Question: Complete the following using the information from the Study Questions and Problems at the end of Chapter 4, on pages 193 - 194, as indicated

Complete the following using the information from the Study Questions and Problems at the end of Chapter 4, on pages 193 - 194, as indicated below:

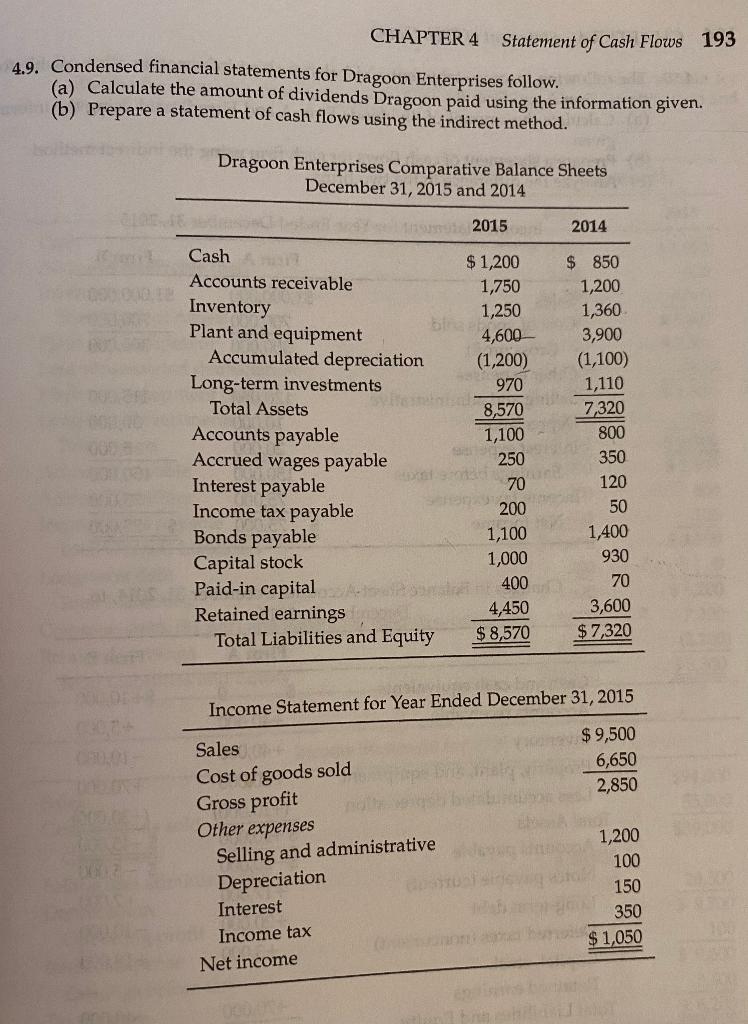

Question 4.9 - Using the condensed financial statements for Dragoon Enterprises that are provided on page 193, you will need to provide information as follows:

(a) Dividends Dragoon paid.

(b) Information from the statement of cash flows using the indirect method including:

1. Net cash provided (used) by operations.

2. Net cash provided (used) by investing activities.

3. Net cash provided (used) by financing activities.

4. Net increase (decrease) in cash.

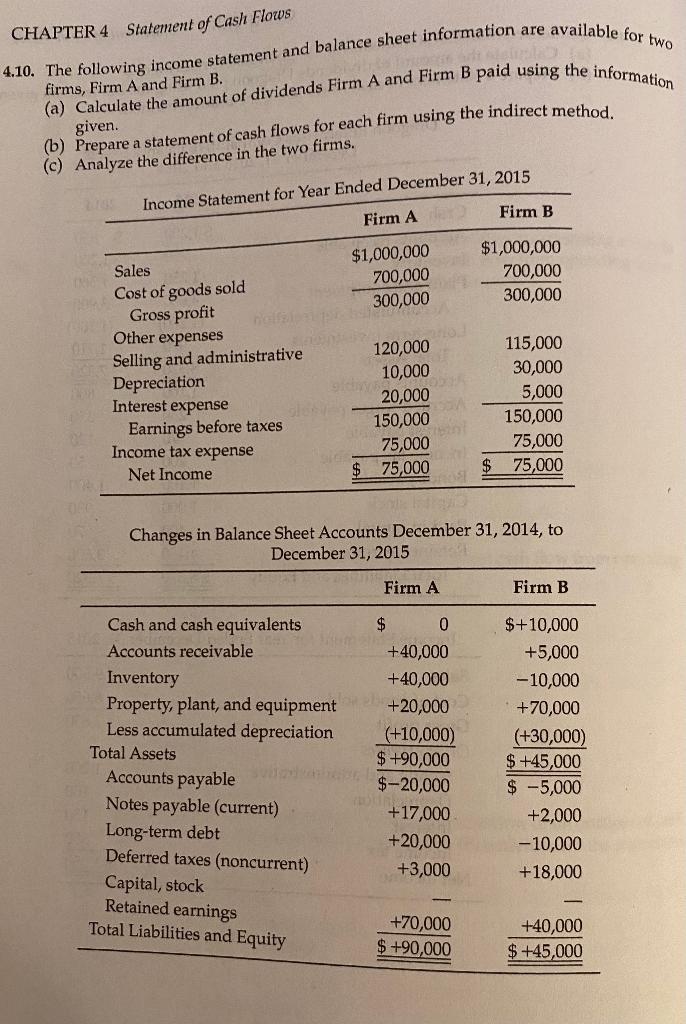

Question 4.10 - Using the income statements and changes in balance sheet accounts provided for Firms A and B, you will need to provide the following information:

(a) Dividends paid by Firms A and B.

(b) Information from the statement of cash flows for Firms A and B including:

1. Net cash provided (used) by operations.

2. Net cash provided (used) by investing activities.

3. Net cash provided (used) by financing activities.

4. Net increase (decrease) in cash.

(c) Summary analysis of the statements of cash flows for Firms A and B:

1. Total inflows for Firm A

2. Total outflows for Firm A

3. Total inflows for Firm B

4. Total outflows for Firm B

5. Which of the following statements is true regarding the summary analysis of the statements of cash flows for Firms A and B?

a.) Firm B had 98% of it's inflows from operations

b.) Firm A had 98% of its inflows from operations

c.) Firm B had 61% of its outflows in dividends

d.) Firm A had 61% of its outflows in dividends

Please label each answer.

Thank you.

CHAPTER 4 Statement of Cash Flows 193 4.9. Condensed financial statements for Dragoon Enterprises follow. (a) Calculate the amount of dividends Dragoon paid using the information given. (b) Prepare a statement of cash flows using the indirect method. Dragoon Enterprises Comparative Balance Sheets December 31, 2015 and 2014 2015 2014 $ 1,200 1,750 1,250 4,600 (1,200) 970 8,570 1,100 Cash Accounts receivable Inventory Plant and equipment Accumulated depreciation Long-term investments Total Assets Accounts payable Accrued wages payable Interest payable Income tax payable Bonds payable Capital stock Paid-in capital Retained earnings Total Liabilities and Equity $ 850 1,200 1,360 3,900 (1,100) 1,110 7,320 800 350 120 50 1,400 250 70 200 1,100 1,000 400 4,450 $ 8,570 930 70 3,600 $ 7,320 Income Statement for Year Ended December 31, 2015 Sales $ 9,500 6,650 2,850 Cost of goods sold Gross profit Other expenses Selling and administrative Depreciation Interest Income tax Net income 1,200 100 150 350 $1,050 CHAPTER 4 Statement of Cash Flows 4.10. The following income statement and balance sheet information are available for two (a) Calculate the amount of dividends Firm A and Firm B paid using the information given. firms, Firm A and Firm B. (b) Prepare a statement of cash flows for each firm using the indirect method. (c) Analyze the difference in the two firms. Income Statement for Year Ended December 31, 2015 Firm A Firm B $1,000,000 700,000 300,000 $1,000,000 700,000 300,000 Sales Cost of goods sold Gross profit Other expenses Selling and administrative Depreciation Interest expense Earnings before taxes Income tax expense Net Income 120,000 10,000 20,000 150,000 75,000 $ 75,000 115,000 30,000 5,000 150,000 75,000 $ 75,000 Changes in Balance Sheet Accounts December 31, 2014, to December 31, 2015 Firm A Firm B Cash and cash equivalents Accounts receivable Inventory Property, plant, and equipment Less accumulated depreciation Total Assets Accounts payable Notes payable (current) Long-term debt Deferred taxes (noncurrent) Capital, stock $ 0 +40,000 +40,000 +20,000 (+10,000) $ +90,000 $-20,000 +17,000 +20,000 +3,000 $+10,000 +5,000 -10,000 +70,000 (+30,000) $ +45,000 $ -5,000 +2,000 - 10,000 +18,000 Retained earnings Total Liabilities and Equity +70,000 $ +90,000 +40,000 $ +45,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts