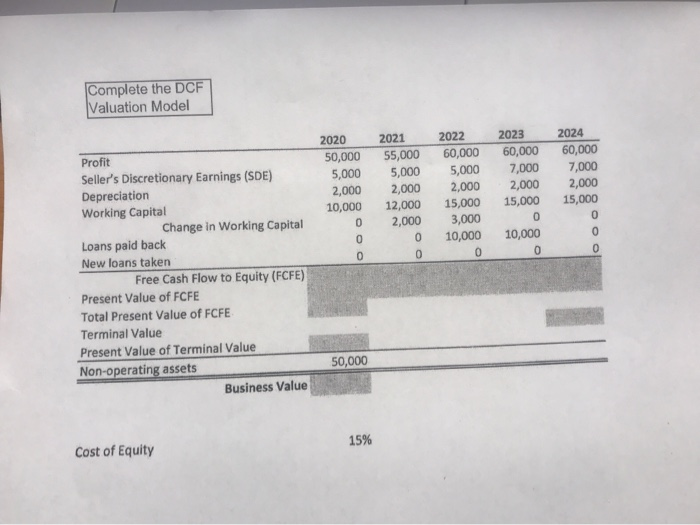

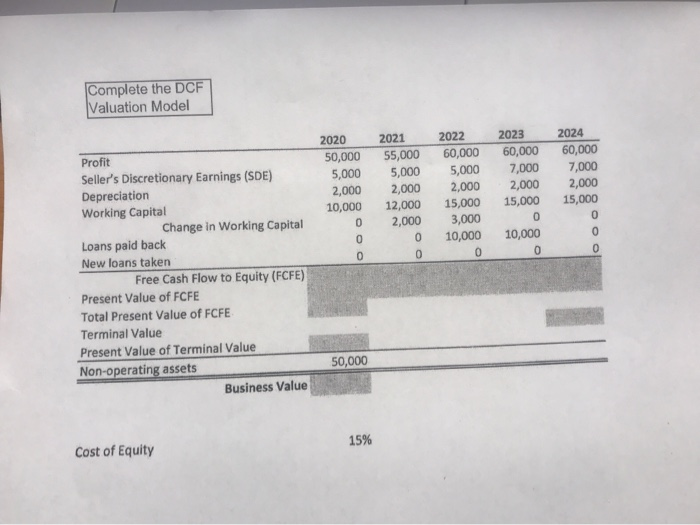

Question: Complete the DCF Valuation Model Complete the DCF Valuation Model 2020 50,000 5,000 2,000 10,000 0 2021 55,000 5,000 2,000 12,000 2,000 0 2022 60,000

Complete the DCF Valuation Model

Complete the DCF Valuation Model 2020 50,000 5,000 2,000 10,000 0 2021 55,000 5,000 2,000 12,000 2,000 0 2022 60,000 5,000 2,000 15,000 2023 60,000 7,000 2,000 15,000 2024 60,000 7,000 2,000 15,000 2,000 3,000 10,000 10,000 Profit Seller's Discretionary Earnings (SDE) Depreciation Working Capital Change in Working Capital Loans paid back New loans taken Free Cash Flow to Equity (FCFE) Present Value of FCFE Total Present Value of FCFE Terminal Value Present Value of Terminal Value Non-operating assets Business Value 50,000 Cost of Equity 15%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock