Question: Complete the following Questions from Chapter 1; Assignment Problem One-12 Check Figures: Assignment Problem One-12 you should also calculate carryovers for each case( if applicable)

Complete the following Questions from Chapter 1; Assignment Problem One-12

Complete the following Questions from Chapter 1; Assignment Problem One-12

Check Figures:

Assignment Problem One-12 you should also calculate carryovers for each case( if applicable)

CASE A: Net Income for tax purposes= $52,550

CASE B: Net Income for tax purposes= NIL

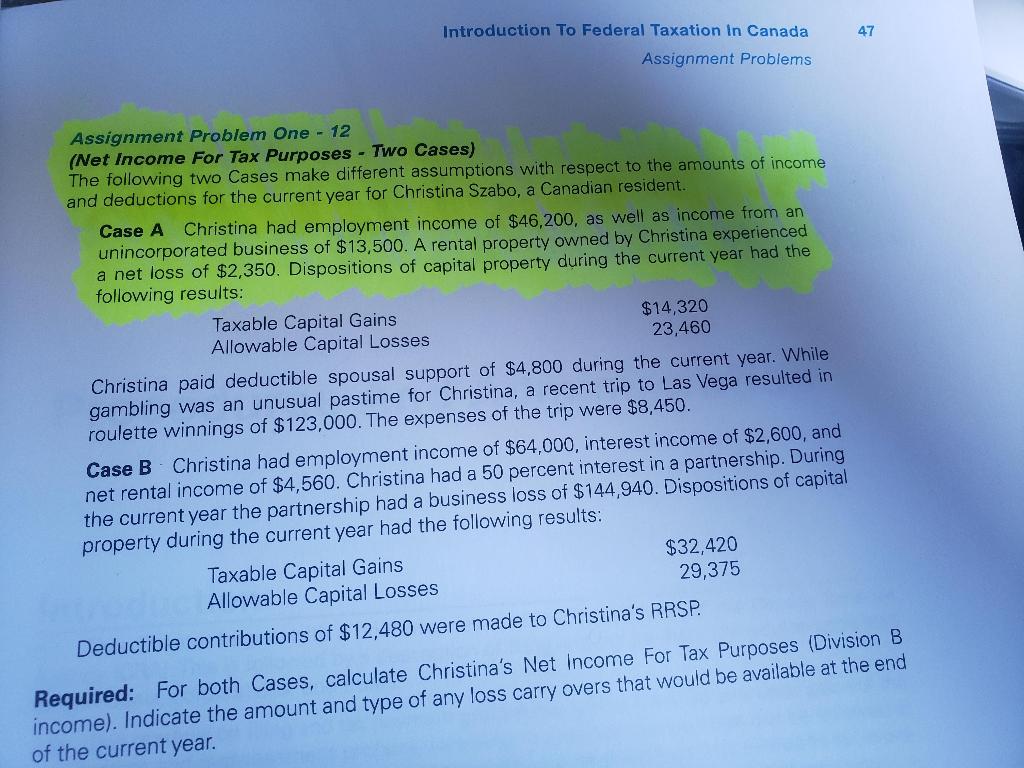

47 Introduction To Federal Taxation in Canada Assignment Problems Assignment Problem One - 12 (Net Income For Tax Purposes - Two Cases) The following two Cases make different assumptions with respect to the amounts of income and deductions for the current year for Christina Szabo, a Canadian resident. Case A Christina had employment income of $46,200, as well as income from an unincorporated business of $13,500. A rental property owned by Christina experienced a net loss of $2,350. Dispositions of capital property during the current year had the following results: Taxable Capital Gains $14,320 Allowable Capital Losses 23,460 Christina paid deductible spousal support of $4,800 during the current year. While gambling was an unusual pastime for Christina, a recent trip to Las Vega resulted in roulette winnings of $123,000. The expenses of the trip were $8,450. Case B Christina had employment income of $64,000, interest income of $2,600, and net rental income of $4,560. Christina had a 50 percent interest in a partnership. During the current year the partnership had a business loss of $144,940. Dispositions of capital property during the current year had the following results: Taxable Capital Gains $32,420 29,375 Allowable Capital Losses Deductible contributions of $12,480 were made to Christina's RRSP. Required: For both Cases, calculate Christina's Net Income For Tax Purposes (Division B income). Indicate the amount and type of any loss carry overs that would be available at the end of the current year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts