Question: Complete the following problems using the information given below: Total Project Cost: $55,000,000 Lender Standards: o Interest Rate: 8.0% o Amortization Rate: 20 Yrs. o

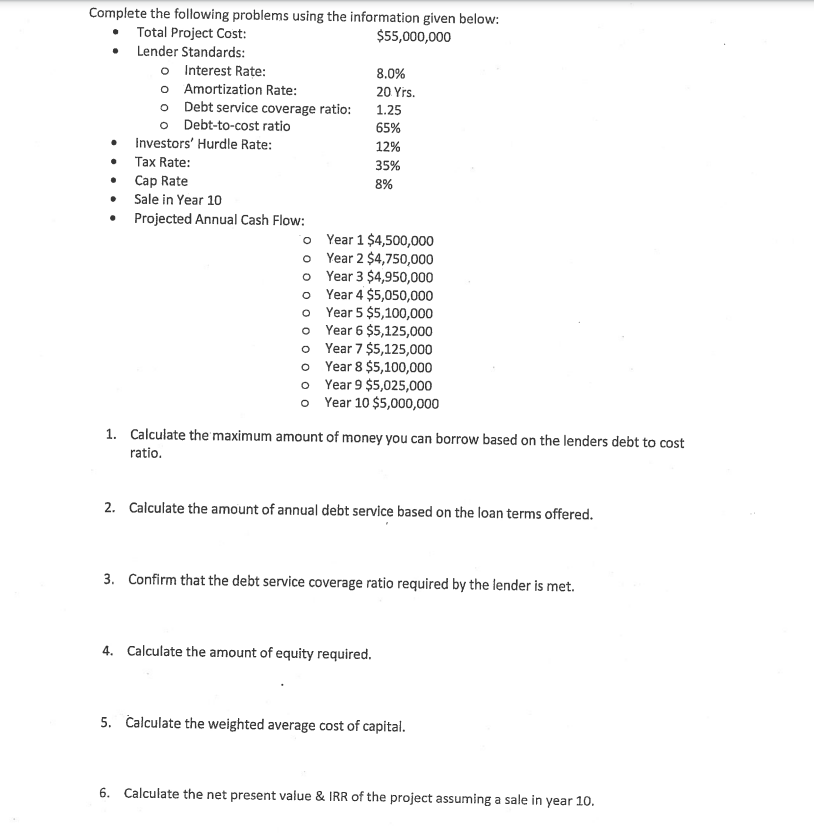

Complete the following problems using the information given below: Total Project Cost: $55,000,000 Lender Standards: o Interest Rate: 8.0% o Amortization Rate: 20 Yrs. o Debt service coverage ratio: 1.25 o Debt-to-cost ratio 65% Investors' Hurdle Rate: 12% Tax Rate: 35% Cap Rate 8% Sale in Year 10 Projected Annual Cash Flow: o Year 1 $4,500,000 o Year 2 $4,750,000 o Year 3 $4,950,000 Year 4 $5,050,000 Year 5 $5,100,000 o Year 6 $5,125,000 o Year 7 $5,125,000 o Year 8 $5,100,000 o Year 9 $5,025,000 o Year 10 $5,000,000 1. Calculate the maximum amount of money you can borrow based on the lenders debt to cost ratio. 2. Calculate the amount of annual debt service based on the loan terms offered. 3. Confirm that the debt service coverage ratio required by the lender is met 4. Calculate the amount of equity required. 5. Calculate the weighted average cost of capital. 6. Calculate the net present value & IRR of the project assuming a sale in year 10. Complete the following problems using the information given below: Total Project Cost: $55,000,000 Lender Standards: o Interest Rate: 8.0% o Amortization Rate: 20 Yrs. o Debt service coverage ratio: 1.25 o Debt-to-cost ratio 65% Investors' Hurdle Rate: 12% Tax Rate: 35% Cap Rate 8% Sale in Year 10 Projected Annual Cash Flow: o Year 1 $4,500,000 o Year 2 $4,750,000 o Year 3 $4,950,000 Year 4 $5,050,000 Year 5 $5,100,000 o Year 6 $5,125,000 o Year 7 $5,125,000 o Year 8 $5,100,000 o Year 9 $5,025,000 o Year 10 $5,000,000 1. Calculate the maximum amount of money you can borrow based on the lenders debt to cost ratio. 2. Calculate the amount of annual debt service based on the loan terms offered. 3. Confirm that the debt service coverage ratio required by the lender is met 4. Calculate the amount of equity required. 5. Calculate the weighted average cost of capital. 6. Calculate the net present value & IRR of the project assuming a sale in year 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts