Question: complete the first question then double check the second question to see if its 1% You wish to purchase a property for $400,000. You intend

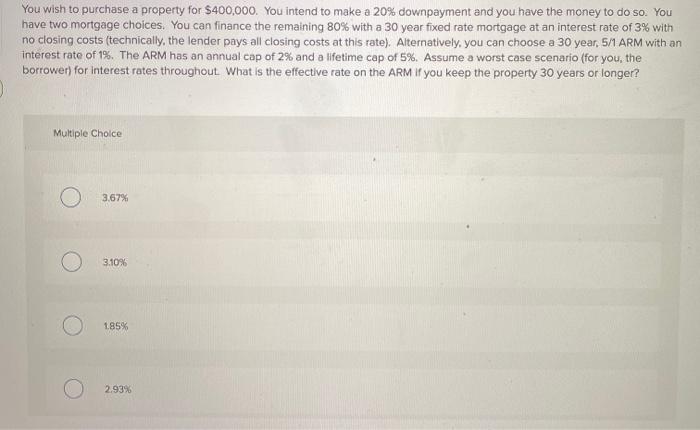

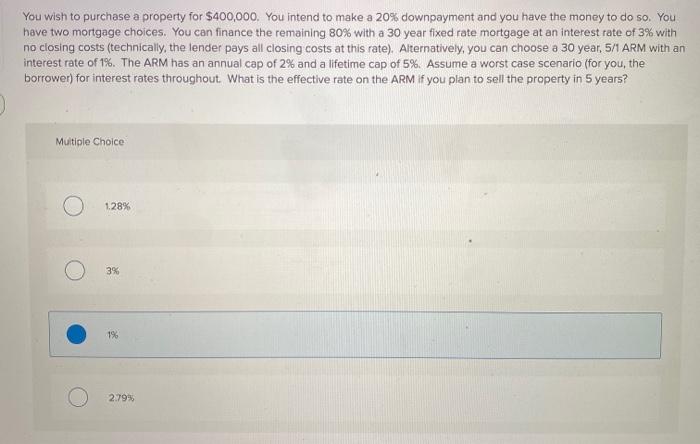

You wish to purchase a property for $400,000. You intend to make a 20% downpayment and you have the money to do so. You have two mortgage choices. You can finance the remaining 80% with a 30 year fixed rate mortgage at an interest rate of 3% with no closing costs (technically, the lender pays all closing costs at this rate). Alternatively, you can choose a 30 year, 5/1 ARM with an interest rate of 1%. The ARM has an annual cop of 2% and a lifetime cap of 5%. Assume a worst case scenario (for you, the borrower) for interest rates throughout. What is the effective rate on the ARM if you keep the property 30 years or longer? Multiple Choice 3.67% 3.10% 185% 2.93% You wish to purchase a property for $400,000. You intend to make a 20% downpayment and you have the money to do so. You have two mortgage choices. You can finance the remaining 80% with a 30 year fixed rate mortgage at an interest rate of 3% with no closing costs (technically, the lender pays all closing costs at this rate). Alternatively, you can choose a 30 year. 5/1 ARM with an interest rate of 1%. The ARM has an annual cap of 2% and a lifetime cap of 5%. Assume a worst case scenario (for you, the borrower) for interest rates throughout. What is the effective rate on the ARM if you plan to sell the property in 5 years? Multiple Choice 1.28% 3% 1% 2.79% You wish to purchase a property for $400,000. You intend to make a 20% downpayment and you have the money to do so. You have two mortgage choices. You can finance the remaining 80% with a 30 year fixed rate mortgage at an interest rate of 3% with no closing costs (technically, the lender pays all closing costs at this rate). Alternatively, you can choose a 30 year, 5/1 ARM with an interest rate of 1%. The ARM has an annual cop of 2% and a lifetime cap of 5%. Assume a worst case scenario (for you, the borrower) for interest rates throughout. What is the effective rate on the ARM if you keep the property 30 years or longer? Multiple Choice 3.67% 3.10% 185% 2.93% You wish to purchase a property for $400,000. You intend to make a 20% downpayment and you have the money to do so. You have two mortgage choices. You can finance the remaining 80% with a 30 year fixed rate mortgage at an interest rate of 3% with no closing costs (technically, the lender pays all closing costs at this rate). Alternatively, you can choose a 30 year. 5/1 ARM with an interest rate of 1%. The ARM has an annual cap of 2% and a lifetime cap of 5%. Assume a worst case scenario (for you, the borrower) for interest rates throughout. What is the effective rate on the ARM if you plan to sell the property in 5 years? Multiple Choice 1.28% 3% 1% 2.79%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts