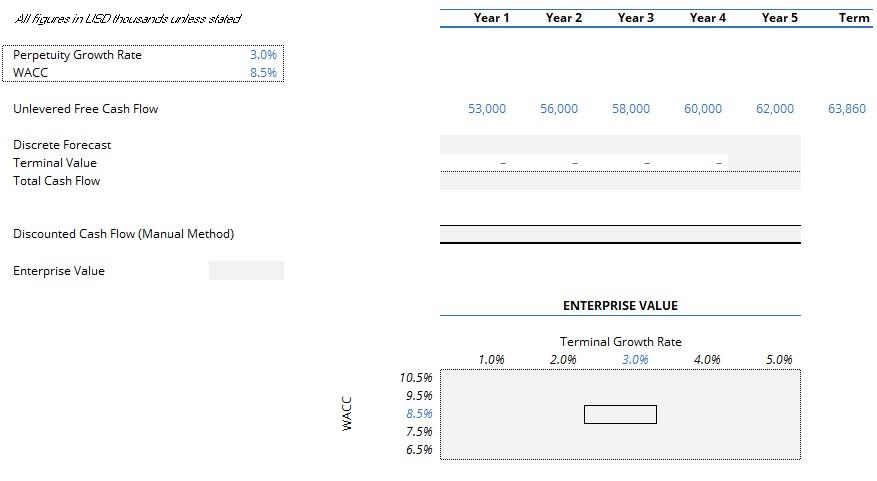

Question: Complete the data table and select the enterprise valuation given using a 4% growth rate and a 7.5% WACC, the value using a 1% growth

Complete the data table and select the enterprise valuation given using a 4% growth rate and a 7.5% WACC, the value using a 1% growth rate and 9.5% WACC, respectively.

1. $998,532; $781,622

2. $697,644; $1,503,484

3. $1,503,484; $697,644

4. $965,119; $903,617

\begin{tabular}{llllll} \hline Year 1 & Year 2 & Year 3 & Year 4 & Year 5 & Term \\ \hline \end{tabular} Perpetuity Growth Rate 3.096 WACC 8.5% Unlevered Free Cash Flow 53,00056,00058,00060,00062,00063,860 Discrete Forecast Terminal Value Total Cash Flow Discounted Cash Flow (Manual Method) Enterprise Value ENTERPRISE VALUE \begin{tabular}{llllll} \hline Year 1 & Year 2 & Year 3 & Year 4 & Year 5 & Term \\ \hline \end{tabular} Perpetuity Growth Rate 3.096 WACC 8.5% Unlevered Free Cash Flow 53,00056,00058,00060,00062,00063,860 Discrete Forecast Terminal Value Total Cash Flow Discounted Cash Flow (Manual Method) Enterprise Value ENTERPRISE VALUE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts