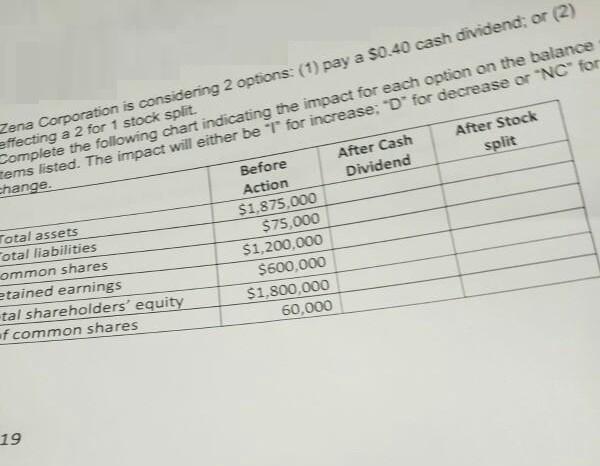

Question: Zena Corporation is considering 2 options: (1) pay a $0.40 cash dividend; or (2) effecting a 2 for 1 stock split. Complete the following

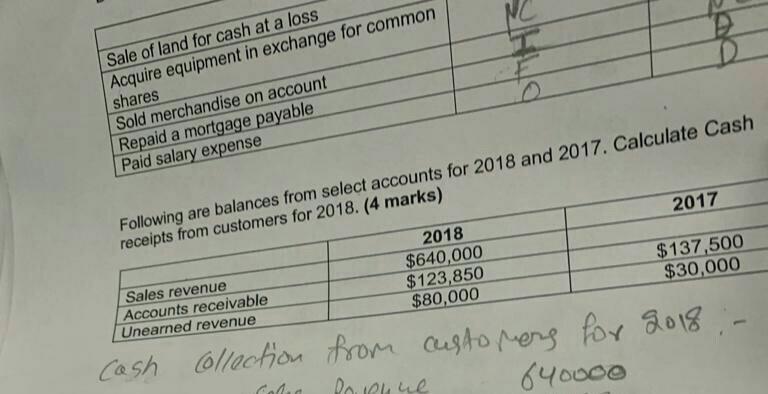

Zena Corporation is considering 2 options: (1) pay a $0.40 cash dividend; or (2) effecting a 2 for 1 stock split. Complete the following chart indicating the impact for each option on the balance Tems listed. The impact will either be "I for increase; "D" for decrease or "NC" for change. After Stock Before After Cash Dividend split Action Total assets otal liabilities ommon shares etained earnings tal shareholders' equity f common shares $1,875,000 $75,000 $1,200,000 $600,000 $1,800,000 60,000 19 Sale of land for cash at a loss Acquire equipment in exchange for common shares Sold merchandise on account Repaid a mortgage payable Paid salary expense Following are balances from select accounts for 2018 and 2017. Calculate Cash receipts from customers for 2018. (4 marks) 2018 $640,000 $123,850 $80,000 2017 Sales revenue Accounts receivable Unearned revenue $137,500 $30,000 Cash ollaction from custo Merg for 2018 640000

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Dividend 60000 x 040 24000 Before Action After Cash Dividend After Stock Spl... View full answer

Get step-by-step solutions from verified subject matter experts