palacios, Investing in Human Capital: A Capital Markets Approach to Student Funding, Cambridge University Press, 2004

She has investigated a couple of options and is asking for your help as a financial planning intern to determine the financial consequences associated with each option. Natasha has already been accepted to both of these programs, and could start either one soon.

One alternative that Natasha is considering is attaining a certification in network design. This certification would automatically promote her to a Tier 3 field service representative in her company. The base salary for a Tier 3 representative is $10,000 more than what she currently earns and she anticipates that this salary differential will grow at a rate of 3% a year as long as she keeps working. The certification program requires the completion of 20 Web-based courses and a score of 80% or better on an exam at the end of the course work. She has learned that the average amount of time necessary to finish the program is one year. The total cost of the program is $5000, due when she enrolls in the program. Because she will do all the work for the certification on her own time, Natasha does not expect to lose any income during the certification.

Another option is going back to school for an MBA degree. With an MBA degree, Natasha expects to be promoted to a managerial position in her current firm. The managerial position pays $20,000 a year more than her current position. She expects that this salary differential will also grow at a rate of 3% per year for as long as she keeps working. The evening program, which will take three years to complete, costs $25,000 per year, due at the beginning of each of her three years in school. Because she will attend classes in the evening, Natasha doesn't expect to lose any income while she is earning her MBA if she chooses to undertake the MBA.

1.Determine the interest rate she is currently earning on her inheritance by going to the U.S. Treasury Department Web site (treasury.gov) and selecting "Data" on the main menu. Then select "Daily Treasury Yield Curve Rates" under the Interest Rate heading and enter the appropriate year, 2016, and then search down the list for March 16 to obtain the closing yield or interest rate that she is earning. Use this interest rate as the discount rate for the remainder of this problem.

As of March 16, 2016 Natasha, is currently earning 2.73% for a 30-year Interest Rate according to the U.S. Treasury Department Web site (treasury.gov).

2.Create a timeline in Excel for her current situation, as well as the certification program and MBA degree options, using the following assumptions:

a.Salaries for the year are paid only once, at the end of the year.

b.The salary increase becomes effective immediately upon graduating from the MBA program or being certified. That is, because the increases become effective immediately but salaries are paid at the end of the year, the first salary increase will be paid exactly one year after graduation or certification.

3.Calculate the present value of the salary differential for completing the certification program. Subtract the cost of the program to get the NPV of undertaking the certification program.

4.Calculate the present value of the salary differential for completing the MBA degree. Calculate the present value of the cost of the MBA program. Based on your calculations, determine the NPV of undertaking the MBA.

5.Based on your answers to Questions 3 and 4, what advice would you give to Natasha? What if the two programs are mutually exclusive? That is, if Natasha undertakes one of the programs there is no further benefit to undertaking the other program. Would your advice be different?

My advice for Natasha based on the NPV results would be for Natasha to select the MBA program. The MBA program's NPV is $600,783.60 versus $352,035.77 from the certification program. If the two programs were mutually exclusive then my advice would be for her to choose the MBA program, this recommendation is based on her achieving a managerial position upon completion along with a raise of $20,000 and a 3% annual pay increase.

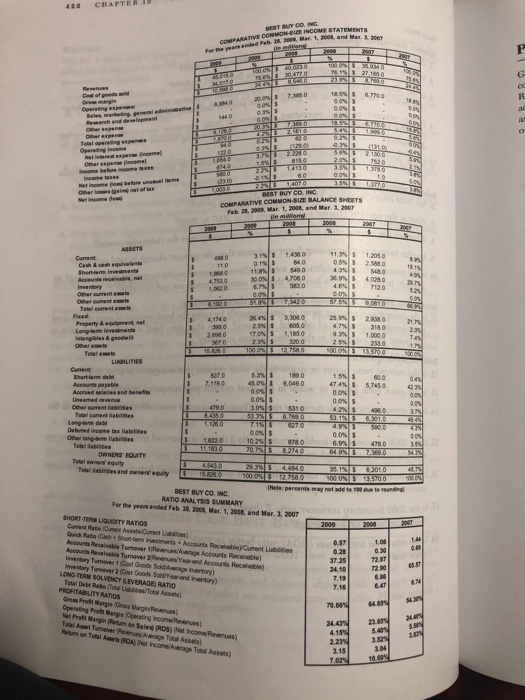

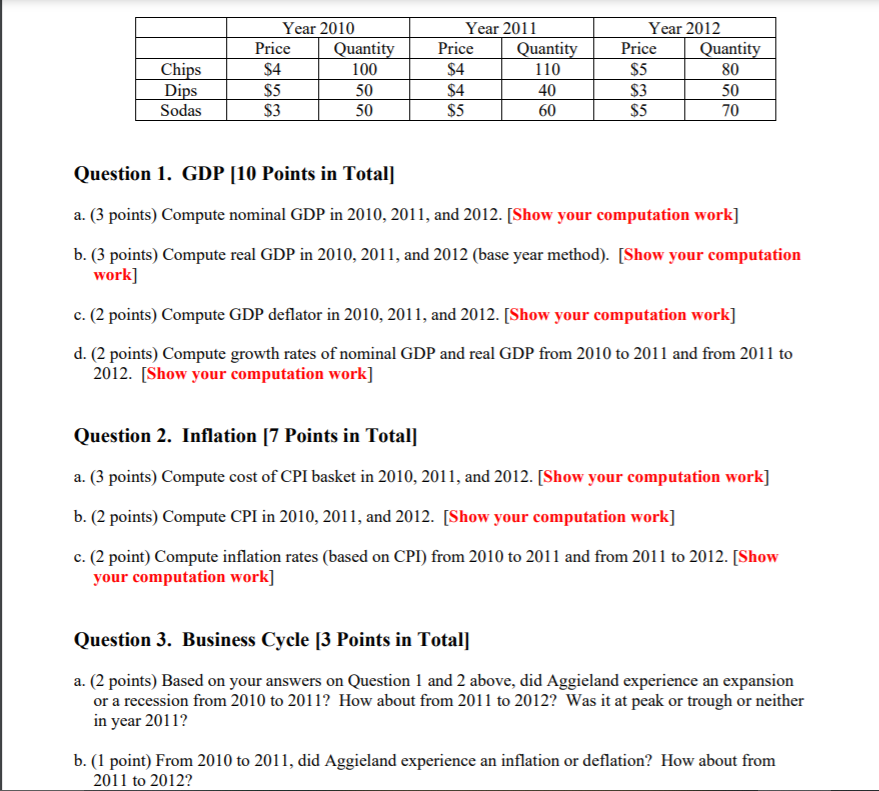

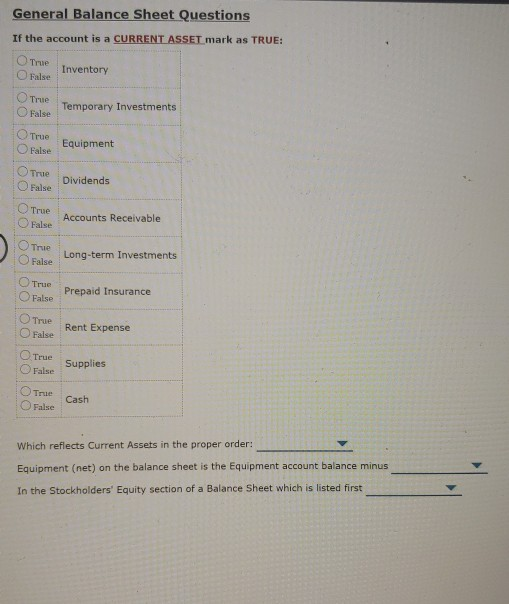

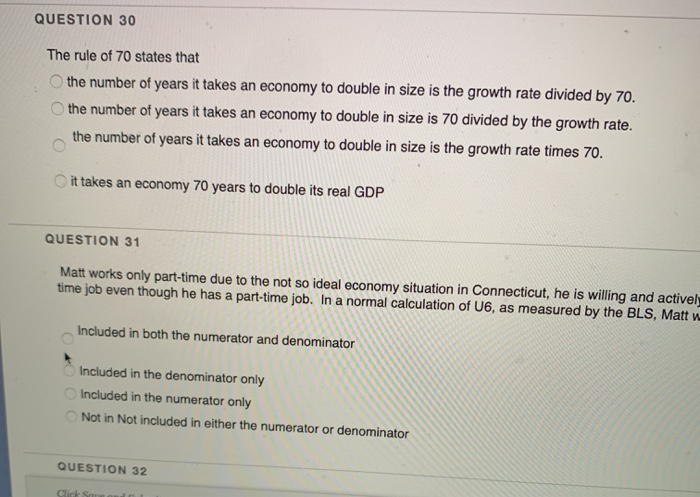

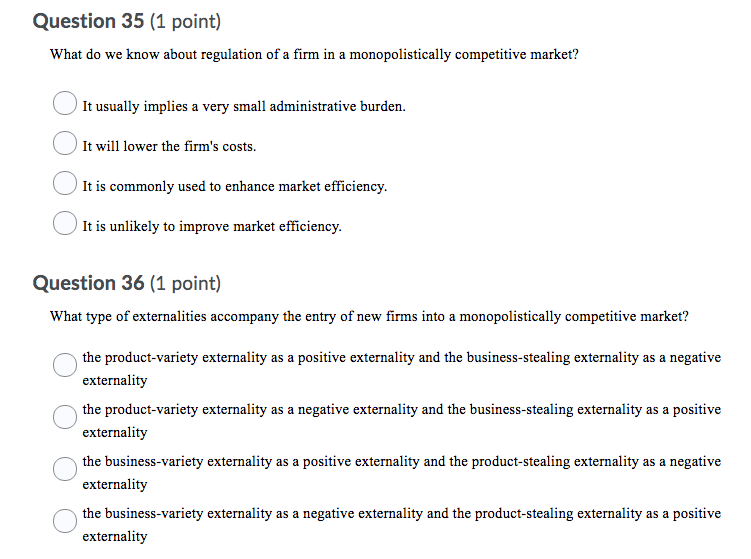

CHAPTER BEST BUT CO. ING. COMPARATIVE COMMON-BUT INCOME STATEMENTS I De pearsended Feb. H Hop, Mar 1, Itg), and Her. $. For God of ponds gold Be march ind developrant 1131 0 213010 8150 1, 370 BEST BUY CO INC COMPARATIVE COMMON-BUT BALANCE SHEETS Feb. 21, 1903, Mar. 1, 2908, and Mar. J. NOT in miWongi ASSETS Current 11.8 9 30 04 4.024 0 Insuntory 10130 TIZO Oner cumnl itabs Talal commit ain't Fond Property A equipment, Fit 4.7% 318 0 1. 185 0 Invinny bles I poodail 1.0010 100 03 5 13 7910 LIABILITIES Short-form that 7. 178.0 8,049.0 47AN 30%$ 531.0 2710 4 79 On lined Income tax listitnon 1.4220 10 2% OWNERS EQUITY Total camps' equity Foul Nabilities and careers equity 314 5 63010 10ON 8 12 7580 100.05 4 1275100 BEST BUY CO. INC IHole- percents may not add to The hat to RATIO ANALYSIS SUMMARY For the yours anded Fab. 28, 2009, Mar, 1, 2010, and Mar. 3, 3907 SHORT-TEAM LIQUIDITY RATIOS 2080 Quick Ratio Cinch + Shortom Insulmints + Account Rych biel Curent Liabilities 1.09 Ancouch Recaleable Turnover 1 Haverun Average Accounts Recunable] /Yearend Accounts Reophable) 37.25 Inwwwtory Turnover 2 [Cost Goods Bold/fair-and Inantory) LONG-TERM SOLVENCY (LEVERAGE) RATIO 7.1 Total Debt Rule (Toul Libifyou Tool Anmetal 7.10 PROFITABILITY RATIOS Grow Prof Bugin (Crops Magin Revrun) Operating Profit Margin Operating Income Revenues Net Profit Margin [Barn on Sales) (803) [het hcome Revenues) 24.AJK Tokill Anget Turnover Pierces/Average Total Assets) 4.15% Butum on Total Arts (RCA) (Net heamalAwrage Total Assets) 2.23% 3.15 1.04 7.02% 10 89Year 2010 Year 2011 Year 2012 Price Quantity Price Quantity Price Quantity Chips $4 100 $4 110 $5 80 Dips $5 50 $4 40 $3 50 Sodas $3 50 $5 60 $5 70 Question 1. GDP [10 Points in Total] a. (3 points) Compute nominal GDP in 2010, 2011, and 2012. [Show your computation work] b. (3 points) Compute real GDP in 2010, 2011, and 2012 (base year method). [Show your computation work] c. (2 points) Compute GDP deflator in 2010, 2011, and 2012. [Show your computation work] d. (2 points) Compute growth rates of nominal GDP and real GDP from 2010 to 2011 and from 2011 to 2012. [Show your computation work] Question 2. Inflation [7 Points in Total] a. (3 points) Compute cost of CPI basket in 2010, 2011, and 2012. [Show your computation work] b. (2 points) Compute CPI in 2010, 2011, and 2012. [Show your computation work] c. (2 point) Compute inflation rates (based on CPI) from 2010 to 2011 and from 2011 to 2012. [Show your computation work] Question 3. Business Cycle [3 Points in Total] a. (2 points) Based on your answers on Question 1 and 2 above, did Aggieland experience an expansion or a recession from 2010 to 2011? How about from 2011 to 2012? Was it at peak or trough or neither in year 2011? b. (1 point) From 2010 to 2011, did Aggieland experience an inflation or deflation? How about from 2011 to 2012?General Balance Sheet Questions If the account is a CURRENT ASSET mark as TRUE: True Inventory False True Temporary Investments False True False Equipment True False Dividends True False Accounts Receivable Long-term Investments False True False Prepaid Insurance True Rent Expense False .True Supplies False True False Cash Which reflects Current Assets in the proper order: Equipment (net) on the balance sheet is the Equipment account balance minus In the Stockholders' Equity section of a Balance Sheet which is listed firstQUESTION 30 The rule of 70 states that O the number of years it takes an economy to double in size is the growth rate divided by 70. O the number of years it takes an economy to double in size is 70 divided by the growth rate. the number of years it takes an economy to double in size is the growth rate times 70. it takes an economy 70 years to double its real GDP QUESTION 31 Matt works only part-time due to the not so ideal economy situation in Connecticut, he is willing and activel time job even though he has a part-time job. In a normal calculation of U6, as measured by the BLS, Matt w Included in both the numerator and denominator Included in the denominator only O Included in the numerator only Not in Not included in either the numerator or denominator QUESTION 32Question 35 (1 point) What do we know about regulation of a firm in a monopolistically competitive market? It usually implies a very small administrative burden. It will lower the firm's costs. It is commonly used to enhance market efficiency. It is unlikely to improve market efficiency. Question 36 (1 point) What type of externalities accompany the entry of new firms into a monopolistically competitive market? the product-variety externality as a positive externality and the business-stealing externality as a negative externality the product-variety externality as a negative externality and the business-stealing externality as a positive externality the business-variety externality as a positive externality and the product-stealing externality as a negative externality O the business-variety externality as a negative externality and the product-stealing externality as a positive externality

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts